Bitcoin’s latest price crash has sent shockwaves across the global market, but two influential indicators, the Coinbase Premium and Kimchi Premium, are flashing signals that may hint at an entirely different story behind the scenes.

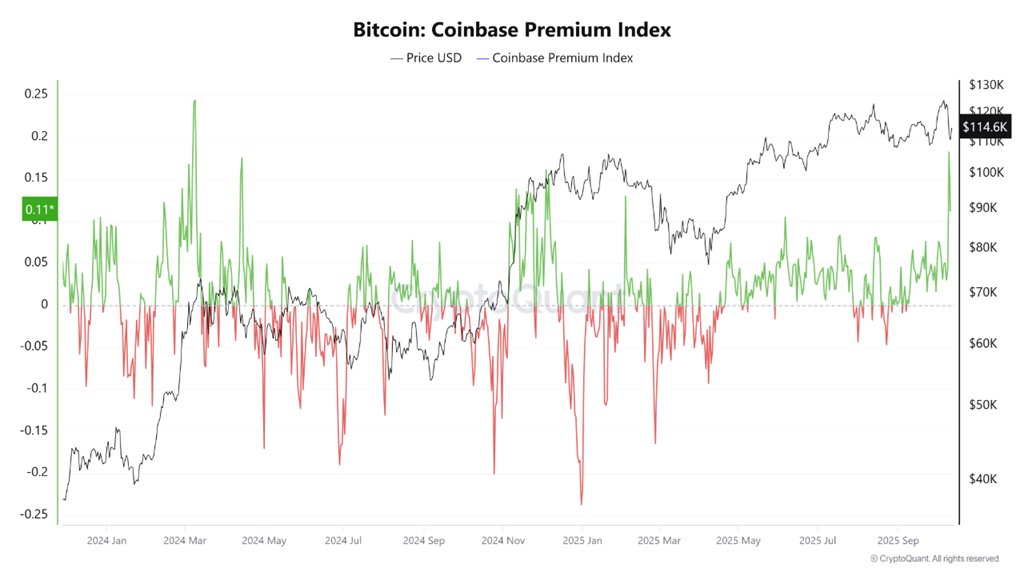

Despite widespread fear and heavy sell-offs, data shows a sharp rise in the Coinbase Premium, a metric used to track the difference between Bitcoin prices on Coinbase and other global exchanges. This surge, according to analysts, suggests renewed demand from US-based institutional investors.

“This is a textbook example of institutional dip-buying on a massive scale,” said on-chain analyst CryptoOnchain. “While the market panicked, large entities were quietly accumulating Bitcoin at lower prices.”

The Coinbase Premium reportedly hit its highest level in 19 months during the sell-off, marking a significant moment in what many analysts describe as a period of institutional accumulation. The data implies that heavy buying took place around the $110,000 price level, potentially creating a new support zone for Bitcoin.

Korean Retail Investors Join the Frenzy

While institutional players dominate in the West, retail traders in Asia are also showing renewed enthusiasm. The Kimchi Premium, which tracks the price difference between Bitcoin on South Korean exchanges like Bithumb and international platforms such as Binance, has also spiked sharply.

CryptoQuant data revealed that the Kimchi Premium has surged to its highest level since February 2025, signalling aggressive buying from Korean investors.

“The Korea Kimchi premium is exploding,” noted Brian HoonJong Paik, Co-founder and CEO of SmashFi. “Bitcoin on Bithumb is trading 7.47% higher than on Binance. Insane.”

A rising Kimchi Premium typically indicates that South Korean retail traders are driving local demand, often acting as a sentiment gauge for retail enthusiasm in Asia.

Interestingly, this surge comes even as the Crypto Fear & Greed Index plunged from “Greed” to “Fear” in early October, underscoring the divergence between market sentiment and investor actions.

A Familiar Pattern and a Possible Warning

Although both signals are being interpreted by some as bullish, historical patterns suggest caution. When smoothed using a 30-day simple moving average (SMA30), past data shows that simultaneous spikes in both the Coinbase and Kimchi Premiums often precede market pullbacks.

This pattern was evident in March 2024 and again in February 2025, when both indicators rose sharply together, followed by notable market corrections in the months that followed.

In both prior cases, Bitcoin’s recovery took between three to six months, hinting that such synchronized surges may represent short-term overheating, even amid long-term bullish sentiment.

“While institutional buying is evident, the retail euphoria in Asia could signal excessive optimism,” one analyst noted. “It’s a classic setup where the market overheats before stabilising.”

What Comes Next for Bitcoin?

The divergence between market sentiment and investor behaviour presents an intriguing picture. On one hand, institutional buyers appear to view current prices as a discount opportunity, while retail traders, especially in Asia, are piling in amid the volatility.

However, the overall market outlook remains uncertain. Analysts warn that while these signals may suggest strength, macro factors, including interest rate policies, inflation trends and global liquidity, will play a decisive role in determining whether Bitcoin can sustain its momentum.

Some believe the current wave of accumulation could solidify Bitcoin’s foundation for the next bull phase. Others, however, argue that the combined surge in both indicators could precede a short-term correction, as traders take profits and market sentiment normalises.

Ultimately, the coming weeks will reveal whether this double spike marks the start of a new accumulation phase or the calm before another downturn.

As Bitcoin continues to trade under heightened volatility, investors will be closely watching both the Coinbase and Kimchi Premiums for clues, two powerful signals that, once again, are shaping the global crypto narrative.

Leave a Reply