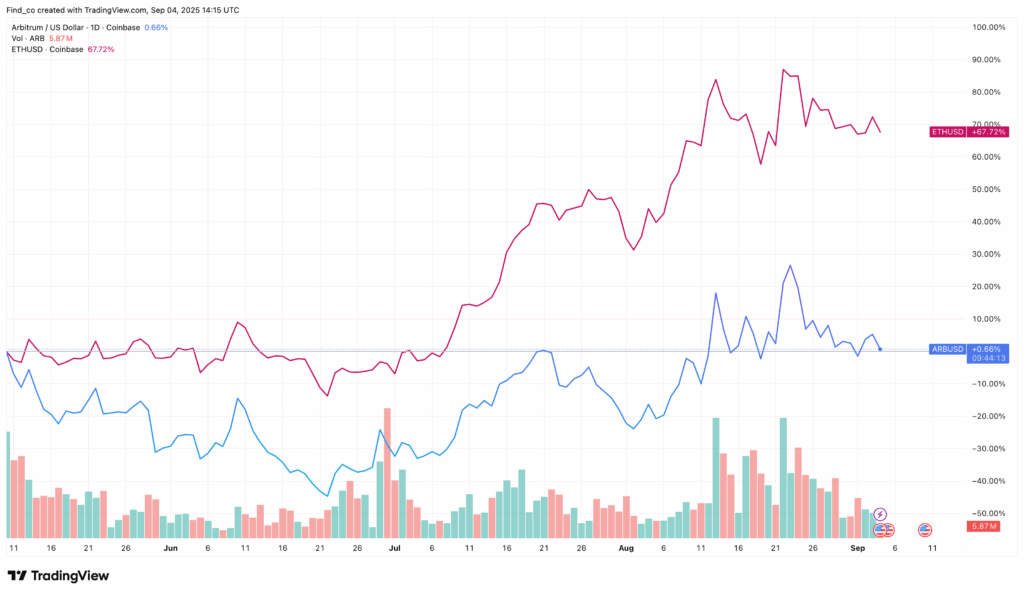

Arbitrum (ARB) may be on the verge of surrendering its recent gains as Ethereum (ETH) battles to reclaim the crucial $4,500 resistance level. The layer-2 scaling token, which often mirrors ETH’s performance, now sits at a crossroads amid weakening technical indicators and declining market interest.

Ethereum’s Struggles Ripple Across Layer-2 Tokens

Ethereum has surged an impressive 174% in recent months, reaching a fresh all-time high. However, the momentum has since slowed, with ETH repeatedly failing to break through the $4,500 psychological barrier. This consolidation has spilled over into tokens tied to its ecosystem, particularly layer-2 networks like Arbitrum.

Over the past 30 days, ARB’s price has climbed 30%, peaking alongside Ethereum’s rally. Yet its fortunes remain tightly correlated with ETH. Historical data shows that, over a 90-day period, ARB tends to shadow Ethereum’s price movements. Consequently, ETH’s current hesitation puts ARB in a precarious position. If Ethereum fails to establish a foothold above $4,500, the downside risk for ARB could intensify.

At the time of writing, ARB trades at $0.49, having already shown signs of weakness in recent sessions.

Open Interest Collapse Signals Weakening Confidence

Beyond correlation, Arbitrum faces challenges from its derivatives market. Open Interest (OI), a metric that tracks the total value of open futures contracts is flashing warning signals. Just two weeks ago, OI for Arbitrum was on course to reach $500 million, highlighting elevated speculative activity and strong trader participation.

Today, however, that figure has plunged to just $206 million. Such a sharp decline reflects capital outflows from ARB’s derivatives market, signalling diminishing confidence among leveraged traders. Lower OI typically translates to reduced liquidity and waning bullish conviction, making it harder for the token to sustain rallies.

If this downtrend persists, Arbitrum could find itself under prolonged pressure, consolidating or sliding lower. Conversely, a rebound in OI could inject fresh liquidity and potentially reignite bullish sentiment. For now, the trend points to the former scenario.

Technical Indicators Paint a Bearish Picture

From a technical analysis perspective, the outlook for Arbitrum appears bearish. The Moving Average Convergence Divergence (MACD), a popular momentum indicator, has slipped into negative territory, underlining fading bullish strength.

Adding to this weakness, the 12-day Exponential Moving Average (EMA) has crossed below the 26-day EMA, forming a bearish crossover. Such a setup traditionally suggests further downside ahead.

Key Fibonacci retracement levels also provide a roadmap for potential declines. If the current setup holds, ARB’s price could slide towards $0.39 at the 0.382 Fibonacci retracement. In a more pessimistic scenario, where selling pressure intensifies, the token could fall as low as $0.33.

A Potential Path to Recovery

Despite the bearish outlook, a shift in market sentiment could turn the tide for Arbitrum. Much hinges on Ethereum’s performance. If ETH successfully reclaims the $4,500 level, it could spark renewed optimism across the ecosystem, enabling ARB to ride the momentum higher.

In such a scenario, Arbitrum could rally towards $0.62, a level that would represent a significant recovery from current prices. Increased Open Interest and renewed speculative activity would further strengthen the case for a rebound.

However, until ETH demonstrates decisive strength and OI stabilises, the prevailing narrative for ARB remains cautious. Traders and investors should watch the $0.45 support level closely, as a breakdown below this mark could accelerate losses.

Arbitrum’s near-term trajectory is closely tied to Ethereum’s ability to overcome resistance at $4,500. While ARB has enjoyed a 30% monthly gain, its outlook is clouded by declining derivatives activity and bearish technical signals. Unless ETH regains upward momentum, Arbitrum risks further downside, with potential targets between $0.39 and $0.33.

On the other hand, a breakout above Ethereum’s resistance could breathe fresh life into ARB, paving the way for a rally towards $0.62. For now, caution prevails as the token balances on a knife-edge between recovery and further decline.

Leave a Reply