Tether, the issuer of the world’s largest stablecoin USDt, has reported record US Treasury holdings in 2025, even as its annual profits fell compared to the previous year. The company’s latest financial report highlights a strategic shift toward safer and more liquid assets amid rising global demand for dollar-backed digital currencies.

Profits fall despite strong balance sheet growth

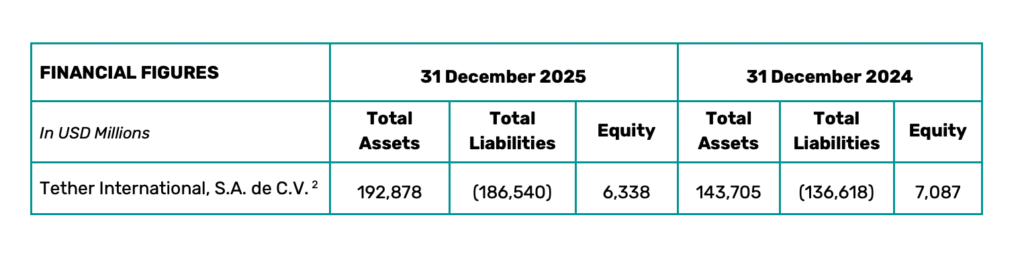

According to a report prepared by accounting firm BDO and released on Friday, Tether posted net profits of more than $10 billion in 2025. This marks a decline of around 23 percent from the $13 billion it reported in 2024, translating to roughly $3 billion less in year-on-year earnings.

Tether CEO Paolo Ardoino downplayed the drop in profits, saying the company’s focus in 2025 was less about scale and more about the structure supporting its long-term growth. He noted that profitability can fluctuate, but the strength and resilience of the company’s reserves and operating model remain the priority.

US Treasury exposure reaches all-time high

While profits declined, Tether’s exposure to US Treasuries surged to new levels. The company said its direct holdings of US government debt climbed above $122 billion in 2025, the highest figure it has ever reported.

Tether described this as an ongoing shift toward highly liquid, low-risk assets, reinforcing the backing behind USDt. US Treasuries are widely considered one of the safest financial instruments globally, and their growing share in Tether’s reserves is likely to be closely watched by regulators, traders, and institutional market participants.

$50 billion in new USDt issued over 12 months

Over the past year, Tether issued approximately $50 billion worth of new USDt tokens, reflecting continued demand for dollar exposure outside traditional banking systems. Ardoino said the growth was driven by rising global demand for US dollars, particularly in regions where access to banking services is limited or inefficient.

He pointed to countries with slow, fragmented, or inaccessible financial infrastructure, arguing that USDt has become a practical alternative for payments, savings, and cross-border transfers. According to Ardoino, the stablecoin now functions as a global monetary network operating beyond conventional financial rails.

USDt’s role in the broader crypto market

USDt remains a cornerstone of the cryptocurrency ecosystem. It is currently the third-largest cryptocurrency by market capitalization, behind Bitcoin and Ether. Data from CoinMarketCap shows USDt with a market capitalization of approximately $185.51 billion.

Because of its size and widespread use, Tether’s financial health is closely monitored by crypto traders, exchanges, and market makers. USDt is commonly used as a substitute for the US dollar in trading pairs, as well as collateral for derivatives and lending platforms. As a result, changes in Tether’s reserves and profitability often influence broader market confidence in stablecoins.

Gold reserves add another layer to Tether’s backing

In addition to US Treasuries, Tether continues to expand its exposure to gold. The company issues XAUt, a gold-backed stablecoin, and reported around $12 billion in gold exposure as of September 2025.

Tether holds 520,089 troy ounces of gold, or roughly 16.2 metric tons, specifically allocated to back XAUt tokens. This gold is held separately from the company’s broader gold reserves, which total approximately 130 metric tons and are valued at around $22 billion based on current prices.

A Tether spokesperson recently said that each XAUt token is fully backed by physical gold held in reserve and is eligible for physical delivery redemption. The separation of XAUt backing from the wider gold reserves is intended to provide clarity and assurance to token holders.

Looking ahead

Despite lower profits, Tether’s growing holdings of US Treasuries and gold suggest a continued effort to strengthen the quality and transparency of its reserves. As stablecoins face increasing regulatory scrutiny worldwide, the composition of Tether’s balance sheet may play a key role in shaping market trust.

For now, the company appears focused on reinforcing its foundations rather than chasing rapid expansion. With USDt deeply embedded in global crypto markets and increasingly used in regions underserved by traditional finance, Tether’s strategy in 2025 signals a push for durability over short-term gains.

Leave a Reply