The Bitcoin mining sector is confronting what analysts describe as the most challenging economic conditions since the network launched fifteen years ago. A steep drop in mining revenue together with rising operating expenses has pushed even the largest publicly traded miners toward breakeven levels, according to new data from TheMinerMag.

Hashprice Falls to Structural Lows

TheMinerMag’s latest report shows that hashprice, which reflects the revenue earned for each unit of computing power, has fallen from an average of roughly $55 per petahash per second in the third quarter to about $35. The publication characterises this level as a structural low rather than a short-lived fluctuation.

This decline closely followed a major correction in Bitcoin’s market value. After reaching a record high near $126,000 in October, Bitcoin dropped below $80,000 in November. The resulting revenue compression has placed sustained pressure on miners across the industry.

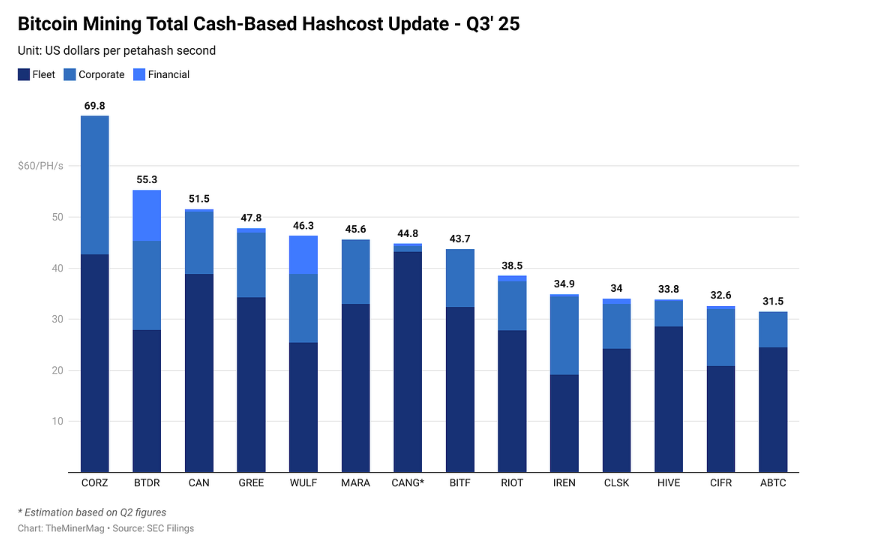

Rising Costs Expose Efficiency Gaps

Cost per hash has become a widely watched benchmark for assessing miner performance. It reveals how effectively each operator converts capital investment and electricity into computational output. The gap between the most efficient miners and the broader market is widening as older machinery struggles to deliver competitive output.

New generation mining rigs now require more than one thousand days to recover their purchase cost. This extended payback period has raised concern, particularly with the next Bitcoin halving event approximately eight hundred fifty days away. The halving will cut block rewards further, reducing miner revenue even more unless market prices recover significantly.

Balance Sheets Shift Toward Safety

TheMinerMag notes a visible shift in miner strategy as companies prioritise liquidity and reduce leverage. CleanSpark recently chose to pay off its Bitcoin backed credit line with Coinbase, a move interpreted as a sign of broader caution within the sector.

The report suggests that miners are preparing for a prolonged period of suppressed margins, raising cash reserves and delaying expansion plans. Companies are also becoming more selective in deploying new hardware, focusing on energy efficient facilities and lower cost power sources.

Mining Stocks Plunge as Market Sentiment Weakens

Publicly traded mining companies have also suffered sharp valuation declines. The MinerMag report highlights a significant drawdown in mining equities beginning in mid October with losses accelerating as Bitcoin prices retreated.

MARA Holdings has fallen about fifty percent from its mid October closing high. CleanSpark has declined thirty seven percent. Riot Platforms is down thirty two percent. HIVE Digital Technologies has experienced the steepest drop, losing fifty four percent of its value since its October peak.

These declines coincided with a broader sell off across global markets, giving the mining sector a second blow as investors reduced exposure to volatile assets.

Industry Braces for Prolonged Pressure

The combined effect of low hashprice, high operational costs and weakening equity performance has created one of the most testing environments miners have faced. Analysts expect consolidation to accelerate as only the most efficient operators withstand the extended margin squeeze.

While long term prospects for Bitcoin mining remain linked to network growth and market adoption, current conditions suggest a period of retrenchment. Miners are likely to continue tightening spending, improving energy efficiency and restructuring debt as they prepare for the next phase of the market cycle.

Leave a Reply