French financial group BPCE is set to introduce crypto trading to a large segment of its retail base, marking a significant move by a major European bank into digital assets. A report from The Big Whale states that users of Banque Populaire and Caisse d’Épargne mobile apps will be able to buy and sell Bitcoin, Ether, Solana, as well as USDC starting Monday.

The first rollout will reach clients of four regional banks, including Banque Populaire Île-de-France and Caisse d’Épargne Provence-Alpes-Côte d’Azur, covering roughly two million customers. BPCE plans a gradual expansion through 2026 until all twenty five regional entities support the service. A bank insider told The Big Whale that the phased strategy allows the group to observe performance at launch before expanding nationwide. This move could position BPCE as one of the earliest traditional banks in Europe to provide retail crypto trading directly inside standard banking apps.

Coinbase Institutional Predicts Strong December Rally for Bitcoin

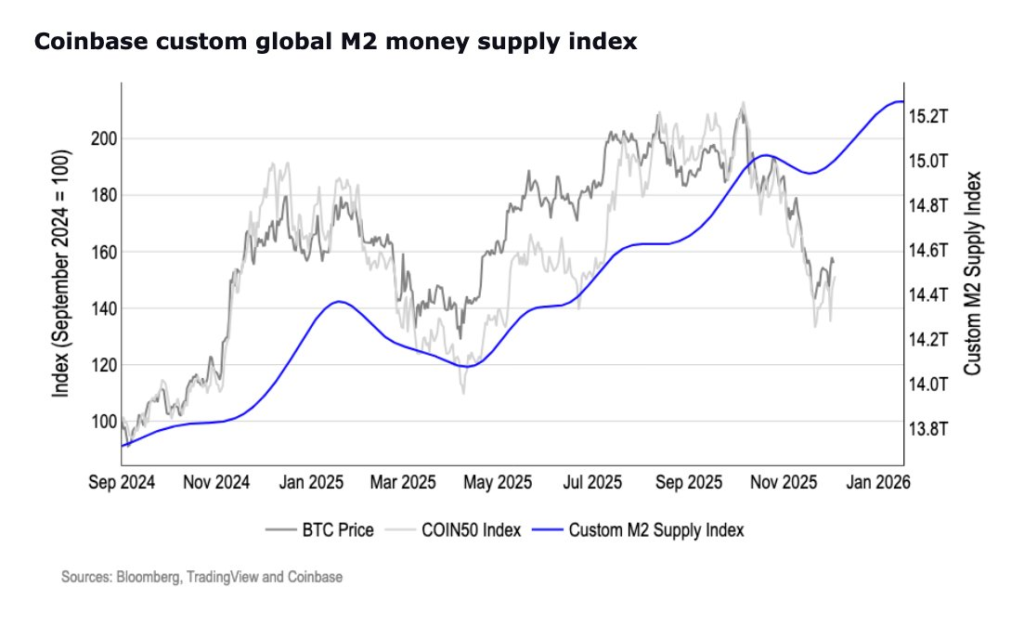

Coinbase Institutional expects Bitcoin to enter a strong year end rally supported by improving global liquidity conditions and anticipated rate cuts in the United States. The latest analysis notes that odds of a US Federal Reserve rate cut climbed to nearly ninety two percent as of four December.

The firm highlights that a rising global M2 supply tends to increase risk appetite across markets. It previously anticipated a period of weakness in October due to monetary trends, followed by a recovery phase in December. A rebound during the final weeks of the year would echo historical market behaviour known as the Santa Claus rally, a period when asset prices often rise during the holidays.

Western Union Announces Stable Card for High Inflation Economies

Western Union has revealed plans for a new “stable card” designed to protect customers living in countries facing severe inflation. The initiative is part of the company’s broader stablecoin strategy and extends its shift from traditional remittance services towards a multi pillar digital asset approach.

Speaking at the UBS Global Technology and AI conference, chief financial officer Matthew Cagwin pointed to Argentina, where annual inflation recently surged between two hundred fifty percent and three hundred percent. He noted that money sent from abroad can lose a large portion of its value within weeks. Cagwin explained that a stable card could help families hold value more effectively, describing it as an enhancement of the company’s existing prepaid cards in the United States.

A Converging Trend Across Traditional and Digital Finance

The day’s developments illustrate a significant convergence between established financial institutions and the crypto sector. BPCE’s adoption of in app trading signals increasing mainstream acceptance of digital assets. Coinbase Institutional’s optimistic market outlook builds on global monetary shifts, while Western Union’s stable card suggests real world use cases for digital currencies in regions with volatile local economies.

As traditional finance entities explore digital asset services, the crypto market continues to mature, with new infrastructure and products aimed at both investment and everyday utility.

Leave a Reply