Arbitrum (ARB), the native token of Ethereum’s layer-2 scaling network, has dropped by 10% over the past week, now trading at $0.31. Despite a short-lived rally in January that pushed ARB to $0.92, the asset has largely struggled throughout 2025. With indicators turning increasingly bearish, analysts warn that ARB may soon revisit its April all-time low — or potentially set a new one.

ARB Faces Stiff Resistance Amid Weak Recovery

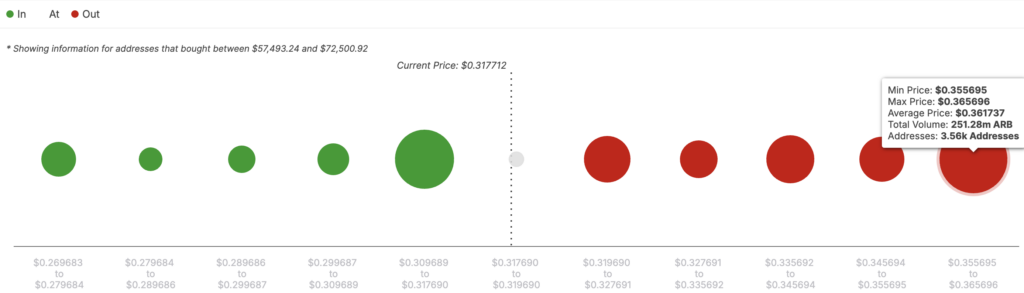

ARB has rebounded 28% from its April low, but resistance levels remain a major obstacle to a sustainable recovery. According to IntoTheBlock’s IOMAP data, a critical resistance zone lies at $0.36, where over 250 million ARB tokens were purchased by 3,560 addresses, now sitting at a loss. This means any price movement toward that zone could trigger heavy selling pressure, dampening chances of an extended bullish run.

Conversely, the strongest support level lies exactly where ARB is now — $0.31. If this level fails to hold, the next significant drop could be steep.

Technical Indicators Signal Further Downside

From a technical standpoint, multiple indicators point to a continuation of the bearish trend. The Money Flow Index (MFI), which gauges buying and selling pressure, has declined from 73.35 to 58.24 — a clear sign that buyers are losing momentum.

Meanwhile, ARB has been stuck in a descending triangle pattern since January 18, a formation that typically signals a bearish breakout. Adding to this negative outlook, the Relative Strength Index (RSI) has fallen below the critical 50.00 mark, confirming growing selling pressure in the market.

A New All-Time Low on the Horizon?

If bearish sentiment continues and ARB breaks below the current support, the token could fall toward $0.25, marking a new all-time low. This would confirm the breakdown from the descending triangle and reflect the ongoing lack of confidence in the altcoin’s short-term prospects.

Such a move would be significant not only for traders but also for the broader sentiment surrounding Ethereum layer-2 solutions, especially as investor interest shifts to newer or more fundamentally strong platforms.

Is a Rebound Still Possible?

While the outlook remains bleak, a bullish reversal isn’t entirely off the table. If buying pressure intensifies and ARB manages to break above the $0.36 resistance, it could pave the way for a recovery rally.

The first target would be around $0.48, aligned with the 0.236 Fibonacci retracement level. A broader market rebound or improved fundamentals could push the token even further, potentially up to $0.62.

However, such a scenario would require a shift in market sentiment — something that currently seems unlikely without external catalysts like Ethereum ecosystem upgrades or renewed interest in Arbitrum-based projects.

Leave a Reply