Global central bank leaders have closed ranks around US Federal Reserve Chair Jerome Powell, issuing a rare show of unity amid rising political scrutiny of the American central bank. The coordinated response highlights growing concern that pressure on the Fed could spill beyond the United States, unsettling financial systems and currency markets worldwide.

Crypto market participants are also watching closely. While political interference could trigger near term volatility, some analysts believe it may strengthen the long term case for assets like Bitcoin and gold as alternatives to the dollar.

Central banks stress independence as a global public good

In a joint statement released on Tuesday, governors from 11 major central banks voiced full support for Powell and the Federal Reserve System. The statement underscored that central bank independence is essential for maintaining price stability, anchoring inflation expectations, and safeguarding trust in monetary policy.

The signatories included European Central Bank President Christine Lagarde, Bank of England Governor Andrew Bailey, Bank of Canada Governor Tiff Macklem, and the heads of the central banks of Sweden, Denmark, Switzerland, Norway, Australia, South Korea, and Brazil. Senior officials from the Bank for International Settlements also added their names.

Such coordinated messaging is unusual and reflects concern that political influence over the Fed could weaken its credibility. Central bankers warned that any erosion of independence in the world’s most influential monetary authority could ripple across global markets, affecting exchange rates, capital flows, and borrowing costs far beyond US borders.

Investigation into Powell heightens tensions in Washington

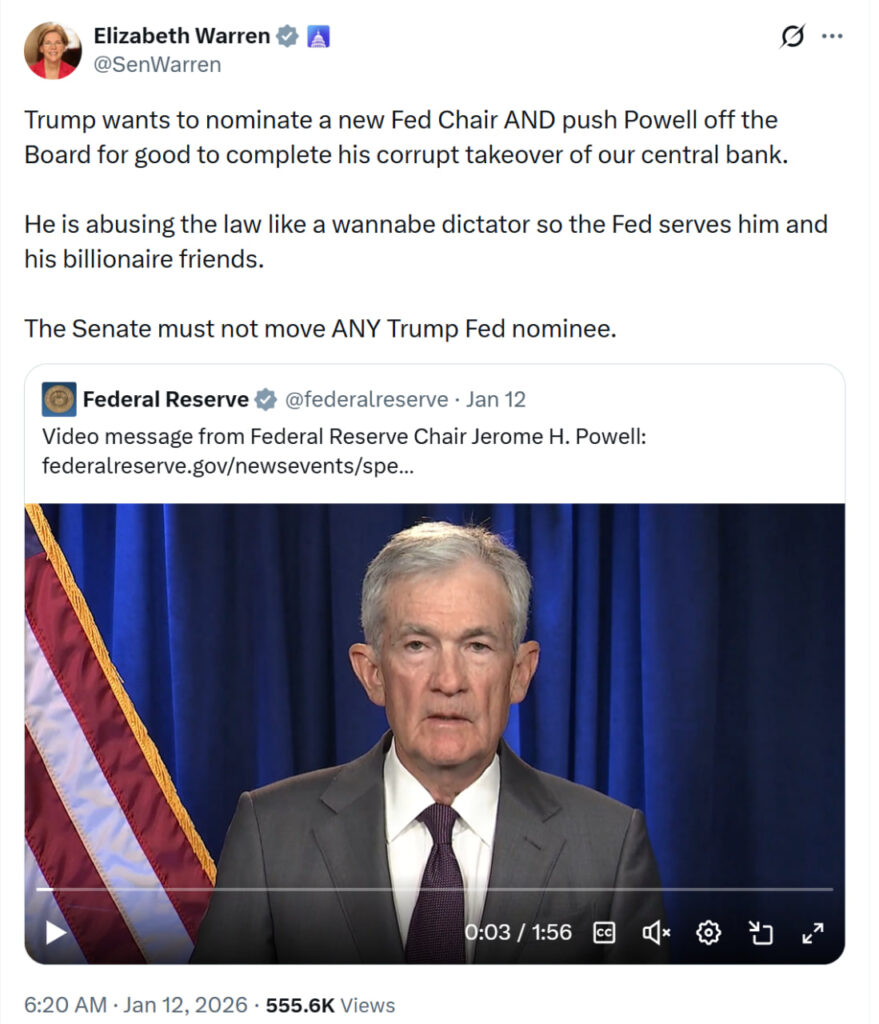

The statement follows news that US authorities have opened a criminal investigation into Powell related to a $2.5 billion renovation of the Federal Reserve’s headquarters. While details remain limited, the move has intensified an already strained relationship between the central bank and the Trump administration.

Critics argue the investigation risks being perceived as political pressure rather than routine oversight. Supporters of the Fed counter that even the appearance of interference can damage investor confidence. Markets tend to react not only to policy decisions, but also to the perceived freedom of policymakers to act without fear of retaliation.

The timing of the probe has added to unease, coming as inflation remains a sensitive issue and interest rate policy continues to divide political leaders and economists alike.

Crypto leaders see volatility but long term shifts

Executives in the digital asset sector say the standoff sends mixed signals to crypto markets. Farzam Ehsani, chief executive of crypto exchange VALR, said that central bank independence has long been a cornerstone of macroeconomic stability. Any attempt at political influence, he noted, can undermine trust in monetary policy and weaken confidence in the dollar.

For cryptocurrencies, this dynamic cuts both ways. On one hand, doubts about dollar policy can drive interest in decentralized assets that operate outside government control. On the other, sudden political shocks often prompt investors to pull back from risk assets, increasing short term volatility and triggering sell offs.

Ray Youssef, chief executive of crypto app NoOnes, pointed to recent market moves as early signals of this tension. The dollar has softened, while gold and silver prices have climbed, suggesting that some investors are rotating into traditional safe havens. Bitcoin, meanwhile, has faced selling pressure during US trading hours, even as longer term interest remains intact.

Youssef added that a potential rate cut could inject liquidity into markets and support crypto prices, but warned that conditions remain fragile until policy clarity improves.

Safe havens regain appeal as uncertainty grows

Beyond crypto, the episode has revived debate over safe haven assets in a politicized monetary environment. Gold has historically benefited when confidence in central banks weakens, and recent price action suggests investors are hedging against policy uncertainty.

Bitcoin proponents argue that similar logic applies to digital assets with fixed supply rules. While Bitcoin still behaves like a risk asset in the short term, periods of monetary or political stress have increasingly drawn attention to its role as an alternative store of value.

At the same time, analysts caution that crypto markets remain sensitive to broader liquidity conditions. If political pressure leads to abrupt policy shifts or market shocks, digital assets could see sharp swings before any longer term trend becomes clear.

Trump allies emerge as potential successors to Powell

Speculation over Powell’s future has intensified as President Donald Trump signals openness to replacing the Fed chair. Several potential successors have emerged from Trump’s inner circle, many of whom have publicly backed interest rate cuts.

Kevin Hassett, a senior economic adviser to Trump and widely viewed as a leading candidate, has said that the president’s personal views on rates would not directly shape Fed decisions under his leadership. Still, markets remain cautious about how independent a Trump appointed chair would be in practice.

The administration has already expanded its footprint at the Fed. Last year, Stephen Miran, a close Trump ally, was appointed to the Board of Governors. At his first meeting in December, Miran argued for a 0.5 percent rate cut, an early signal of a more dovish approach from officials aligned with the White House.

For investors, the outcome of this power struggle could have lasting consequences. Whether the Fed maintains its independence or bends under political pressure may shape not only US monetary policy, but also global capital flows and the future role of alternative assets.

Leave a Reply