Tether has accumulated 116 tonnes of physical gold, placing the stablecoin issuer alongside the central banks of South Korea, Hungary and Greece in terms of total reserves. An analysis by Jefferies, cited by the Financial Times, states that Tether is now the largest gold holder outside central banks. The firm believes that Tether’s aggressive buying has contributed to recent strength in gold prices.

Jefferies estimates that Tether accounted for almost two percent of global gold demand last quarter. The company’s purchases also represent nearly twelve percent of all central bank acquisitions in the same period. According to the report, the pace of accumulation during the past two months has likely tightened short term supply and changed market sentiment, prompting further speculative interest in the metal.

Expectations for Further Purchases in 2025

Investors quoted by Jefferies expect Tether to acquire another 100 tonnes of gold in 2025. With the company projected to generate about 15 billion dollars in profit this year, analysts believe that such a target is achievable. Tether’s growing appetite for gold signals a strategic shift as it diversifies reserves beyond US Treasurys and strengthens its position within global markets.

Tether Expands Across the Gold Industry

Tether has invested more than 300 million dollars this year in companies tied to precious metals. In June it purchased a 32 percent stake in Elemental Altus Royalties, a Canadian publicly listed gold royalty firm. Reports from September suggest that Tether is also evaluating opportunities across the entire gold supply chain including mining, refining, trading and royalty operations. These moves form part of a broader effort to build influence across the sector as the company increases its exposure to physical bullion.

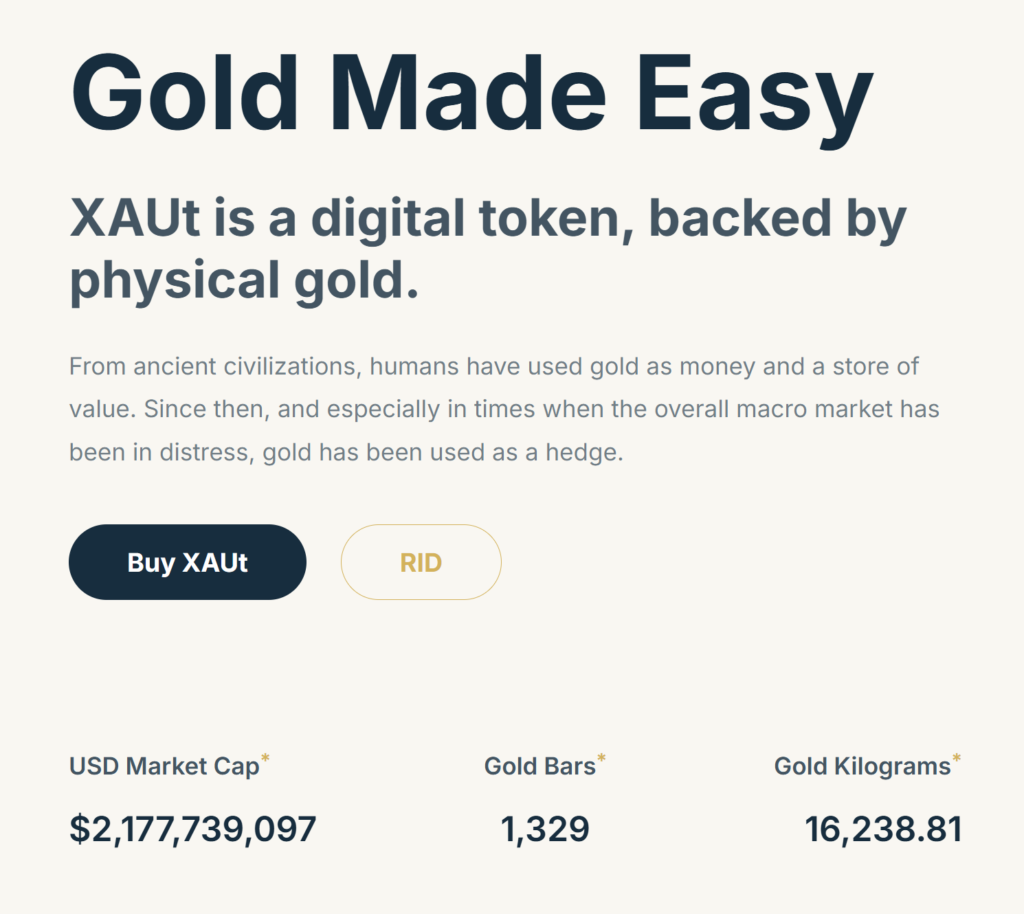

Alongside these investments Tether issues Tether Gold (XAUt), a token launched in 2020 that is backed by gold held in a Swiss vault. Blockchain data indicates that issuance of XAUt has doubled in the last six months. Since August Tether has added about 275,000 ounces of gold, valued at roughly 1.1 billion dollars. Jefferies argues that the company is positioning itself for wider adoption of tokenised gold by addressing limitations linked to physical bullion and traditional investment products.

Operations Resembling Central Banks

Jefferies notes that Tether’s operations increasingly mirror those of central banks. The company mints and redeems USDT directly for verified users, allowing it to adjust token supply in a manner similar to monetary authorities. Its reserves are heavily composed of short duration US Treasurys with additional allocations to gold and Bitcoin. This portfolio enables Tether to earn substantial interest while issuing a token that does not pay interest to holders.

Tether also employs tools that resemble policy measures. It freezes wallet addresses when requested by law enforcement and phases out support for certain blockchains in order to reduce operational risks. These actions highlight the company’s emerging role as a significant financial actor far beyond the typical scope of private technology firms.

A Growing Influence on Global Markets

Jefferies concludes that Tether’s rapid expansion into gold and related industries is influencing both investor sentiment and market structure. As the company continues to diversify its reserves and strengthen ties across the gold supply chain, its impact on commodity markets may grow further. With expectations of new gold purchases in 2025 and rising demand for tokenised assets, Tether is positioning itself as a major player in the evolving landscape of global finance.

Leave a Reply