As 2025 unfolds, the crypto market is experiencing a surprising surge of optimism. A wave of altcoin ETFs applications is flowing into the U.S. Securities and Exchange Commission (SEC), signalling a major shift in how traditional finance is starting to embrace cryptocurrencies beyond Bitcoin and Ether.

So far this year, at least 31 applications for altcoin exchange-traded funds (ETFs) have been submitted, a significant jump that reflects growing interest and regulatory changes. The new SEC leadership under Chairman Paul Atkins is proving to be a game-changer for the crypto space.

Here’s everything you need to know about the rise of altcoin ETFs and what it could mean for the future of crypto in the US and beyond.

What’s Behind the ETF Boom?

The approval of spot Bitcoin ETFs in January 2024, followed by Ether ETFs in July, marked a major milestone in crypto adoption. These products made it easier for institutional investors to gain exposure to crypto through a familiar vehicle.

This success encouraged fund managers to expand their horizons beyond the top two cryptocurrencies. Now, we’re seeing a flood of altcoin ETF filings from established financial firms like VanEck, WisdomTree, and Franklin Templeton, to crypto-native players like REX-Osprey.

Some of the most notable altcoins in these filings include:

- XRP (Ripple’s payments token)

- BNB (Binance Coin)

- Avalanche

- Dogecoin (the original memecoin)

- Solana

- Litecoin

Even more surprising is the filing of an ETF based on Donald Trump’s meme token by REX-Osprey, showing just how diverse and unconventional the crypto ETF scene is becoming.

A New Look SEC: Crypto-Friendly and Open-Minded

Much of the current optimism stems from a major leadership shift at the SEC.

In April 2025, Paul Atkins was confirmed as the new SEC Chair, replacing Gary Gensler. Gensler had a reputation for taking a tough stance on crypto, often opting for regulation through enforcement, which created uncertainty and fear in the industry.

Atkins, however, is taking a more progressive approach:

- He’s reversed several Gensler-era proposals that limited DeFi and crypto innovation.

- He’s pushing for “notice and comment” rulemaking allowing the public and industry to give input before new regulations are made.

- The SEC is working on an “innovation exemption”, which could fast-track approval for onchain financial products.

One major reversal includes the withdrawal of Rule 3b-16, which would have expanded the definition of “exchange” to include decentralised finance (DeFi) protocols. This move is seen as a green light for DeFi platforms to innovate without fear of immediate clampdowns.

In addition, the SEC rolled back a rule that required crypto companies to use “qualified custodians” a rule many argued was outdated and unfair to the crypto industry.

Will the ETFs Actually Be Approved?

While the volume of filings is impressive, not all will make it across the finish line. Still, analysts are hopeful.

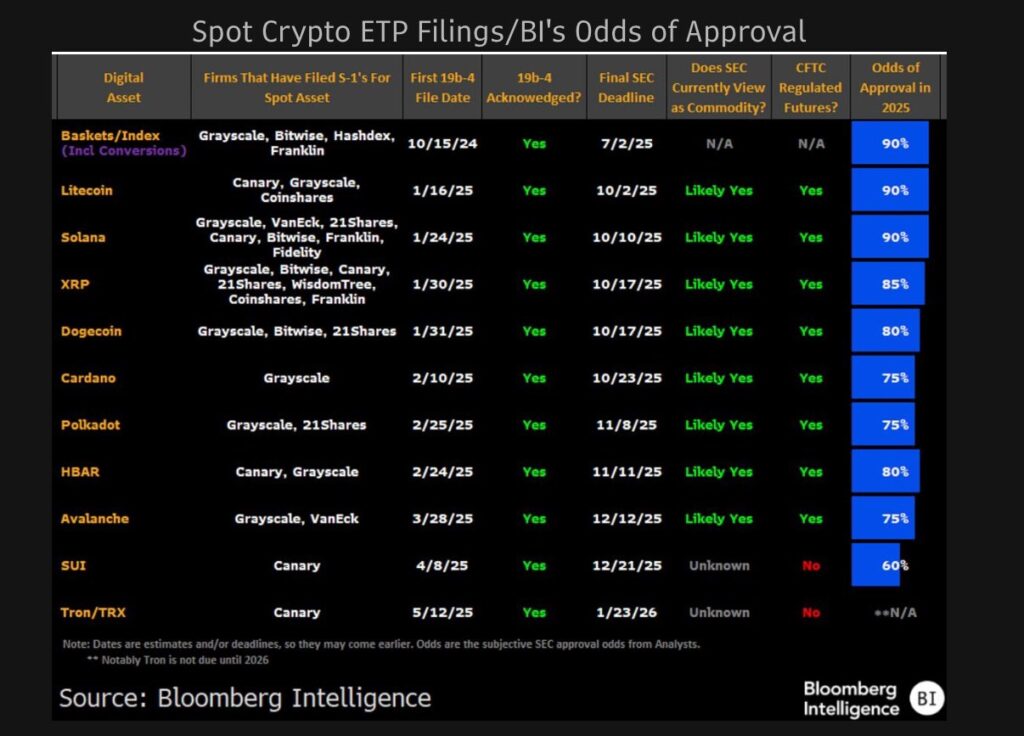

According to Bloomberg ETF expert Eric Balchunas, at least 10 altcoin ETFs have a 60% or higher chance of approval. He believes Litecoin could be the first altcoin to get a green light, with Solana not far behind.

In fact, REX-Osprey’s aggressive filing for a Solana ETF might have sped things up, prompting the SEC to engage with applicants more openly. The SEC has reportedly asked for clarification on staking and in-kind redemptions, which many see as a positive sign.

Why does this matter? Because staking is a critical part of how many altcoins operate. If the SEC is opening the door to staking within ETFs, it could set the stage for a much broader set of crypto investment products.

“Altcoin Summer” or Another Crypto Winter?

There’s plenty of buzz about a possible “altcoin summer”, referring to a period when altcoins surge in popularity and price. But not everyone is convinced it’s around the corner.

Some analysts are cautious. After all, ETH which got its spot ETF in 2024 hasn’t seen the same explosive growth as Bitcoin. Although Ether ETFs have shown solid inflows recently, prices remain relatively flat.

Eric Balchunas summed it up well:

“Nothing will compare to Bitcoin. The further away you get from BTC, the less assets there will be.”

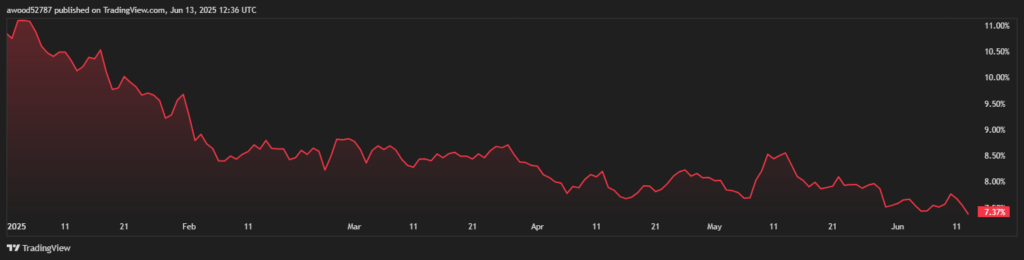

Market data backs this up. Two independent trackers, Blockchain Center’s Altcoin Season Index and CoinMarketCap’s Bitcoin Season Meter both show that we’re still deep in Bitcoin Season, where Bitcoin dominates trading and investment.

Even altcoin dominance (the market share of all altcoins compared to Bitcoin) is shrinking faster than in previous cycles. That’s a red flag for those expecting quick gains.

Still, not all analysts are bearish.

Crypto expert Michaël van de Poppe believes the real altcoin rally hasn’t even started. He’s predicting the biggest crypto bull market ever, driven by post-bear market expansion. And despite recent price shocks like the Israel-Iran conflict in June, he’s advising investors to “buy the dip.”

What’s Next for US Crypto Regulation?

While the SEC is grabbing headlines, the Commodity Futures Trading Commission (CFTC) is also stepping up.

Caroline Pham, acting chair of the CFTC, has praised Atkins’ crypto-friendly approach. Collaboration between these two regulators could lead to clearer rules and fewer conflicts for crypto projects in the US.

The crypto industry is hopeful that the regulatory environment will keep improving, helping legitimize the space further. A more stable legal framework could attract institutional capital, accelerate innovation, and ultimately fuel the growth of the entire market.

Final Thoughts: A Turning Point for Altcoins?

With 31 new altcoin ETF filings, changing SEC leadership, and a more open regulatory tone, 2025 might go down as a pivotal year for crypto.

But whether this turns into an “altcoin summer” or ends up being another false dawn depends on two things: regulatory approvals and real investor demand.

If even a handful of these ETFs get the green light, especially for popular coins like XRP, Solana, and Dogecoin, we could see a new wave of institutional money flow into the altcoin space.

For now, crypto enthusiasts and investors are watching the SEC closely. Approval could turn hope into reality and finally bring altcoins into the mainstream financial spotlight.

Leave a Reply