European regulators are stepping up pressure on crypto based prediction market Polymarket, with Hungary and Portugal becoming the latest countries to move against the platform. The actions underline a widening debate across the region over whether prediction markets should be regulated as financial instruments or treated as online gambling.

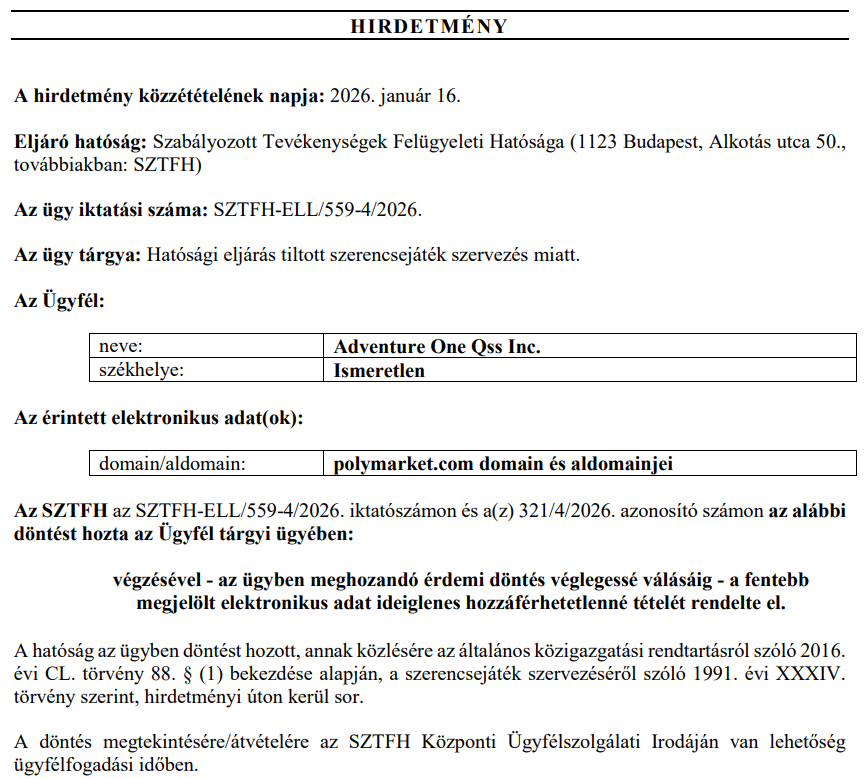

Hungary blocks access over gambling concerns

Hungary’s Szabályozott Tevékenységek Felügyeleti Hatósága has temporarily blocked access to Polymarket’s domain and related subdomains, citing the illegal organization of gambling activities. The regulator said the restriction would stay in place while it completes a formal review of the platform.

Following the order, users attempting to visit Polymarket from Hungarian IP addresses were met with a warning notice issued by the authority. The move effectively cut off local access to the site and placed Polymarket in the same category as other unlicensed gambling platforms operating in the country.

Hungarian officials have not given a timeline for when the review will conclude, leaving uncertainty for users and the company alike.

Portugal orders wind down but access remains

In Portugal, the Gaming Regulation and Inspection Service, known as SRIJ, has instructed Polymarket to wind down its activities in the country. According to local media reports, the regulator argued that Polymarket operates without the required license and offers political betting in a jurisdiction where such activity is banned nationwide.

Despite the order, users were still able to access the platform earlier this week, suggesting that enforcement measures are still being rolled out. Portuguese authorities reportedly flagged around 4 million euros in wagers placed on presidential election outcomes shortly before results were announced, raising concerns about possible insider trading or misuse of privileged information.

The Portuguese case adds another layer to the debate over whether prediction markets can safely operate around political events without undermining public trust.

A growing list of European restrictions

Hungary and Portugal are not isolated cases. Polymarket has faced restrictions or outright blocks in a growing number of countries, many of them in Europe. France’s National Gaming Authority announced plans to block the platform in November 2024 for failing to comply with gambling laws. Switzerland followed soon after, when its gambling watchdog classified Polymarket as unlicensed and ordered access restrictions.

Poland added the platform to its registry of prohibited gambling websites on Jan. 8, 2025. Singapore blocked access days later as part of a wider crackdown on unlicensed online platforms. Belgium’s gambling regulator took similar action at the end of January, citing violations of national gambling legislation.

According to Polymarket’s own disclosures, the platform is already geoblocked in 33 countries worldwide, highlighting the scale of regulatory resistance it faces.

Gambling or financial market?

At the heart of the issue is how prediction markets should be defined. Polymarket allows users to trade contracts tied to real world outcomes, ranging from elections to economic data and geopolitical events. Prices are determined by supply and demand rather than set by a bookmaker.

Supporters argue that this structure makes prediction markets closer to financial markets than traditional betting, with prices reflecting collective expectations rather than odds designed to favor the house. Critics and regulators in many jurisdictions disagree, viewing the activity as gambling that should fall under existing gaming laws.

So far, European authorities have largely taken the latter view, opting to apply gambling regulations rather than develop new rules tailored to crypto based prediction platforms.

Insider trading concerns add pressure

Regulatory scrutiny has intensified following a controversial bet earlier this month that raised alarms about insider trading. On Jan. 3, a Polymarket account placed a wager predicting the removal of Venezuelan President Nicolás Maduro just hours before US forces reportedly captured him during a military operation. The bet generated an estimated profit of about $400,000.

The timing sparked questions about whether the trader had access to non public information. In response, US lawmakers have proposed legislation aimed at restricting political prediction market trading by government officials, further increasing attention on the sector.

Despite these controversies, interest in prediction markets continues to grow. Trading volume across the sector hit a record $701.7 million on Jan. 12. Polymarket rival Kalshi accounted for roughly two thirds of that activity, showing that demand remains strong even as regulators tighten oversight.

Polymarket has not publicly commented on the latest actions by Hungarian and Portuguese authorities.

Leave a Reply