Avalanche has recorded a significant spike in blockchain activity, fuelled by decentralised trading, automated bots and renewed whale interest in speculative memecoins. Analysts suggest that the smart contract platform is gaining traction among both retail and institutional users, though government adoption claims remain uncertain.

Avalanche Outpaces Rivals in Transaction Growth

According to data from blockchain intelligence firm Nansen, Avalanche’s transaction growth surpassed that of all other networks last week. Transactions rose by 66 per cent to reach 11.9 million, spread across more than 181,000 active addresses. This rapid expansion highlights growing investor attention towards the Avalanche ecosystem.

The rise coincided with news that the US Department of Commerce had included Avalanche among ten public decentralised blockchains used to publish real gross domestic product (GDP) figures. However, Nansen research analyst Nicolai Sondergaard cautioned against drawing direct links between government usage and the transaction surge.

“At this point, we cannot attribute Avalanche’s increased activity to the US Government adopting it for GDP data,” Sondergaard explained.

DeFi and Bots Account for Majority of Activity

Nansen data shows that the majority of Avalanche’s growth was powered by decentralised finance protocols and automated strategies. Sondergaard estimated that 60 per cent of activity came from DeFi platforms such as Trader Joe, Aave and Benqi. Automated trading bots and miner extractable value (MEV) activity contributed a further 25 per cent, while whale trading and memecoin speculation made up 10 per cent. The remaining 5 per cent stemmed from blockchain gaming and NFTs.

The findings underline the central role of decentralised exchanges in Avalanche’s growth, with trading activity emerging as a dominant use case for the network.

Trader Joe Emerges as Primary Driver

Among the decentralised exchanges, Trader Joe stood out as the leading driver of blockchain traffic. It saw more than 333 million dollars in volume for Avalanche’s wrapped ether (WETH.e) during the week. High-value traders on Nansen’s top 100 leaderboard played a key role, executing multiple six-figure trades that boosted liquidity.

The Aave lending protocol also contributed, with flash loan activity worth 624,000 dollars channelled through DEX aggregators. Meanwhile, the Benqi protocol attracted over 650,000 dollars in deposits from cryptocurrency trading bots, reinforcing its position as another important contributor.

Whale Traders Target Black Token

Whale addresses with substantial balances also helped drive Avalanche’s activity. A notable example was the Black token, which recorded 14 million dollars in weekly trading volume. Some whale wallets accumulated up to 95,000 dollars worth of the token, reflecting renewed appetite for speculative assets within the Avalanche ecosystem.

These movements highlight how large investors continue to play a central role in shaping activity on emerging blockchains, particularly when chasing high-risk, high-reward opportunities.

Solana Records Decline in Weekly Transactions

Avalanche’s strong performance stood in contrast to Solana, one of its closest competitors. Solana recorded a 6.7 per cent fall in weekly transactions, with 433 million transactions across 18.9 million active addresses.

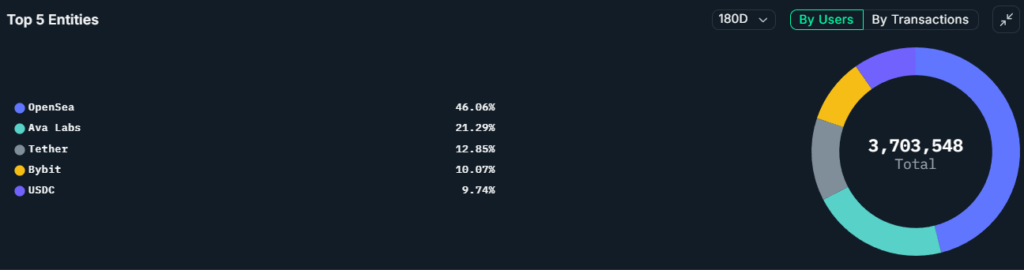

Like Avalanche, Solana’s activity was dominated by decentralised exchange trading. Raydium DEX led the network’s performance with 12.4 million users and 297 million transactions, followed by Fluxbeam with 7.3 million users and 178 million transactions.

The comparison illustrates how both networks are competing for mindshare among decentralised traders, though Avalanche’s recent surge suggests it may be capturing momentum in the near term.

Leave a Reply