The Trump family’s official memecoins, TRUMP and MELANIA, saw a meteoric rise in trading activity following U.S. President Donald Trump’s inauguration but have since experienced sharp declines. Over the past 24 hours, TRUMP and MELANIA tokens plummeted by up to 60%, with investors rushing to take profits after the initial hype subsided.

Despite the downturn, trading volumes were impressive. Data revealed TRUMP amassed over $19 billion in 24-hour volumes, while MELANIA saw $4.5 billion exchange hands—far exceeding activity in established cryptocurrencies like Tron (TRX) and Cardano (ADA), which each generated less than $4 billion.

Profit-Taking and Liquidations Hit Hard

The surge in interest was short-lived, leaving hopeful investors with significant losses. Futures linked to TRUMP and MELANIA faced liquidation losses nearing $70 million, particularly for those betting on higher prices.

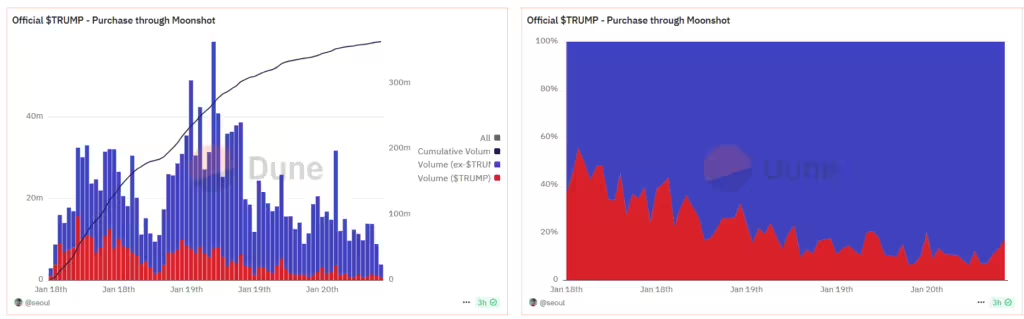

Data from trading platform Moonshot showed a sharp drop in buying volumes, declining from over $6 million between January 18 and 19 to just $1 million in the past 24 hours. This steep decline suggests waning interest and a potential shift in market sentiment.

No Crypto Boost from Trump’s Inaugural Speech

Crypto markets had high hopes for a pro-crypto signal during Trump’s inaugural address, with speculation surrounding a strategic Bitcoin reserve. However, the lack of any mention of cryptocurrencies caused Bitcoin (BTC) to fall sharply, dropping from a high of $109,000 on Monday to just over $101,000 in Asian trading hours.

Despite the disappointment, optimism remains among traders, particularly around the Solana (SOL) blockchain. The launch of TRUMP tokens on Solana has been viewed as a major endorsement of the chain and has raised expectations for the early approval of a Solana-based exchange-traded fund (ETF).

Future Prospects for Pro-Crypto Policies

Market analysts remain hopeful for a pro-crypto policy shift under Trump’s administration. Singapore-based QCP Capital highlighted the potential for increased retail and institutional interest following the launch of Trump-themed tokens.

“Launching $TRUMP on SOL is a strong endorsement of the chain and could accelerate the approval of the SOL ETF,” QCP Capital stated in a broadcast. They added that Trump’s memecoin launch bridges the gap between retail investors and major institutions, potentially shaping the broader crypto economy.

The Trump-themed token frenzy has showcased the volatile nature of memecoins, attracting significant trading activity but leaving many investors with steep losses. While short-term prospects for these tokens remain uncertain, the broader implications for the crypto market—including potential policy shifts and institutional adoption—could drive future growth in the sector.

Leave a Reply