Crypto investment products have marked a milestone, recording their 10th consecutive week of inflows, with a total of $3.2 billion added in the trading week of December 9–13. The surge highlights strong investor sentiment as Bitcoin hits new highs and Ethereum-based products gain traction.

$3.2 Billion Inflows Amid Bitcoin’s Rally

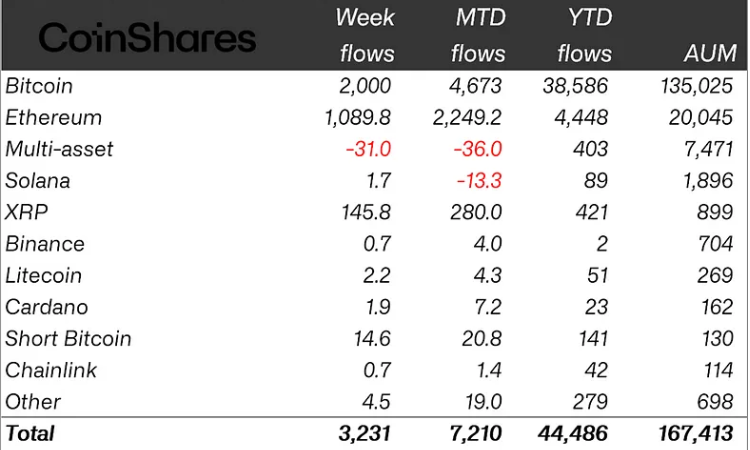

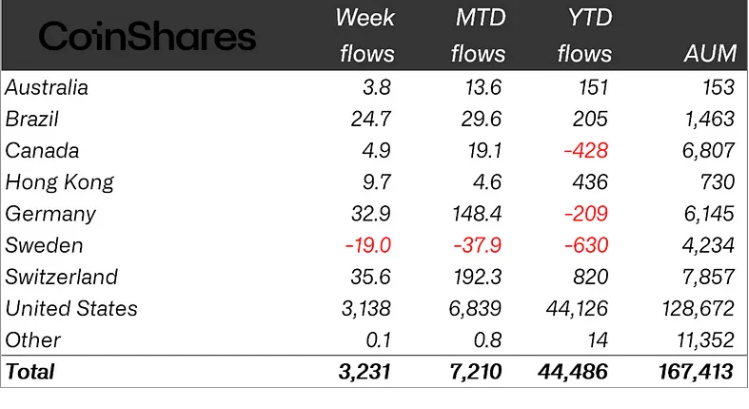

Digital asset investment products recorded $3.2 billion in inflows last week, bringing the total for 2024 to $44.5 billion. This follows a record-breaking $3.85 billion inflow the previous week, according to a report by CoinShares.

The past 10 weeks alone have accounted for $20.3 billion, representing 45% of all inflows in 2024. The continuous streak of positive flows began in early October, signaling growing confidence in the cryptocurrency market.

Bitcoin Leads the Charge

Bitcoin investment products dominated last week’s inflows with $2 billion, reflecting its status as the primary driver of the crypto market. Since the U.S. presidential election, Bitcoin-related inflows have reached $11.5 billion.

BlackRock’s iShares Bitcoin Trust emerged as the leading contributor to Bitcoin inflows, adding $2 billion, while Grayscale’s Bitcoin Trust saw outflows of $145 million. Short Bitcoin products also witnessed increased activity, recording $14.6 million in inflows, though their assets under management remain low at $130 million.

Ethereum ETPs Maintain Momentum

Ethereum-based exchange-traded products (ETPs) saw inflows of $1 billion last week, marking the seventh consecutive week of positive activity. Over this period, Ethereum ETPs have amassed $3.7 billion in inflows.

Ether’s sustained performance underscores its appeal among investors seeking exposure to alternative digital assets beyond Bitcoin. The ongoing momentum highlights Ethereum’s critical role in the broader crypto investment landscape.

2024: A Record Year for Crypto ETPs

The crypto investment market has flourished in 2024, with exchange-traded products (ETPs) amassing $20.3 billion over the past 10 weeks. This growth reflects the sector’s resilience amid macroeconomic uncertainty and institutional adoption.

While Bitcoin continues to dominate, Ether’s growing share in the market signifies diversification in investor preferences. With inflows showing no signs of slowing, the crypto investment landscape is poised for further expansion as institutional and retail investors fuel demand.

As Bitcoin and Ethereum hit new milestones, the outlook for digital assets remains optimistic, bolstered by steady inflows and increasing mainstream adoption.

Leave a Reply