Michael Saylor’s investment firm, Strategy, opened November with another significant Bitcoin acquisition worth $45.6 million. However, the company’s pace of accumulation has slowed notably since September, sparking concern among market watchers about potential effects on Bitcoin’s ongoing price recovery.

Fresh Bitcoin Purchase Adds to Massive Holdings

According to a recent filing with the US Securities and Exchange Commission, Strategy purchased 397 Bitcoin last week at an average price of $114,771 per coin. This brought its total holdings to 641,205 Bitcoin, valued at around $47.49 billion. The firm’s year-to-date Bitcoin yield now stands at 26.1%, reflecting solid returns from its long-term accumulation strategy.

Strategy’s latest purchase follows another 390 Bitcoin buy worth $43.3 million during the final week of October. Despite these steady additions, the firm’s monthly total for October stood at only 778 Bitcoin, one of its smallest monthly accumulations in recent years.

Buying Pace Slows Compared to September

The slowdown becomes evident when compared to September, when Strategy purchased 3,526 Bitcoin, about 78% more than its October total. Analysts believe this deceleration marks a shift in the company’s strategy or a temporary pause amid fluctuating market conditions.

Michael Saylor, who has been one of Bitcoin’s most vocal advocates, previously maintained an aggressive acquisition approach, often treating market dips as opportunities. The reduced buying pace could reflect a more cautious stance as Bitcoin prices test new resistance levels above $100,000.

Analysts See Institutional Demand as Key to Recovery

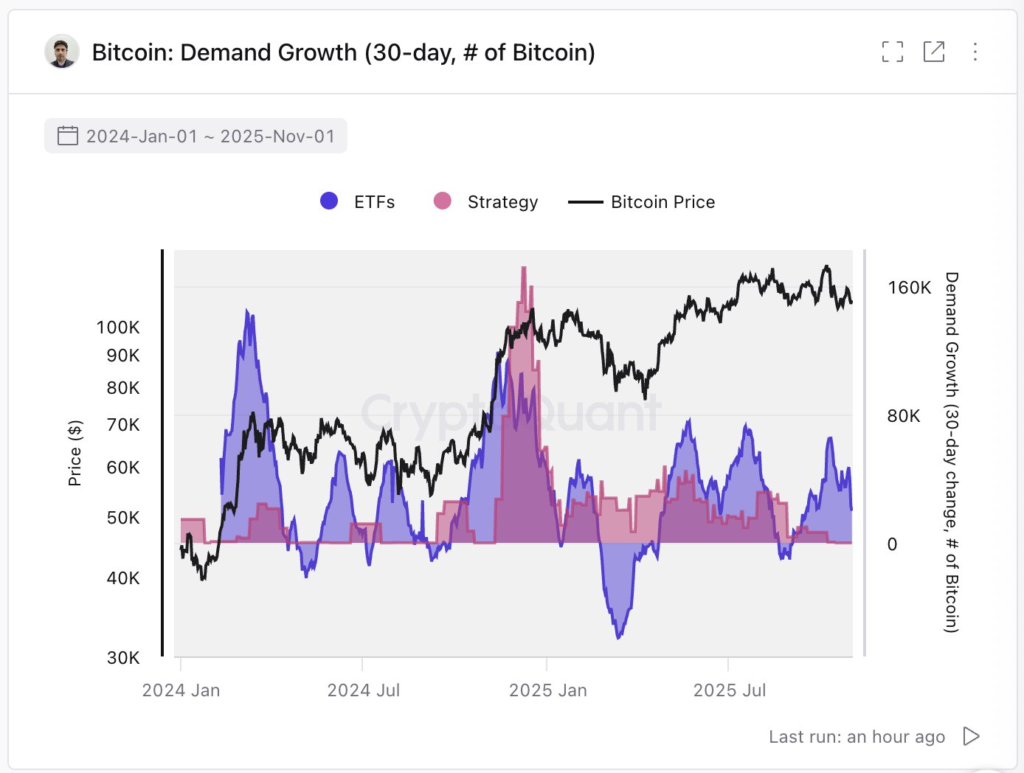

Crypto analysts warn that Strategy’s slowdown might limit Bitcoin’s short-term recovery potential. Institutional demand has been the main driver behind Bitcoin’s price performance throughout 2025, largely fueled by corporate buyers like Strategy and spot Bitcoin exchange-traded funds (ETFs) in the United States.

According to data from CryptoQuant, Bitcoin’s upward momentum often aligns with the buying activity of these large players. When their accumulation slows, so does the broader market’s energy. “Demand is now driven mostly by ETFs and MicroStrategy, both slowing buys recently. If these two channels recover, market momentum likely returns,” said Ki Young Ju, CEO of CryptoQuant, in a recent post on X.

Market Watches for Next Institutional Wave

Bitcoin’s price performance in the coming weeks may depend heavily on whether institutional investors resume large-scale purchases. While retail investors continue to participate, their influence remains limited compared to the impact of major corporate buyers and ETF inflows.

Analysts suggest that Strategy’s next few filings will be closely watched as an indicator of broader institutional sentiment. If Saylor’s firm ramps up its buying again, it could inject renewed confidence into the market and potentially support Bitcoin’s push toward new highs.

Saylor’s Long-Term Commitment Remains Firm

Despite the current slowdown, Strategy’s long-term stance on Bitcoin remains unchanged. The company’s holdings, now exceeding 641,000 Bitcoin, make it one of the largest corporate holders globally. Michael Saylor has consistently framed Bitcoin as a superior store of value and a hedge against inflation, emphasizing that short-term volatility does not affect the company’s conviction.

Whether Strategy resumes its rapid accumulation or maintains a measured pace, its influence over Bitcoin’s market dynamics remains undeniable. As the crypto industry heads deeper into the final months of 2025, institutional demand from players like Strategy will likely continue to shape the next phase of Bitcoin’s price journey.

Leave a Reply