The native token of decentralised science (DeSci) project Bio Protocol (BIO) has witnessed an extraordinary recovery, soaring 350% from its all-time low. Following weeks of steady accumulation by large holders, the token has now regained momentum, trading at $0.19 at the time of writing.

Once languishing at $0.041 in April, BIO has staged a remarkable comeback, attracting renewed investor attention and surging trading volumes. Analysts suggest whale activity, strong technical indicators, and rising investor participation are driving the current uptrend.

From Rock Bottom to Strong Rebound

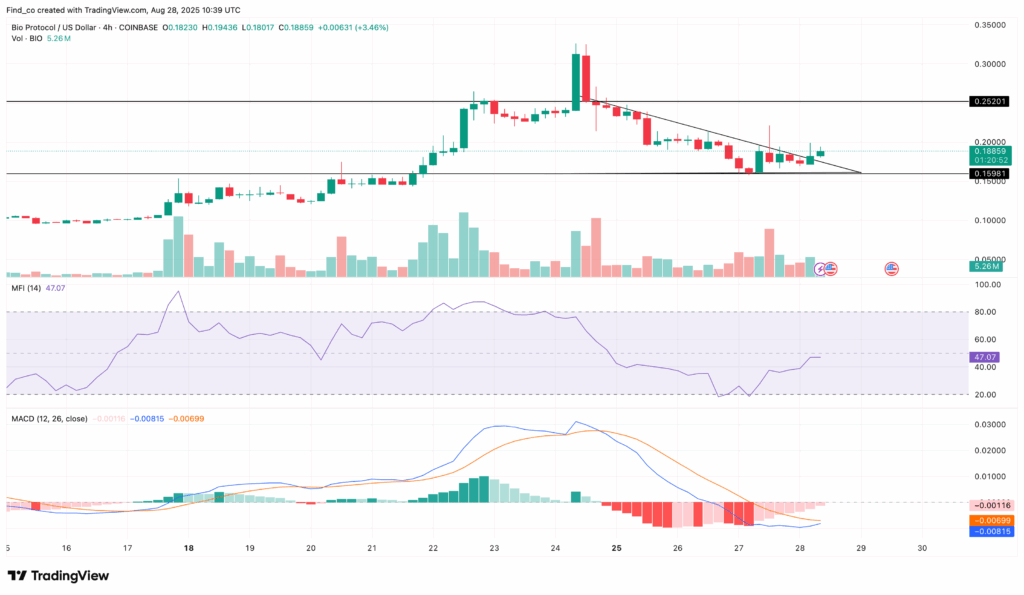

The BIO price recovery began after weeks of consolidation within a descending triangle, where the token repeatedly found support around $0.16. A decisive breakout above the resistance trendline shifted momentum back in favour of buyers.

Technical signals confirm this shift. The Money Flow Index (MFI) has risen to 46.98, reflecting improving inflows and strengthening buying pressure. While the reading remains well below the overbought threshold of 70, it suggests further upside potential before the rally risks overheating.

If capital inflows continue at the current pace, BIO could attempt to challenge resistance at $0.25 in the short term. Sustained buying activity could even propel the token towards $0.27 and beyond.

Whale Accumulation Strengthens Support

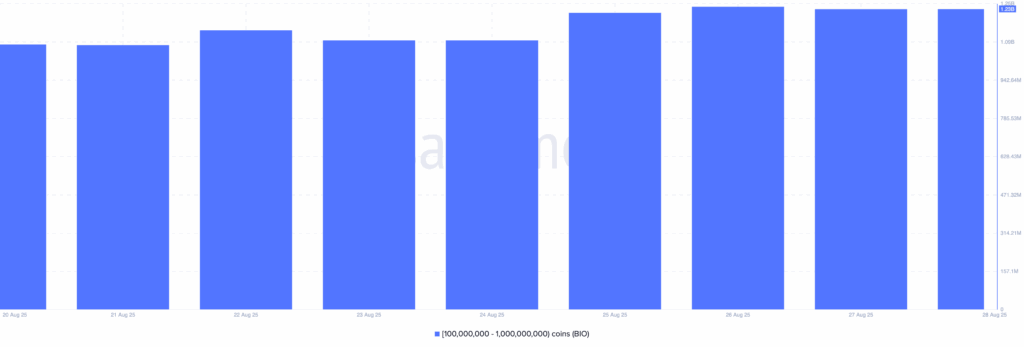

Perhaps the most significant factor underpinning BIO’s rally is the confidence shown by large holders. On-chain data reveals wallets holding between 100 million and 1 billion BIO have expanded their collective ownership from 1.1 billion tokens to 1.23 billion in recent days.

This accumulation by whales signals conviction in BIO’s long-term prospects and provides a cushion for its price. With large investors increasing their stakes, the likelihood of BIO collapsing below its horizontal support appears minimal.

Alongside accumulation, trading activity has exploded. BIO’s daily trading volume recently spiked to $810 million, a dramatic increase that confirms heightened market interest and lends further weight to the bullish momentum.

Technical Indicators Paint a Mixed Picture

Despite the encouraging outlook, not all indicators are aligned. The Moving Average Convergence Divergence (MACD) has recently formed a bearish crossover, hinting at weakening momentum. Should selling pressure intensify, BIO may face difficulties clearing its near-term resistance and could slide back towards lower support levels.

In a bearish scenario, failure to hold above the $0.16–$0.19 region may push BIO down to test support around $0.11. This highlights the fragile balance between bullish enthusiasm and the technical risks that still linger in the market.

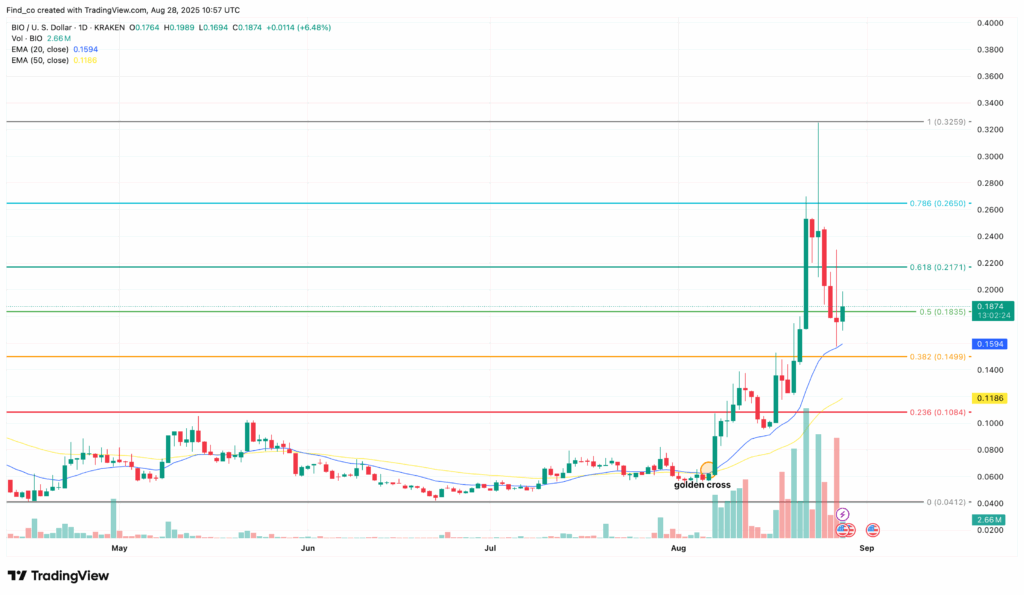

On the brighter side, the daily chart has printed a golden cross, a strong bullish signal. The 20-day EMA has moved above the 50-day EMA, indicating short-term momentum is now outpacing the longer-term trend. If this crossover holds, BIO could be setting the stage for further highs.

Price Outlook: Higher Highs or Risk of Reversal?

If the bullish trend remains intact, BIO could attempt a decisive breakout above $0.22, followed by a challenge at $0.27. A successful push beyond this barrier may open the path toward $0.32, establishing a new short-term high.

However, if momentum fades, BIO risks invalidating its bullish setup. A rejection at resistance could trigger a correction back to the $0.11 support zone, testing investor resolve.

For now, whale accumulation, surging volume, and strong EMA signals point towards a favourable trajectory. Still, investors must remain cautious of potential reversals, particularly given the MACD’s bearish signal.

Bio Protocol’s dramatic rebound has transformed the once struggling token into one of the more compelling recovery stories in the DeSci sector. A mix of whale confidence, bullish technicals, and surging volume has driven the rally, positioning BIO for potential new highs if current momentum continues.

The coming weeks will be crucial. If BIO breaks above its immediate resistance zones, the token could solidify its upward momentum. Conversely, a failure to sustain support may leave it vulnerable to sharp pullbacks.

Leave a Reply