Cryptocurrency markets faced a sharp downturn as the dollar strengthened, causing XRP to lead losses and bitcoin (BTC) to retreat. Here’s a look at the factors contributing to the market’s slide and insights into its potential trajectory.

XRP Drops 5%, Leading Crypto Losses

XRP fell by over 5% in the past 24 hours, marking the steepest decline among major cryptocurrencies. Other digital assets, including dogecoin (DOGE), Solana (SOL), ether (ETH), and Binance Coin (BNB), experienced drops of up to 2%. The broader market saw a 3% contraction, while the CoinDesk 20 Index, tracking the largest non-stablecoin tokens, lost 3.5%.

This decline comes amid thinning liquidity and profit-taking as investors close positions ahead of year-end. The crypto market’s recent volatility has been further exacerbated by macroeconomic uncertainty.

Stronger Dollar Pressures Dollar-Denominated Assets

The U.S. Dollar Index (DXY), which measures the dollar’s strength against major global currencies, surged, weighing on dollar-denominated assets like bitcoin and gold. Historically, a stronger dollar makes such assets less attractive, reducing demand.

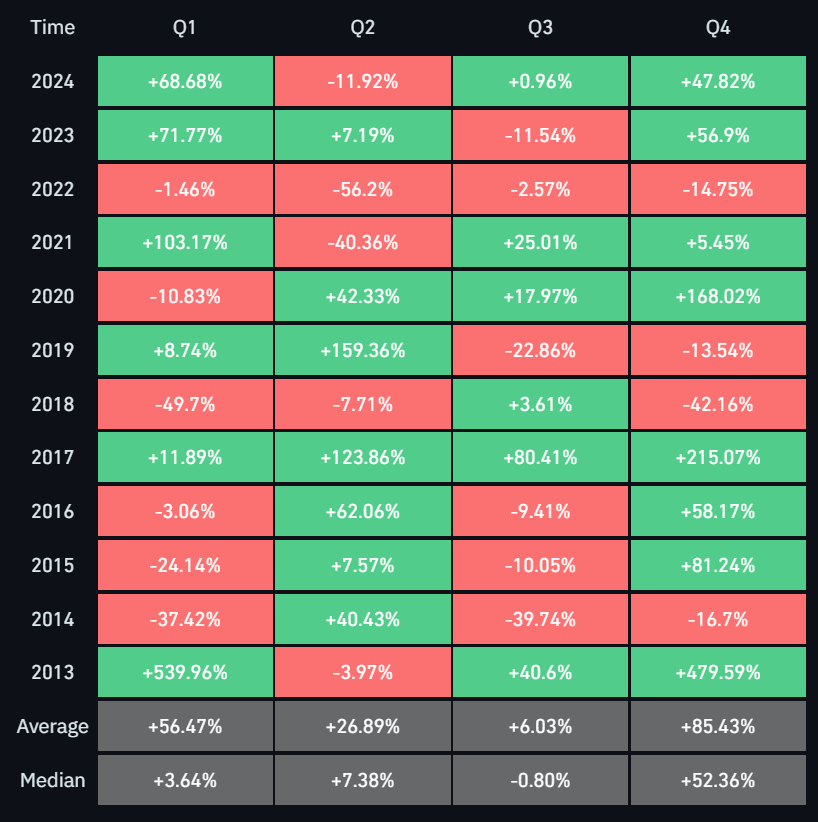

Investors have pivoted towards traditional financial instruments such as U.S. Treasuries, which typically yield higher returns in a robust dollar environment. This shift has hindered hopes for a sustained crypto rally during December, traditionally known for a “Santa rally.” Despite BTC’s 47% gain in Q4, it has dropped nearly 4% this month, underscoring the market’s struggles.

Muted Optimism Amid Fed Policy Adjustments

The Federal Reserve’s scaled-back expectations for future interest-rate cuts have added to the crypto market’s woes. Reduced expectations for monetary easing have led to dampened sentiment among investors.

However, some industry players remain optimistic about crypto’s long-term prospects. Maksym Sakharov, co-founder of WeFi, noted, “The current selloff reflects the market’s knee-jerk reaction to macroeconomic uncertainties. With inflation nearing the 2% benchmark, the Fed is preparing for tighter conditions next year, which could shift market dynamics.”

The Role of Regulatory Expectations

The crypto market’s future could be influenced by regulatory shifts as President-elect Donald Trump takes office. Sakharov highlighted the potential for favorable regulations to encourage more corporate participation in the crypto space, potentially decoupling BTC’s price from macroeconomic pressures.

“Corporate interest in bitcoin is likely to rise with improved regulatory clarity, which could mitigate its volatility and create a more stable investment environment,” Sakharov added.

Leave a Reply