As global interest in digital payments and regulated crypto grows, Ant International, the fintech arm of Jack Ma’s Ant Group, is preparing to step firmly into the stablecoin arena. With plans to obtain licences in both Hong Kong and Singapore, this move highlights a growing trend: traditional fintech giants are now embracing regulated crypto payment systems.

Ant International’s Strategic Push into Stablecoins

Ant International, a Singapore-based division of Ant Group, is set to apply for stablecoin issuer licences in both Singapore and Hong Kong. This comes shortly after Hong Kong passed the Stablecoin Ordinance bill on May 21, introducing the city’s first licensing framework for fiat-backed stablecoins. The regulation will be enforced starting August 1, 2025.

The move signals Ant’s confidence in the evolving global stablecoin regulatory landscape. By seeking official approval, Ant International is positioning itself as a key player in regulated digital finance. According to Bloomberg, the firm is also considering a similar licensing move in Luxembourg, further hinting at its global ambitions.

As part of Jack Ma’s Ant Group, the company already plays a huge role in digital finance. Ant’s flagship platform, Alipay, is the world’s largest digital payment platform with over 1.3 billion users and 80 million merchants.

Key to Ant’s Cross-Border Ambitions

According to sources, Ant International plans to use stablecoins for cross-border payments and treasury management, two critical areas where stable digital currencies can shine.

In 2024 alone, around one-third of the company’s $1 trillion in global transactions was processed through its blockchain-based Whale platform. By integrating stablecoins into this system, Ant can reduce friction in international payments, lower fees, and increase speed and transparency.

This isn’t Ant Group’s first foray into blockchain. In December 2024, its digital division partnered with the Sui blockchain to tokenize real-world assets related to environmental, social, and governance (ESG) goals. This growing interest in tokenization and blockchain infrastructure shows a long-term commitment to building digital-first financial systems.

Hong Kong’s New Stablecoin Rules: A Game Changer

Hong Kong is positioning itself as a leading hub for regulated digital finance. The Stablecoin Ordinance, passed in May 2025, mandates that all fiat-backed stablecoin issuers must be licensed by the Hong Kong Monetary Authority (HKMA). Noncompliance can lead to penalties of up to HK$5 million (US$640,000).

This regulation is designed to protect users, ensure transparency, and encourage innovation within a safe framework. For fintech giants like Ant, entering such a regulated environment not only builds trust but also allows them to scale globally without legal uncertainties.

Singapore, another leading financial centre, is also expected to launch or update its stablecoin regulatory framework, making it an ideal base for Ant International’s operations.

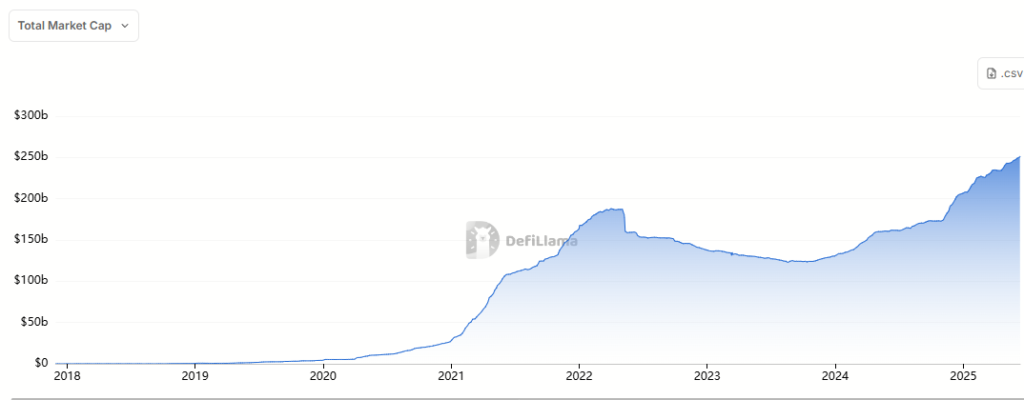

$1 Trillion Stablecoin Market? A 2025 Crypto Catalyst

Ant International’s timing couldn’t be better. Just this week, the total market cap of stablecoins surpassed an all-time high of $250 billion, according to DefiLlama. Experts now predict that the stablecoin market may exceed $1 trillion by the end of 2025.

David Pakman, managing partner at CoinFund, believes this could be the long-awaited breakthrough for crypto adoption:

“This is the major catalyst that’s been missing for over a decade—a major movement of people’s wealth on-chain,” he said during a Cointelegraph show.

Stablecoins offer a stable, digital alternative to traditional fiat, making them ideal for global payments, trading, and settlements. With fintech giants like Ant entering the space, the market is likely to accelerate even faster.

A New Era for Crypto and Fintech

Ant International’s plans to secure stablecoin licences in key financial hubs like Hong Kong and Singapore marks a pivotal moment for both the crypto and fintech industries. As regulated stablecoin systems become more widespread, we can expect safer, faster, and more efficient digital finance solutions on a global scale.

With over $1 trillion in annual transactions, deep expertise in digital finance, and backing from Alibaba and Jack Ma, Ant International is well-positioned to become a leader in the next wave of crypto adoption.

Leave a Reply