Binance has applied for authorization under the European Union’s Markets in Crypto-Assets Regulation in Greece, as pressure mounts on crypto firms to meet looming compliance deadlines across the bloc. The move comes at a time when regulators are stepping up scrutiny of exchanges that have yet to secure a MiCA license ahead of the June 30 transition cutoff.

A Binance spokesperson confirmed that the company has submitted its application to the Hellenic Capital Market Commission, Greece’s financial watchdog, and is actively engaging with the regulator as the framework is implemented. The exchange said it views MiCA as a step that can bring clarity and consistency to crypto regulation across the European Union.

France highlights Binance’s unlicensed status

Binance’s application in Greece follows a warning from France’s Autorité des Marchés Financiers earlier this month. The AMF listed Binance among dozens of crypto companies that are registered in France but remain unlicensed under MiCA. According to the regulator, firms in this category were informed in late 2025 that France’s MiCA transition period will end on June 30, after which non-compliant companies will be required to halt operations starting in July.

The French regulator’s notice underscored the narrowing window for major exchanges to secure authorization in at least one EU member state if they wish to continue serving customers across the bloc under the passporting rules of MiCA.

MiCA seen as a milestone by the exchange

Binance has publicly welcomed the MiCA framework, describing it as an important development for the digital asset industry in Europe. The company said the regulation provides stronger user protections, clearer rules for operators, and a structured environment for innovation.

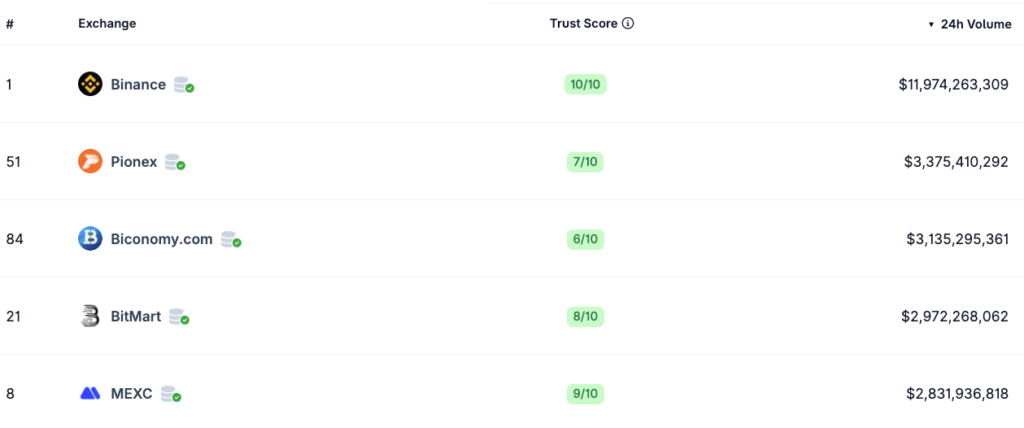

Founded in 2017, Binance has grown into the world’s largest centralized crypto exchange by trading volume. Data from CoinGecko shows the platform processes an average of nearly 12 billion dollars in daily trading activity. Its scale has made regulatory approval in major markets a critical issue for its long-term strategy.

Greece yet to grant its first MiCA license

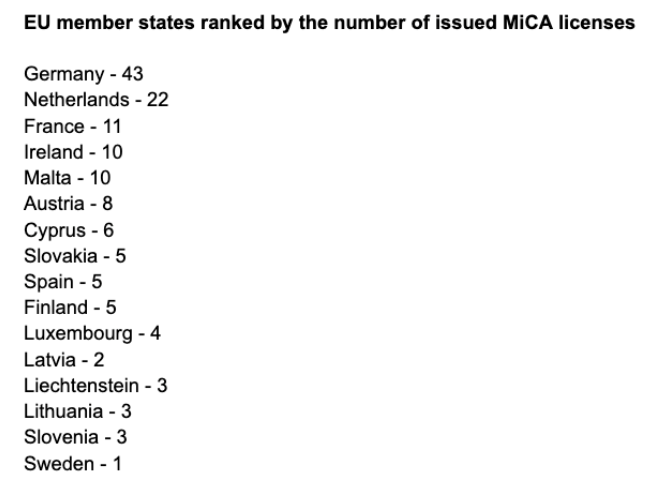

Despite Binance’s application, Greece has not yet issued a single MiCA license to a crypto-asset service provider. Public data from the European Securities and Markets Authority shows that, as of mid-January, Germany and the Netherlands are leading the EU in MiCA authorizations, with 43 and 22 licenses respectively. France follows with 11 approved providers.

The lack of issued licenses in Greece highlights the uneven pace at which MiCA is being rolled out across member states. Still, a successful application could position Greece as a new regulatory hub if approvals begin to accelerate.

Wider European context and regulatory pressure

The push for MiCA compliance extends beyond crypto-native firms. Last week, Belgian banking group KBC announced plans to launch Bitcoin and Ether trading services in February. The bank said it expects to obtain a MiCA license in Belgium, another country that has yet to grant its first authorization under the new regime.

Binance’s relationship with European regulators has been under strain for several years. As early as 2021, authorities in multiple EU countries warned that the exchange was operating without proper registration. Oversight intensified as MiCA approached full implementation in late 2024.

The exchange has also faced global regulatory challenges. In 2023, Binance co-founder and former chief executive Changpeng Zhao pleaded guilty in the United States to money-laundering violations and served a four-month prison sentence. The case reinforced regulators’ resolve to impose stricter compliance standards on large crypto platforms.

As the June deadline approaches, Binance’s application in Greece signals an effort to secure a regulatory foothold within the European Union. Whether Greece becomes the gateway for Binance’s MiCA approval remains to be seen, but the move reflects the urgency facing crypto firms as the EU’s new regulatory era takes hold.

Leave a Reply