BTC demonstrates resilience as it regains six-figure territory despite a dip driven by stock market fluctuations.

Bitcoin (BTC) staged a remarkable recovery on January 27, bouncing back 4.6% from local lows of $97,750 to reclaim the $102,000 mark. This surge followed a brief slump triggered by a sell-off in US equities, spurred by the launch of DeepSeek, a Chinese ChatGPT rival, which raised concerns about US competitiveness in artificial intelligence.

BTC Price Regains Momentum

The recovery comes as traders and analysts closely monitor BTC’s price action. Popular trader Crypto Chase highlighted the significance of Bitcoin holding support around $95,000, which would maintain a bullish outlook. His sentiment reflected broader optimism in the market, with others suggesting the recent dip was an overreaction.

Market analyst Caleb Franzen provided a broader perspective, noting that the S&P 500’s 10-week return of 1.65%, translating to an annualised return of 8.8%, aligns with historical averages. Bitcoin, however, outshone traditional markets, with a 37% gain over the same period.

Mixed Reactions to Market Dynamics

The brief downturn in BTC’s price coincided with a notable sell-off in US tech stocks at the market open. This reaction was linked to the debut of DeepSeek, which unsettled investors by highlighting the growing challenge of international competition in the tech space.

Despite these pressures, some analysts criticised Bitcoin holders for selling during the turbulence. Jan Wuestenfeld, lead researcher at Melanion GreenTech, urged investors to deepen their understanding of Bitcoin’s long-term potential before making hasty decisions.

Outlook and Key Influences

Looking ahead, trading firm QCP Capital tempered expectations for immediate significant gains, noting that a clear confirmation of a Strategic Bitcoin Reserve would be needed to fuel sustained bullish momentum. The firm referenced the Trump administration’s prior consideration of a “national digital asset stockpile,” which failed to spark long-term market enthusiasm.

QCP also pointed to the upcoming Federal Reserve interest rate decision as a pivotal factor for Bitcoin and broader market performance. With risk reversals favouring bullish call options only from March onward, the firm projected limited upside potential until the end of the first quarter.

Resilience Amidst Uncertainty

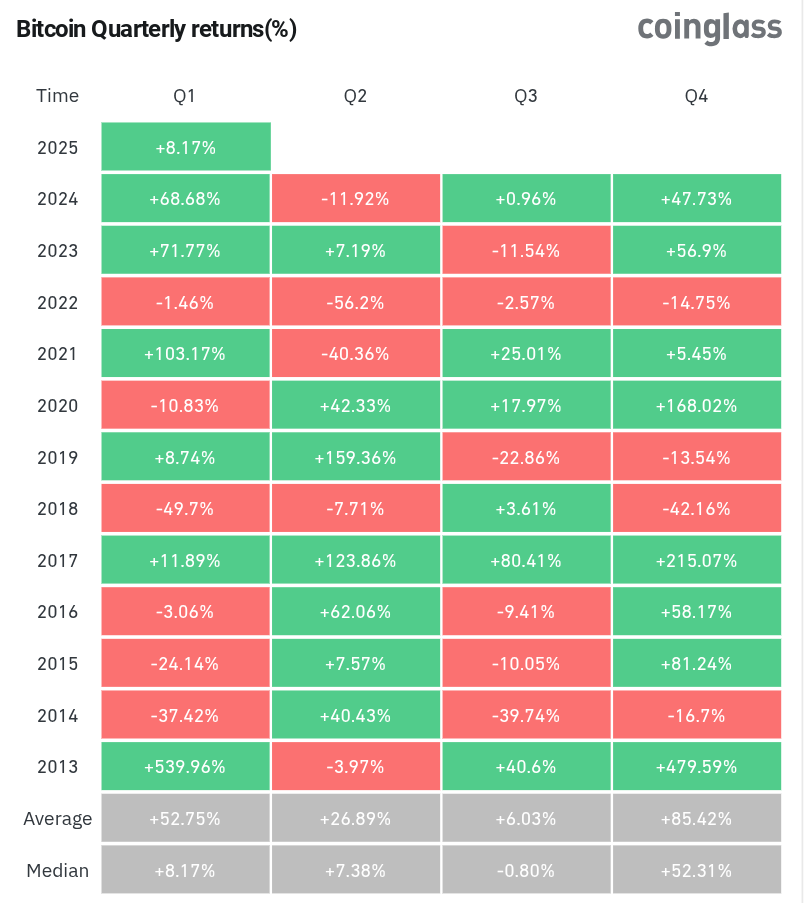

Despite external shocks and stock market volatility, Bitcoin has demonstrated notable resilience. Data from CoinGlass confirmed that BTC remains up over 8% in the first quarter, underscoring its ability to withstand external pressures.

The recovery to $102,000 marks a significant psychological milestone, highlighting Bitcoin’s enduring appeal in an uncertain financial landscape. While macroeconomic factors and regulatory developments continue to shape market sentiment, Bitcoin’s performance suggests it remains a favoured asset for investors seeking both short-term gains and long-term value.

Leave a Reply