Cryptocurrency payment platform BitPay recorded 608,000 transactions in 2024, marking significant growth as digital asset holders embraced spending during the year’s bull market. Litecoin (LTC) emerged as the most used cryptocurrency on the platform, followed by Bitcoin (BTC) and Ether (ETH), according to BitPay’s “Decrypted 2024” report.

Litecoin Tops Transactions

Litecoin dominated BitPay’s transaction volumes with 201,165 payments, showcasing its popularity for day-to-day use. Bitcoin trailed with 130,250 payments, while Ether secured third place with 56,356 payments. The report highlighted the growing acceptance of crypto as a medium of exchange, stating, “2024 was all about putting crypto to work.”

The trend underscores a shift in how cryptocurrencies are perceived, moving beyond investment tools to practical payment options. BitPay users increasingly utilised digital assets for luxury goods, jewellery, electronics, and precious metals. Transactions for these items grew by 39% to 205% compared to the previous year.

US Leads Crypto Payment Adoption

The United States accounted for over 76% of BitPay’s total transactions in 2024, reflecting the country’s dominant position in the crypto payments sector. BitPay, headquartered in the US, allows merchants to accept crypto payments and settle in their local currencies. This ease of use has made the platform popular among merchants and consumers alike.

Crypto Payments Slowly Gain Traction

Despite the growth in 2024, cryptocurrency as a payment method still lags behind its role as an investment vehicle. Between 2021 and 2023, crypto retail transactions comprised only 3% of payments, according to Deutsche Bank data.

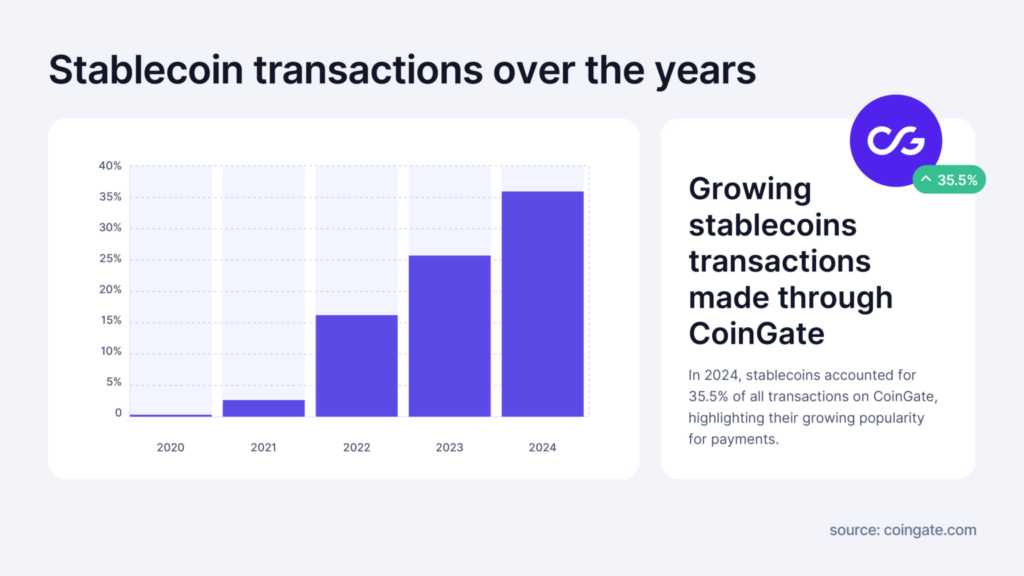

Stablecoins, digital currencies pegged to fiat values, are driving some of this adoption. Crypto payment processor CoinGate reported a 29.6% rise in transactions in 2024, with stablecoins making up more than a third of the total.

However, critics argue that stablecoins diverge from the decentralised ethos of cryptocurrency. Monty Munford, writing for Magazine, noted that centralised stablecoins require significant trust in their issuers, a departure from Bitcoin’s trustless framework.

Stablecoins Command Market Share

The market for stablecoins continues to grow, with a total capitalisation of $206 billion, according to DefiLlama. The two largest stablecoins, issued by Tether and Circle, collectively represent nearly 89% of this total.

As crypto payment infrastructure matures, platforms like BitPay are paving the way for broader adoption. With a strong correlation between crypto prices and spending habits, 2024 demonstrated the potential for cryptocurrencies to function as more than just a store of value.

Leave a Reply