Aster’s (ASTER) recovery could not have been more timely. The altcoin surged back above the key $2 threshold after Binance announced its decision to list ASTER for spot trading, igniting fresh optimism among investors. The listing comes amid turbulent days for the project, which faced severe Fear, Uncertainty and Doubt (FUD) following accusations of inflated trading volumes on its decentralized exchange (DEX).

Earlier this week, ASTER’s price briefly dropped to $1.82 after the on-chain analytics platform DeFiLlama removed ASTER DEX’s volume data due to irregularities. Core builder 0xngmi revealed that Aster’s perpetual DEX volumes were nearly identical to Binance’s, an unusual correlation that prompted an internal review. On-chain investigator ZachXBT also alleged possible wash trading activities, further fueling market concerns.

Despite the controversy, Aster quickly stabilized, with buyers stepping in to absorb the dip. The project’s resilience, coupled with Binance’s official confirmation of the listing, helped restore investor confidence, allowing ASTER to reclaim the $2 mark.

Binance Spot Listing Lifts Market Sentiment

Binance announced that ASTER will begin spot trading on October 6, marking a major milestone for the project. The listing will feature three trading pairs: ASTER/USDT, ASTER/USDC and ASTER/TRY. Deposits opened in advance, while withdrawals are set to begin on October 7.

Initially, only simple order types will be enabled, with bots and copy-trading features becoming available after the first 24 hours. The exchange has also applied a “Seed Tag” to ASTER, signifying a high-risk, early-stage asset with strong community potential.

Before this upgrade, Aster was part of Binance Alpha, a testing program where tokens could generate Alpha Points based on trading activity. With the transition to spot trading, the Alpha phase has concluded, meaning users can now transfer ASTER from Alpha Accounts to their regular spot accounts. Binance confirmed that all remaining ASTER in Alpha Accounts will be automatically migrated within 24 hours of the launch.

The move effectively validates Aster’s progress, as the Binance Alpha programme serves as a pre-screening process for tokens deemed to have strong growth potential. By graduating from Alpha to full listing, Aster has cleared a key hurdle that many newer projects never reach.

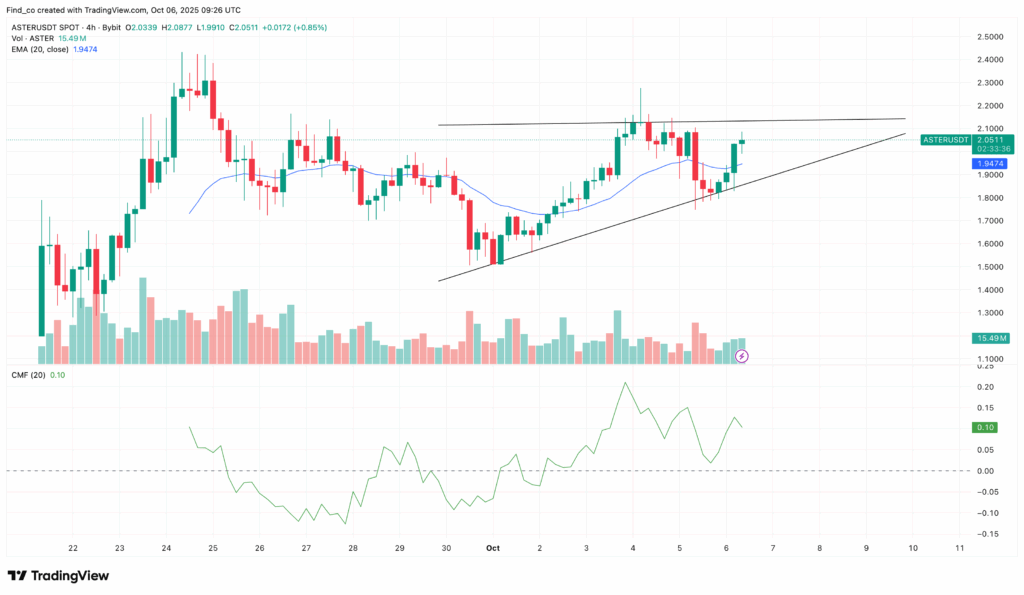

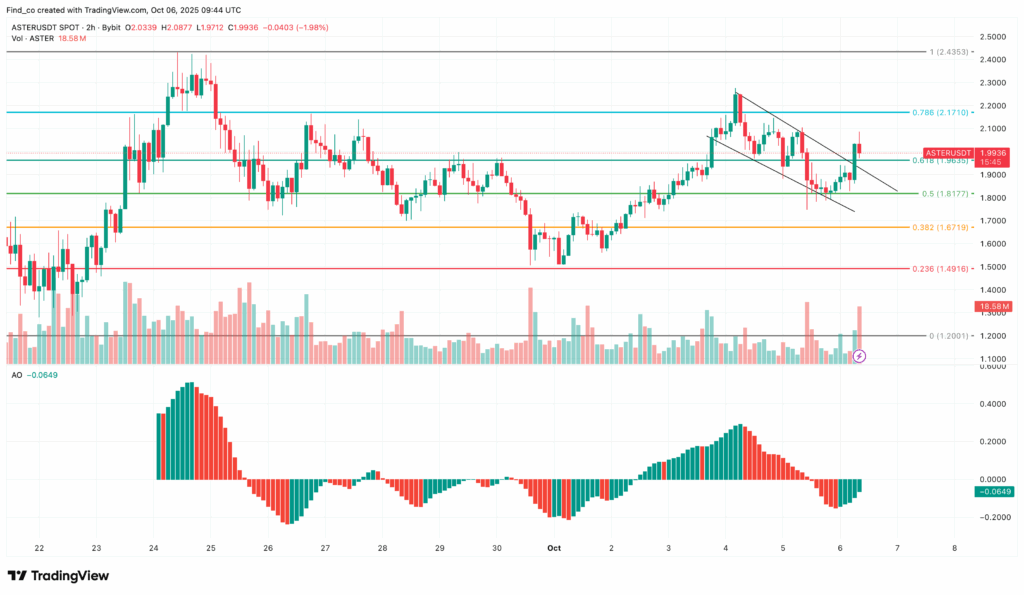

Technical Outlook: Ascending Triangle Signals Breakout Potential

From a technical perspective, ASTER’s price action appears constructive. On the 4-hour chart, the token trades inside an ascending triangle pattern, a structure typically associated with bullish breakouts. The Chaikin Money Flow (CMF) indicator has climbed to 0.12, suggesting steady capital inflows.

Additionally, ASTER has reclaimed its 20-period Exponential Moving Average (EMA), confirming renewed short-term strength. This technical alignment signals that buyers are gradually tightening control. A breakout above the triangle’s upper boundary could open the path toward the next resistance level at $2.17, with a potential run-up to $2.44, which would mark a new all-time high.

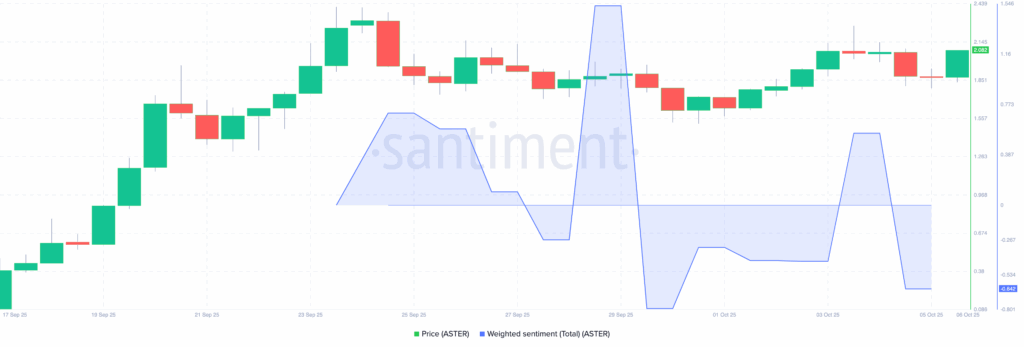

However, traders remain cautious. On-chain sentiment, as measured by Weighted Social Mentions, is still negative, a sign that broader market participants remain sceptical. Yet, the price’s upward trajectory despite bearish sentiment suggests that “smart money” may be quietly accumulating ASTER.

Such divergences often precede strong bullish moves, as short-term bears are forced to re-enter the market once momentum shifts decisively upward.

Controversy Over DEX Volumes Still Casts a Shadow

While the Binance listing has brought relief, questions around Aster DEX’s trading volumes remain unresolved. The DEX had previously reported over $96 billion in 24-hour volume, surpassing major centralised exchanges, a claim that raised eyebrows across the DeFi community.

DeFiLlama subsequently removed Aster DEX from its data dashboard, citing “non-organic trading activity.” The platform’s reported numbers suggested potential wash trading or inflated volume metrics. Despite the backlash, Aster’s team defended its data, highlighting that its “dark pool” design enables large institutional orders with minimal slippage, making comparisons with traditional DEXs misleading.

Nevertheless, the controversy has dampened sentiment and prompted calls for greater transparency. Analysts note that while Aster DEX ranked among the top generators of fees in September, its liquidity still lagged behind leading derivatives exchanges such as Hyperliquid.

Future Plans: VIP Tiers and Market Maker Incentives

To address concerns and attract institutional users, Aster DEX is revamping its trading ecosystem. The platform is preparing to launch VIP-tier trading, offering reduced fees based on a 14-day rolling volume. Additionally, a new $300,000 monthly reward pool will be distributed to market makers who achieve high trading volumes.

This initiative coincides with the launch of Season 3 of its point farming programme, which will run until November 9. Participants from Stage 2 are set to receive their rewards on October 10, further reinforcing Aster’s focus on long-term user engagement.

As the project continues to evolve, market observers view Binance’s endorsement as a critical step in restoring credibility. If the ongoing investigations clear Aster of volume manipulation, the combination of improved liquidity, growing exchange access, and bullish technical setups could fuel a strong rally through “Uptober.”

Aster (ASTER) has weathered a major reputational storm to emerge stronger, buoyed by its upcoming Binance spot listing. While controversy over trading volumes lingers, the token’s technical structure and renewed investor confidence hint at further upside. If buying momentum sustains and sentiment shifts, Aster could be poised to test and possibly exceed its previous highs before the end of October.

Leave a Reply