The world’s largest cryptocurrency exchange, Binance, has entered into a landmark partnership with global investment giant Franklin Templeton to accelerate the tokenisation of securities. The collaboration, announced on Wednesday, signals another major step in bridging traditional finance with blockchain technology and could reshape how capital markets operate on a global scale.

Tokenisation Moves From Concept to Practice

Tokenisation, the process of representing real-world assets as blockchain-based tokens has long been discussed as a transformative innovation in finance. Now, Binance and Franklin Templeton intend to turn this concept into practice by leveraging their complementary strengths.

Franklin Templeton, a US-based asset manager overseeing $1.64 trillion as of August 2025, will contribute its expertise in compliant tokenisation of securities. The firm was among the first to issue a spot Bitcoin ETF in the US, launching the Franklin Bitcoin ETF (EZBC) in January 2024. It also manages the BENJI token, a pioneering tokenised money market instrument with over $657 million in assets under management.

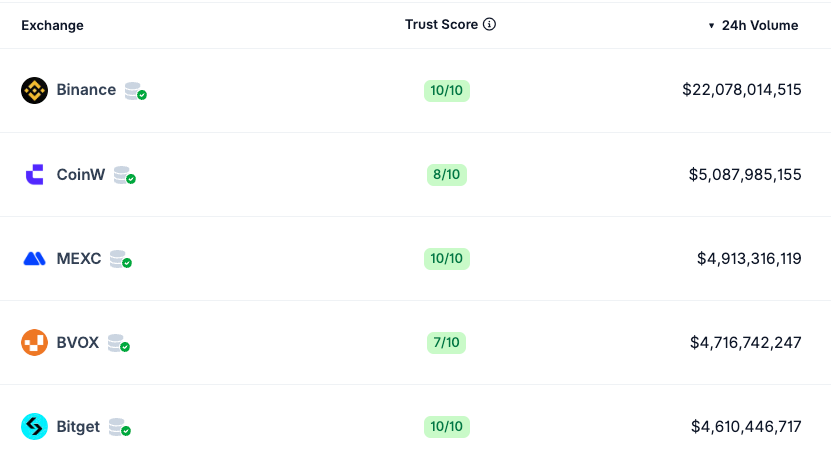

Binance, meanwhile, brings unmatched infrastructure to the table. Handling around $22 billion in daily trades according to CoinGecko, the exchange far outpaces rivals such as CoinW and MEXC, which average closer to $5 billion. Its global trading reach and large user base make it a natural partner for scaling tokenisation products to institutional and retail investors alike.

Roger Bayston, Franklin Templeton’s executive vice-president and head of digital assets, outlined the ambition behind the collaboration:

“Our goal is to take tokenisation from concept to practice for clients to achieve efficiencies in settlement, collateral management and portfolio construction at scale.”

Co-Creating the Portfolios of the Future

The partnership is being pitched as more than just a technology integration. Franklin Templeton and Binance emphasised their shared vision of designing financial products tailored for the evolving needs of global capital markets.

Bayston described the effort as “co-creating the portfolios of the future”, while Franklin Templeton’s head of innovation, Sandy Kaul, highlighted how tokenisation has matured from the fringes of fintech into the mainstream.

“We see blockchain not as a threat to legacy systems, but as an opportunity to reimagine them,” Kaul said. “By working with Binance, we can harness tokenisation to bring institutional-grade solutions like our Benji Technology Platform to a wider set of investors and help bridge the worlds of traditional and decentralised finance.”

This balance between regulatory compliance and technological innovation appears central to the partnership. Franklin Templeton will focus on designing secure, regulation-friendly tokenisation frameworks, while Binance provides the infrastructure to distribute these products to millions of investors across its platform.

BNB Surges to New All-Time High

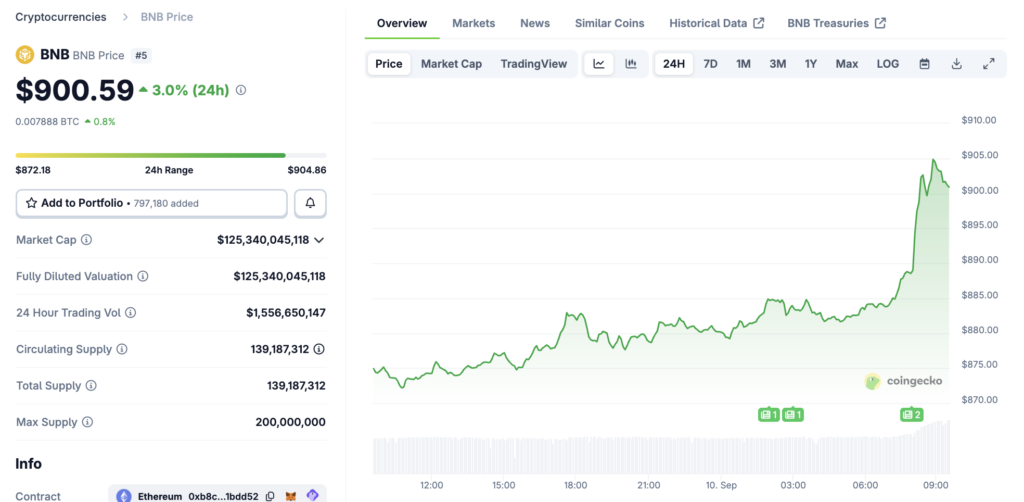

The announcement triggered an immediate market reaction, propelling Binance’s native token, BNB, to a new record. The token briefly crossed $900, touching $902.55 at its peak and is now up almost 29% in 2025 alone, with a 75% gain over the past 12 months.

BNB, which offers holders benefits such as staking rewards, ecosystem perks and participation in token launches, has long been a cornerstone of Binance’s growth strategy. Analysts suggest the token’s rally reflects both renewed investor confidence in Binance’s regulatory standing and optimism about its role in future tokenisation projects.

Despite limited trading volumes during the surge, market observers believe the momentum could drive BNB past the symbolic $1,000 mark if Binance successfully rolls out tokenised securities later this year.

BENJI and the Multi-Chain Future

At the heart of Franklin Templeton’s tokenisation strategy is its BENJI token, a blockchain-based representation of money market funds. Initially launched on the Stellar network, BENJI has since been tested across multiple blockchains, including Avalanche, Base, Polygon, Aptos and Arbitrum.

The partnership with Binance raises the prospect of BENJI expanding to the BNB Smart Chain, a move that could significantly broaden its accessibility. Franklin Templeton’s known crypto holdings already include around $715 million in BTC and ETH, though it has yet to reveal any direct exposure to BNB.

Integrating BENJI within Binance’s infrastructure could also open the door to new institutional products, blending tokenised cash equivalents with Binance’s decentralised finance ecosystem. This would mark another milestone in the effort to merge liquidity from traditional and crypto-native markets.

Broader Industry Context

The Binance–Franklin Templeton deal comes amid a surge of interest in tokenisation across global financial markets. Earlier this week, Reuters reported that Nasdaq invested $50 million into Gemini, the Winklevoss-founded crypto exchange, which already operates tokenisation products worldwide. Nasdaq also filed with the US Securities and Exchange Commission for approval to list tokenised stocks directly on its platform.

Other exchanges, including Kraken, have launched dedicated venues for tokenised assets. With momentum building, tokenisation is increasingly seen as a competitive arena for both traditional financial giants and crypto-native players.

For Binance, which has faced years of regulatory challenges and multiple relocations of its headquarters, the Franklin Templeton partnership represents a chance to showcase regulatory credibility and institutional trust. For Franklin Templeton, it is an opportunity to extend its pioneering tokenisation efforts beyond pilot projects and into large-scale adoption.

Outlook

The partnership between Binance and Franklin Templeton is more than a symbolic handshake between two financial heavyweights. It represents the convergence of traditional asset management expertise with cutting-edge crypto infrastructure.

By combining Franklin Templeton’s regulatory know-how with Binance’s unmatched liquidity and user base, the collaboration could redefine how securities are issued, traded and settled. It also provides a tangible boost to tokenisation’s credibility as it moves further into the mainstream of global finance.

If successful, the initiative could pave the way for tokenised portfolios, faster settlement systems, greater transparency and more inclusive access to capital markets, while also cementing Binance’s and Franklin Templeton’s positions as leaders in shaping the future of finance.

Leave a Reply