Bitcoin slipped below the $90,000 mark on Thursday, extending a short term pullback that traders had been watching closely. As the market digests recent gains, attention has shifted to an open gap in CME futures that some analysts believe could play a key role in defining the next major bottom for BTC.

Bitcoin drops below $90,000 in Asia session

Data from TradingView showed Bitcoin falling to fresh local lows of around $89,530 on Bitstamp during early Asia trading. The move confirmed a brief loss of the psychologically important $90,000 level, an area that had acted as near term support earlier in the week.

The decline followed a cooling in risk appetite after Bitcoin and gold both eased from their new year rebound. That rally had gained momentum amid geopolitical developments linked to Venezuela, but traders now appear more cautious as prices consolidate.

Focus shifts to the 21 day moving average

Technical traders were quick to point out that Bitcoin’s dip coincided with a retest of the 21 day moving average, a level often watched to gauge short term trend strength.

Crypto trader and analyst Michaël van de Poppe highlighted that BTC briefly moved below the 21 day MA near $88,900 before stabilizing. According to him, a temporary dip below this line is not necessarily bearish, as it can help absorb liquidity before the market attempts to move higher again. His view suggests that holding this zone could still keep the broader uptrend intact.

Key liquidity zones emerge on exchanges

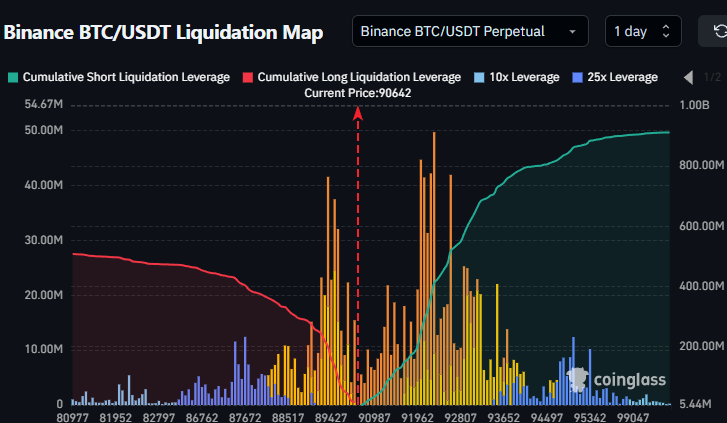

Order book data from major exchanges also helped frame expectations for the days ahead. Trader Daan Crypto Trades pointed to $89,000 and $92,000 as critical levels where buy and sell liquidity is concentrated.

With price now sitting near the middle of a wider trading range, he noted that Bitcoin could continue to move sideways through the end of the week. Such choppy action would fit with a market that is waiting for a clearer catalyst before committing to a stronger directional move.

CME futures gap draws trader attention

A major talking point on lower time frames remains the open gap on CME Group’s Bitcoin futures market. These gaps are created when BTC price moves sharply while CME futures are closed, often over weekends or holidays.

Bitcoin has already filled one of two gaps formed around the new year period after dropping below $90,000. The remaining gap sits near the $88,000 to $88,200 region. Historically, BTC has shown a tendency to revisit and fill such gaps, making this area a natural short term target if selling pressure continues.

Coin Bureau raised the possibility that price could extend lower to close the second gap, a move that would bring Bitcoin closer to $88,000 before any sustained recovery attempt.

Could $88,000 mark a future cycle low?

While some analysts see the unfilled gap as a downside risk, others view it through a longer term lens. Pseudonymous analyst CW, who contributes to onchain analytics platform CryptoQuant, described the remaining gap as a potential hurdle for a clean uptrend.

In his view, filling the gap could remove uncertainty and clear the way for a stronger rally. However, he also suggested an alternative scenario. If Bitcoin reverses higher without filling the $88,000 gap, that price zone could later be seen as the bottom of the next market cycle.

This interpretation is based purely on technical behavior rather than macroeconomic factors. It reflects a pattern seen in past cycles where unfilled CME gaps eventually align with major turning points in price.

Short term caution, long term debate

For now, Bitcoin traders remain divided between expecting a deeper pullback and betting on support holding near current levels. The interaction with the 21 day moving average, combined with the unresolved CME gap, is likely to shape sentiment in the near term.

Whether Bitcoin revisits $88,000 or not, the discussion highlights how closely traders continue to watch technical signals as the market searches for direction in the early part of the year.

Leave a Reply