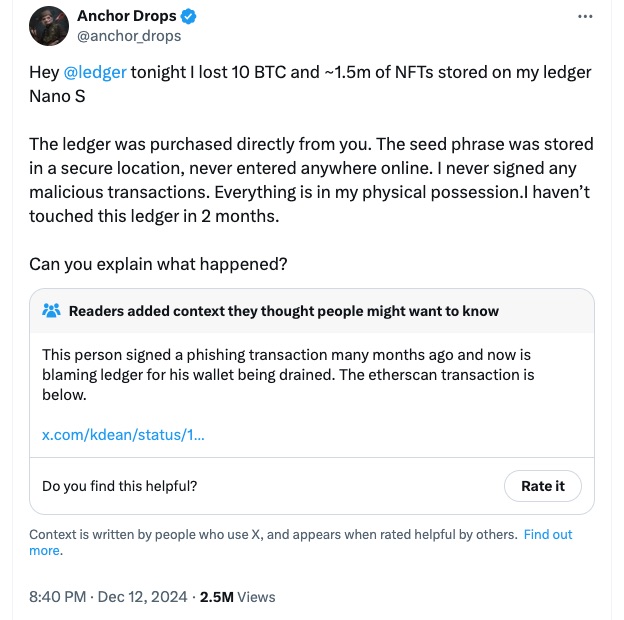

A crypto user, known as “Anchor Drops” on X (formerly Twitter), has reported the loss of 10 Bitcoin (approximately $1 million) and $1.5 million worth of NFTs, allegedly stolen from their Ledger Nano S hardware wallet.

The incident has been linked to a phishing attack dating back to February 2022. A post by community member KDean identified a malicious transaction, tagged as “Fake_Phishing5443,” tied to the user’s Ethereum address. While this explains the NFT losses, it remains unclear how Bitcoin was compromised. Ledger attributed the losses to phishing and older malicious transactions.

Solana Tops Ethereum in New Developer Growth

For the first time since Ethereum’s inception, Solana has outpaced it in onboarding new developers. A December report from Electric Capital revealed Solana added 7,625 developers this year, surpassing Ethereum’s 6,456.

The surge in Solana’s developer community, primarily driven by growth in Asia, marks a significant shift in the blockchain ecosystem. Despite this, Ethereum retains its lead in overall developer activity, with 6,244 monthly developers, even as its numbers declined by 17% this year.

Grayscale Launches Lido and Optimism Funds

Grayscale Investments has introduced two new investment funds for the governance tokens of Lido DAO (LDO) and Optimism (OP). The Grayscale Lido DAO Trust and Grayscale Optimism Trust will offer investors exposure to these protocols, which focus on Ethereum scalability and staking democratisation.

Rayhaneh Sharif-Askary, Grayscale’s head of product and research, highlighted the importance of these tokens in supporting Ethereum’s DeFi ecosystem. The announcement follows the company’s October launch of an Aave governance token fund.

With nearly $35 billion in assets under management, Grayscale continues to expand its portfolio, targeting Ethereum-aligned innovations.

The day’s events underscore the need for vigilance in crypto security, as well as the shifting dynamics in blockchain development and investment trends.

Leave a Reply