ARK Invest, the asset management firm led by Cathie Wood, has made bold moves in the crypto space by buying heavily into Coinbase and BitMine Immersion Technologies during a sharp market dip. On Friday, the firm acquired a total of $47 million worth of shares in these companies, seizing the opportunity created by falling stock prices.

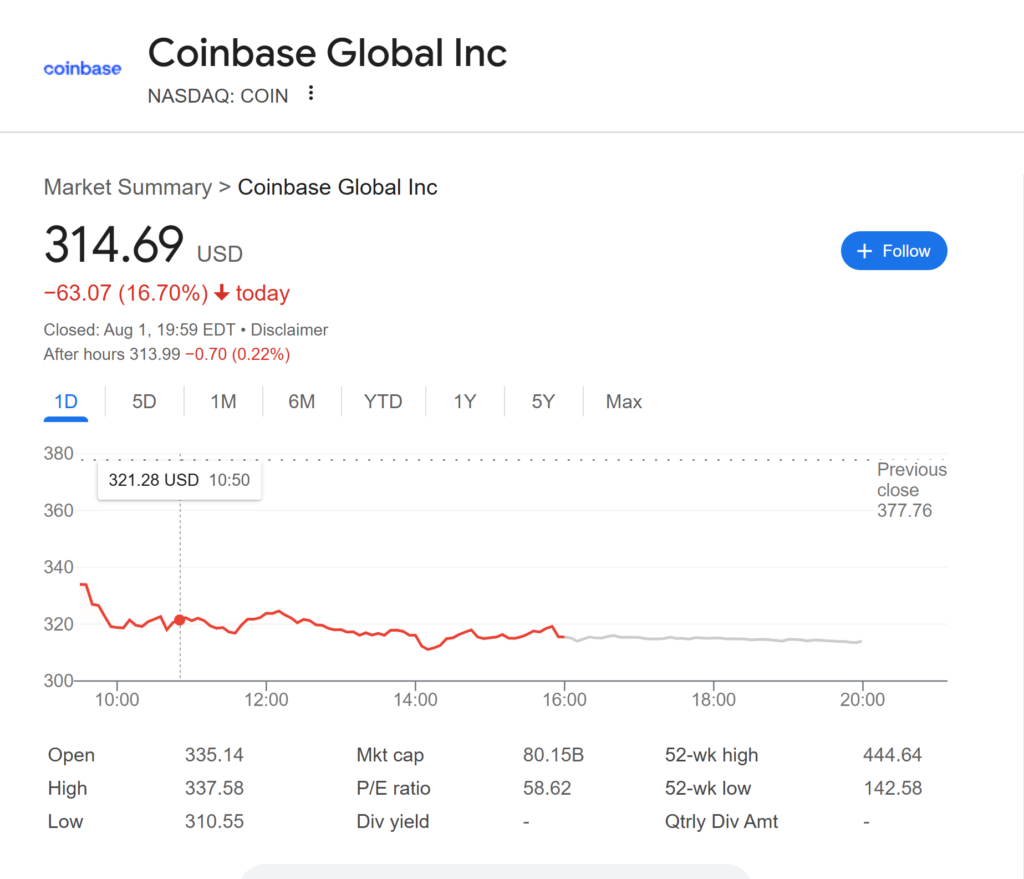

$30 Million Coinbase Buy as Stock Drops 17%

Coinbase (COIN), the largest cryptocurrency exchange in the United States, saw its stock price plunge by 16.7% on Friday. It closed at $314.69, with an intraday low of $310.55, far below its 52-week high of $444.64. This sharp decline marks one of the worst single-day performances for Coinbase in recent months.

ARK Invest responded by acquiring 94,678 Coinbase shares, worth around $30 million, across three of its ETFs: ARK Innovation (ARKK), ARK Next Generation Internet (ARKW), and ARK Fintech Innovation (ARKF). This move comes after a recent period of selling. In fact, ARK sold nearly $7 million worth of Coinbase shares just four days earlier, unloading 18,204 shares from the ARKW fund.

The latest buy signals a renewed bullish stance on Coinbase by ARK Invest, suggesting confidence in the exchange’s long-term prospects despite short-term volatility.

BitMine Immersion Tech Gets a $17 Million Boost

ARK Invest also significantly increased its holdings in BitMine Immersion Technologies (BMNR), a company focused on cryptocurrency mining. On the same day that Coinbase stock dropped, BMNR fell 8.55%, closing at $31.68 after reaching a low of $30.30.

Rather than backing away, ARK added 540,712 shares of BitMine across its three main ETFs, investing roughly $17 million. This follows over $20 million in purchases earlier that week and a massive $182 million buy the previous week, highlighting ARK’s strong conviction in BitMine’s strategic direction.

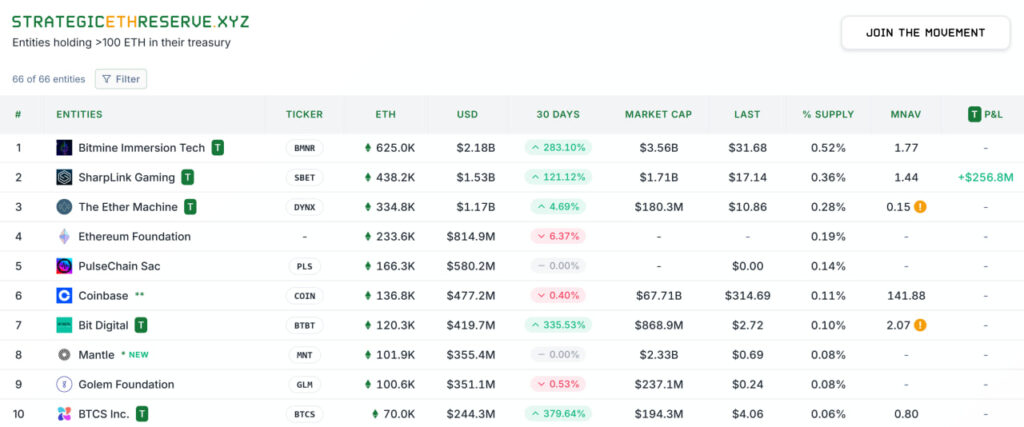

BitMine has recently pivoted toward Ethereum, becoming the largest corporate holder of Ether according to StrategicEtherReserves. The firm now holds 625,000 ETH, ahead of SharpLink Gaming, which holds 438,200 ETH. ARK’s continued investment suggests it views this shift as a long-term strength for BitMine.

Market Declines Amid Economic Concerns

The broader U.S. stock market had a rough start to August. The Dow Jones Industrial Average dropped 542 points on Friday, the biggest fall since mid-June. The S&P 500 and Nasdaq also experienced their worst days in several months.

The sharp market downturn followed disappointing jobs data. Only 73,000 jobs were added in July, far below expectations. Even worse, the figures for May and June were revised downward, revealing a slower pace of hiring than initially reported. This has raised fresh concerns about the health of the U.S. economy.

Banking stocks were hit particularly hard. JPMorgan dropped over 2%, while Bank of America and Wells Fargo each fell more than 3%. Industrial firms like Caterpillar and GE Aerospace also closed in the red. Market sentiment was further shaken by newly announced tariff policies from President Trump’s administration, adding to investor uncertainty.

ARK’s Strategy: Buying Opportunity in Chaos

ARK Invest’s aggressive buying of crypto-related stocks amid a broad market downturn suggests a high-risk, high-reward approach. By snapping up Coinbase and BitMine shares at lower prices, Cathie Wood’s team appears to be positioning itself for a rebound in the crypto sector once the current economic turbulence subsides.

While some investors are retreating due to short-term fear and market volatility, ARK is betting on the long-term growth of crypto infrastructure and blockchain adoption. The firm’s recent focus on Ether accumulation by BitMine may also point to a growing belief that Ethereum’s role in the future of decentralised finance (DeFi) and smart contracts will be pivotal.

Despite a weakening economy and a tumbling stock market, ARK Invest is doubling down on its crypto convictions. With nearly $50 million in new investments into Coinbase and BitMine, the firm is taking advantage of market fear to accumulate what it sees as undervalued assets. Whether this bold strategy will pay off depends on the recovery of both the crypto sector and the broader economy in the months ahead.

Leave a Reply