BNB is showing strong signs of recovery after rebounding sharply from a recent dip, reigniting hopes that the token could revisit the $1,000 mark in December. The price climbed beyond $910 mid-week after rising more than thirteen percent from a local low near $800. Technical patterns, liquidation pressure and a favourable breakout structure now point toward a possible continuation higher.

Double Bottom Pattern Signals a Move Beyond $1,000

BNB has formed a clear double bottom on the four hour chart within the $800 to $820 demand zone. The pattern developed as the token recorded two similar lows followed by a strong upward reaction, a sign that selling pressure is easing while buyers step back in.

A double bottom usually hints at a trend reversal once the price pushes above the neckline. For BNB, this boundary sits between $900 and $920. A firm breakout above this region could open a path to about $1,020 during December as the price approaches the 0.382 Fibonacci retracement zone. If the token drops back under the neckline, the bullish outlook weakens and the price may revisit the 20 EMA and 50 EMA on the four hour chart near $860.

Short Liquidation Cluster Supports a Move to $1,020

Data from CoinGlass highlights roughly $112.28 million worth of short liquidity concentrated near $1,020. This zone represents a potential magnet for price as traders who bet against BNB face rising losses.

Liquidation heatmaps reveal where leveraged positions could be forced to close. As BNB continues to rise, short positions may be automatically liquidated, leading to additional buying pressure. This mechanism can accelerate upward movement, pulling the price toward the heavy liquidation cluster around $1,020.

Falling Wedge Breakout Reinforces Bullish Momentum

BNB has also broken out from a multi week falling wedge, a structure that often resolves to the upside following an extended period of selling. The breakout occurred in late November when the price climbed above the descending trendline. A brief pullback retested the breakout level which held as support, confirming the strength of the move.

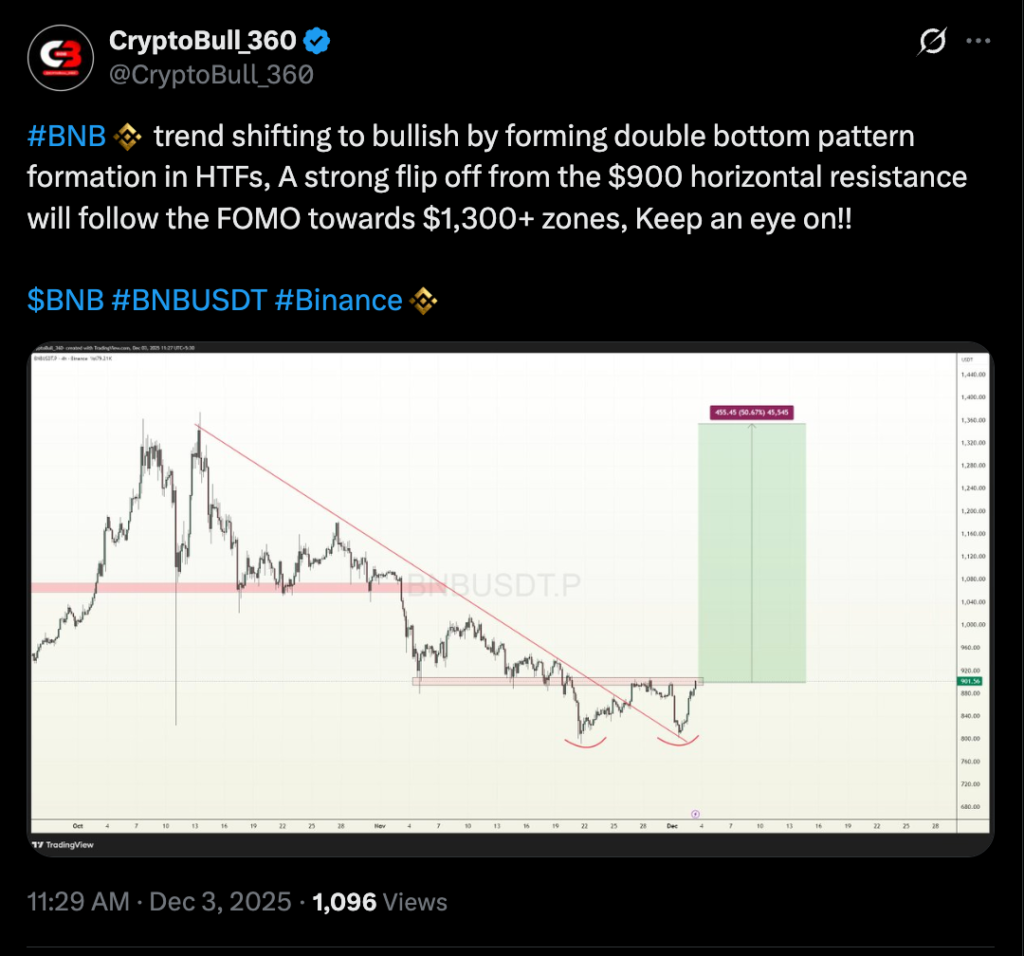

The wedge carries an implied target between $1,100 and $1,115 for December provided the price remains above the retest level. Some traders such as CryptoBull_360 expect even stronger gains with projections reaching up to $1,300 or more. A move back under the former resistance level would weaken the setup and could trap early buyers.

Will BNB Reach $1,000 in December

BNB now stands at a pivotal point. If it maintains support above $900 and completes a decisive breakout from the double bottom neckline, the path to $1,020 looks achievable with the falling wedge target further boosting confidence. Losing the $900 support could delay the rally and expose the token to a deeper pullback.

Leave a Reply