BTC Hits $104,630 Amid Growing Market Optimism

Bitcoin (BTC) has surged past the highly anticipated $100,000 milestone, reaching a record high of $104,630 on 5 December. The cryptocurrency’s 9% rally from its $95,000 support has marked another period of price discovery, popularly referred to as the “Santa rally,” as investors eye further gains before the year ends.

Retail and Institutional Momentum Drive Price Surge

A notable surge in trading volume, particularly in transactions between $0 and $10,000, has hit an all-time high, surpassing levels last seen in 2020. Analysts view this as a sign of growing retail participation, which, when combined with sustained institutional interest, could maintain upward momentum in the market.

Demand from US investors has also been a significant factor. The Coinbase premium index—a key metric of buying pressure—has shown consistent strength for the past five weeks, marking its longest streak since March 2024.

Bitcoin’s Ceiling Price Adjusts Higher

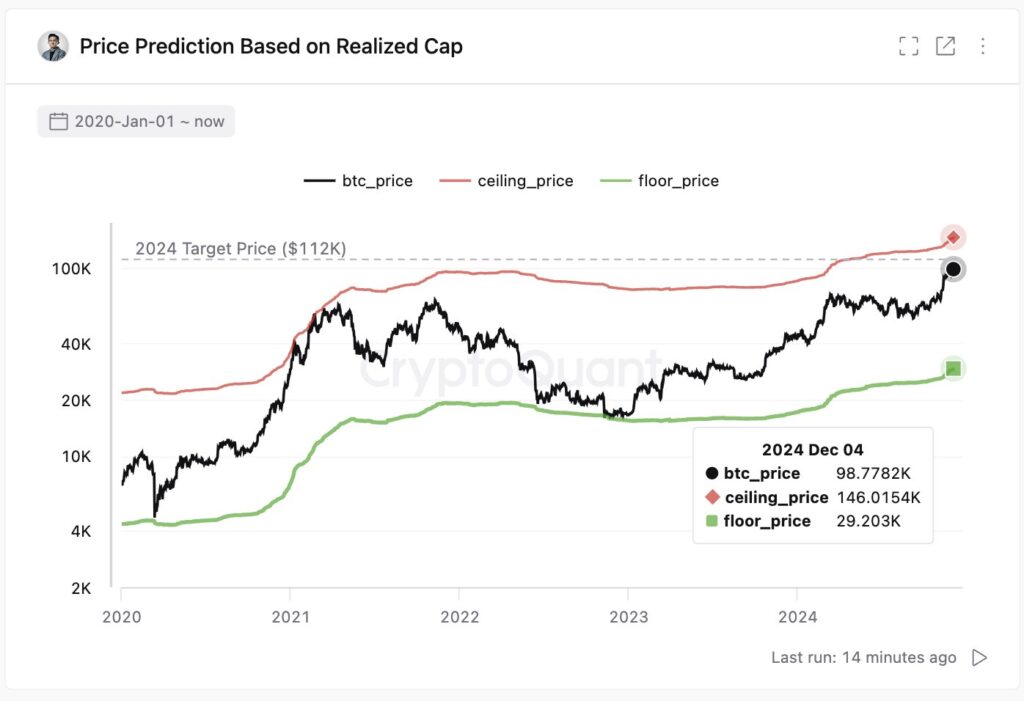

Following the breakthrough, CryptoQuant CEO Ki-Young Ju highlighted the influx of fresh capital as a key driver behind Bitcoin’s rising “ceiling price.” The ceiling price, calculated using realized and market caps to determine overvaluation levels, has been raised from $129,000 to $146,000.

“At $102K, Bitcoin is far from being in a bubble—it would need to surge 43% further to reach bubble territory,” Ju said on X (formerly Twitter).

Market Caution Ahead of Potential Correction

Despite the bullish momentum, some traders warn of a potential market correction. Edward Morra, an anonymous Bitcoin trader, suggested that a short-term pullback could occur as early as this week to clear overleveraged positions. Morra advised caution, encouraging investors to “prepare to buy the dip.”

For now, Bitcoin’s immediate targets, based on Fibonacci extension levels, are $105,000 and $111,000. With the Relative Strength Index (RSI) undergoing a reset, analysts believe the cryptocurrency has room to rise slightly further before any significant correction occurs.

Bitcoin’s rally has reinforced its position as a leading asset in 2024’s financial landscape, with growing confidence among both retail and institutional investors.

Leave a Reply