Ant Digital Technologies, the enterprise arm of Jack Ma-backed Ant Group, is pushing ahead with one of the largest blockchain-based energy initiatives to date. The company is preparing to tokenise more than $8 billion worth of energy infrastructure on its proprietary AntChain network, according to a Bloomberg report.

This marks a significant step for the fintech giant as it seeks to digitise and democratise investment in clean energy projects while strengthening its foothold in the real-world asset (RWA) sector.

Tokenising Power Infrastructure at Scale

Ant Digital plans to tokenise around 60 billion yuan ($8.4 billion) of power infrastructure, leveraging blockchain to track and monetise energy production. The company has already been monitoring performance from over 15 million energy devices across China, including wind turbines and solar panels, with the data uploaded directly onto AntChain.

The tokenisation process has already been tested with financing rounds for clean energy firms. Ant Digital has raised around 300 million yuan ($42 million) across three projects through asset tokenisation and is now preparing to issue tokens directly linked to those assets.

Sources cited by Bloomberg suggest that Ant is also considering taking a further step by placing tokens on decentralised offshore exchanges. This could boost liquidity but would depend heavily on regulatory approvals.

Early Wins in Clean Energy Funding

Ant Digital has already demonstrated how tokenisation can transform project financing. In August 2024, the company raised 100 million yuan ($14 million) for Longshine Technology Group and connected 9,000 of its electric vehicle charging units to AntChain. Later, in December, it secured over 200 million yuan ($28 million) for GCL Energy Technology by tokenising photovoltaic assets.

These examples highlight the efficiency gains of blockchain-based fundraising. By issuing digital tokens tied to energy assets, Ant Digital reduces reliance on intermediaries such as banks, loan officers and underwriters. This lowers costs, accelerates access to funding, and potentially opens investment to smaller players and retail investors who are usually excluded from infrastructure projects.

Ant’s Broader Blockchain and Stablecoin Ambitions

The tokenisation of energy infrastructure is only part of Ant Group’s wider blockchain strategy. Reports from July indicated that Ant was in talks with Circle, issuer of USDC, to integrate the stablecoin into its platforms.

Meanwhile, Ant International, the group’s global division, has been focusing on cross-border payment solutions and applying for licences tied to stablecoins. These initiatives suggest that Ant is seeking to merge its enterprise blockchain solutions with global payment and liquidity networks, creating a more comprehensive financial ecosystem.

Tokenisation Sector Reaches Record Highs

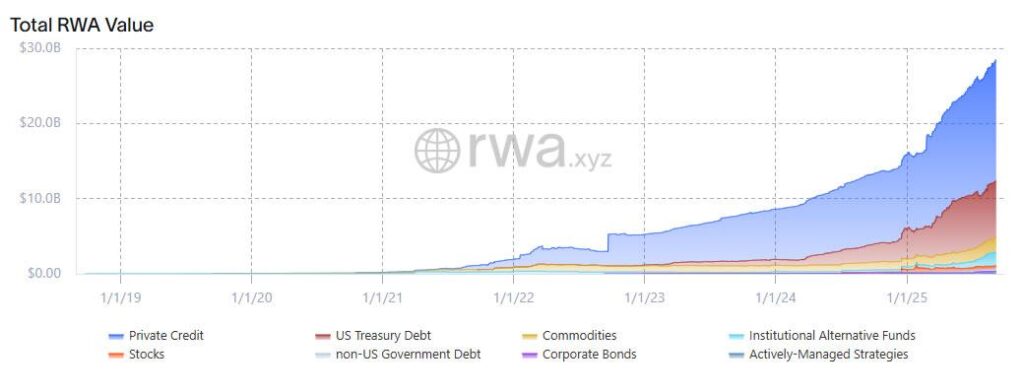

Ant’s move comes at a time when RWA tokenisation is rapidly gaining momentum. Data from RWA.xyz shows that the total onchain value of tokenised RWAs has nearly doubled in 2025, reaching a record $28.4 billion this week.

Private credit represents more than half of this total, while tokenised US Treasuries account for just over a quarter. Ethereum remains the leading chain for RWAs with a dominant 57% market share.

As Ant Digital looks to tokenise billions in energy assets, it is positioning itself not only as a blockchain innovator but also as a key player in bridging sustainable energy finance with decentralised markets. The project underscores how tokenisation could unlock fresh liquidity streams, broaden access to infrastructure investment, and accelerate the shift toward greener energy solutions.

Leave a Reply