Prediction markets are cooling on the idea that former President Donald Trump will retain broad authority to impose tariffs without congressional approval. Traders on both regulated and crypto-based platforms are betting that the Supreme Court will curb the scope of presidential power in a case that could reshape future US trade policy.

Traders Lose Confidence in Trump’s Tariff Case

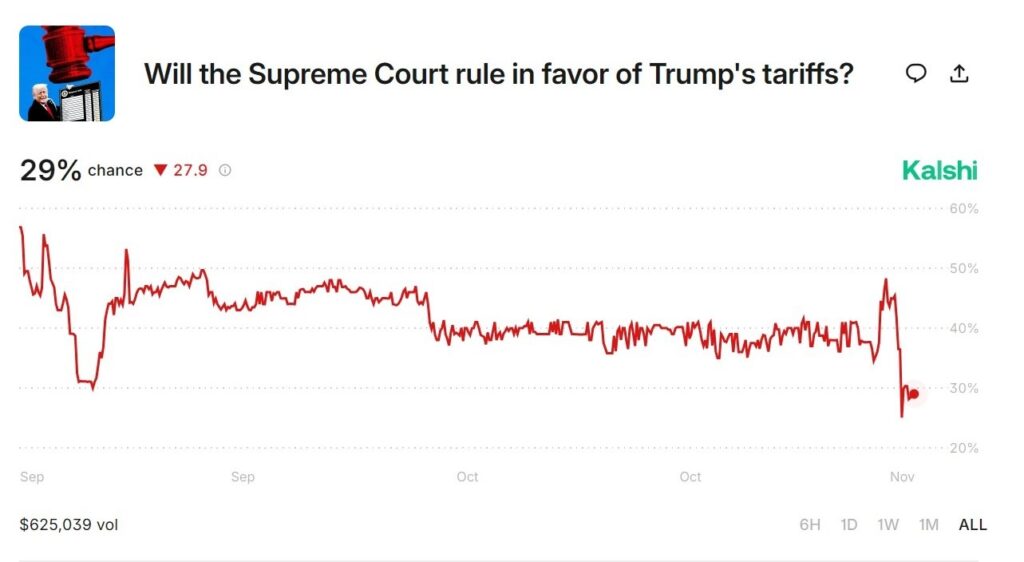

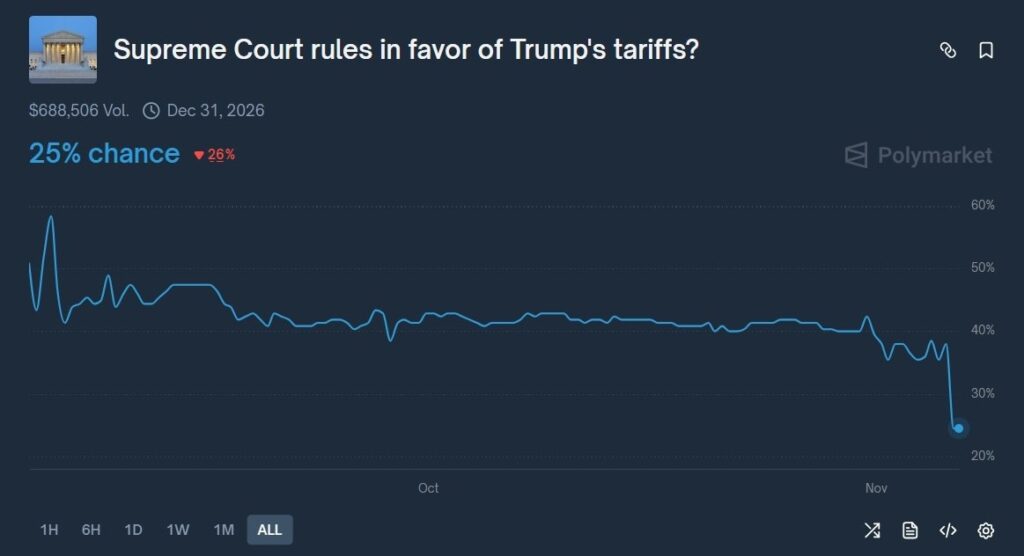

On Thursday, data from Kalshi, a US-regulated event market, showed that traders now see only a 29 percent chance of the Supreme Court siding with Trump, a sharp 28-point decline from a day earlier. On Polymarket, its blockchain-based counterpart where trades settle in USDC, sentiment was similarly weak, with odds slipping to 25 percent.

Combined trading volume on both platforms surpassed 1.3 million dollars, highlighting how prediction markets are increasingly being used to gauge early shifts in political and judicial expectations. The dramatic moves suggest traders are preparing for a decision that could limit the executive branch’s ability to act unilaterally on tariffs.

Markets Brace for Limits on Executive Power

Both Kalshi and Polymarket have seen heavy volatility since the Supreme Court agreed in September to hear the case, which questions whether the president can impose tariffs under the 1977 International Emergency Economic Powers Act. Wednesday marked the largest single-day drop in confidence since the contracts launched, reflecting the growing belief that the court may draw a firmer line on executive authority.

Traders appear to be pricing in a ruling that could redefine how future administrations use emergency economic powers. If the court narrows the law’s interpretation, it would restore more of Congress’s constitutional role over taxation and trade policy — areas traditionally considered legislative responsibilities.

The alignment between Kalshi and Polymarket also points to a growing overlap between regulated and decentralized markets. Both retail and institutional traders, whether dealing in fiat or stablecoins, are interpreting the same legal and political signals with similar outcomes.

Supreme Court Justices Express Doubts

The latest market slide followed a tense Supreme Court hearing on Wednesday, where several conservative justices questioned Trump’s argument that he could impose sweeping import duties without congressional approval. The justices spent hours debating whether the 1977 law, designed for national security emergencies, was meant to give presidents such broad economic powers.

Reports from the hearing suggested skepticism even among Trump-appointed justices. Chief Justice John Roberts noted that tariffs are effectively taxes, a power historically held by Congress. Justice Amy Coney Barrett questioned the rationale for targeting countries like Spain and France under an emergency framework. Justice Neil Gorsuch warned that allowing the executive to act freely could create a “one-way ratchet” toward unchecked presidential authority.

Their questioning raised concerns among traders that the court’s eventual decision may restrict how presidents use emergency economic laws to influence trade or fiscal policy.

Implications for Markets and Crypto

Trump’s trade policies have often rippled through financial and crypto markets. During his presidency, aggressive tariffs on China and Europe fueled inflation concerns and global market volatility. At the time, many investors viewed Bitcoin as a hedge against policy uncertainty and currency risk.

However, if the Supreme Court imposes tighter limits on presidential tariff powers, it could bring a degree of predictability to future trade actions. That stability might ease some inflation pressures and reduce the appeal of speculative assets as safe havens.

For crypto traders, the case carries symbolic weight as well. It reflects how traditional legal decisions can influence decentralized markets, where participants use blockchain-based contracts to forecast political and economic outcomes. The fact that both Kalshi and Polymarket showed near-identical trends underscores how sentiment in both traditional and decentralized finance is becoming more intertwined.

A Defining Case for Presidential Power

The final ruling, expected in early 2025, could be one of the most consequential decisions of the term. A judgment restricting executive tariff authority would mark a significant shift in how emergency economic powers are interpreted, potentially reshaping decades of precedent.

For now, prediction markets are sending a clear message. Traders are no longer betting on Trump’s expansive view of presidential control over trade. Instead, they are positioning for a Supreme Court decision that reinforces the balance of power between the White House and Congress — and possibly resets the rules for how presidents can use economic emergencies to drive foreign policy.

Leave a Reply