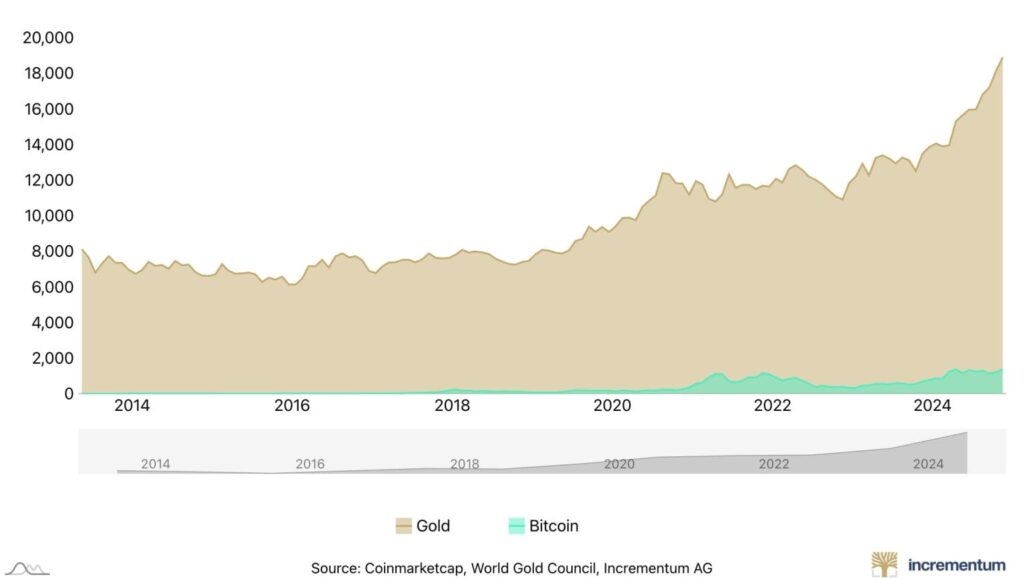

Bitcoin has achieved another historic milestone, soaring past $106,000 per coin and reaching unprecedented purchasing power relative to gold. The Bitcoin-to-gold ratio, a key metric comparing Bitcoin’s value to that of gold, hit an all-time high of 40 ounces of gold per Bitcoin.

Bitcoin-to-Gold Ratio Hits Record High

Veteran trader Peter Brandt highlighted this milestone, revealing that the Bitcoin-to-gold ratio has reached 40:1 as Bitcoin surged to $106,000, while spot gold traded at $2,650 per ounce. The ratio, calculated by dividing Bitcoin’s price by the gold spot price, showcases Bitcoin’s growing dominance as a store of value.

Brandt predicted the ratio could climb even further, targeting a potential 89 ounces of gold per Bitcoin. This highlights the growing belief that Bitcoin is not just competing with but potentially overtaking gold as the preferred asset for wealth preservation.

Bitcoin’s Growing Appeal as Digital Gold

Bitcoin’s rise has reignited debates over its potential to replace gold’s role in the global economy. Proponents argue Bitcoin’s scarcity, digital nature, and decentralization make it superior to gold, a sentiment reflected in its increasing market adoption.

Currently, Bitcoin’s market value stands at $2.1 trillion, still trailing gold’s massive $15 trillion market cap. However, influential voices within the crypto space, like MicroStrategy’s Michael Saylor, suggest that Bitcoin could one day eclipse gold.

Saylor recently urged the U.S. government to sell its gold reserves—accounting for 72% of its total assets—and invest in Bitcoin instead. According to him, “Dump your gold… and buy Bitcoin. You can demonetise gold as an asset class and drive Bitcoin’s value to trillions.”

Bitcoin Mining Difficulty Breaks Records

Adding to Bitcoin’s bullish momentum, its mining difficulty has reached a new high. On December 15, the difficulty surpassed 105 trillion, reflecting the network’s growing security and competition among miners. This metric, which adjusts every two weeks, is a crucial indicator of Bitcoin’s robustness.

The next adjustment is scheduled for January 1, 2025, and further increases are expected as mining investments intensify. Notably, Jack Dorsey’s Block announced plans to expand its Bitcoin mining initiatives and self-custody wallet solutions, reflecting sustained confidence in the asset’s future.

What Lies Ahead for Bitcoin?

With Bitcoin’s price and purchasing power breaking records, the debate over its role as a store of value continues. Enthusiasts see it as the digital successor to gold, poised to claim a larger share of the traditional asset’s market dominance.

As Bitcoin’s price trajectory accelerates and mining activity grows, all eyes are on its potential to rewrite the rules of global finance. Could Bitcoin truly dethrone gold as the ultimate reserve asset? Only time will tell, but its rise shows no signs of slowing.

Leave a Reply