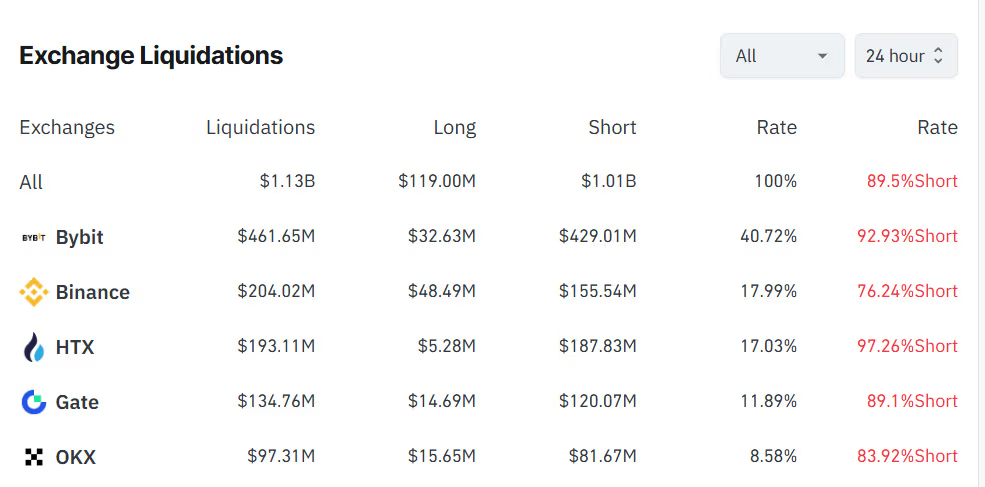

Bitcoin has skyrocketed past the $118,000 mark, marking a major milestone in its ongoing bull run. The massive surge triggered the largest wave of short liquidations this year, with more than $1.13 billion in positions wiped out in just 24 hours. The vast majority of these over $1.01 billion were from traders who had bet against the market.

A total of approximately 237,000 traders saw their positions liquidated, highlighting the aggressive stance many had taken in anticipating a price drop. The biggest single liquidation was an $88.5 million BTC-USDT short on the crypto exchange HTX.

This dramatic upward move underlines the unpredictable nature of crypto markets and the risks of leverage trading during periods of high volatility.

Futures Activity Surges with Bullish Momentum

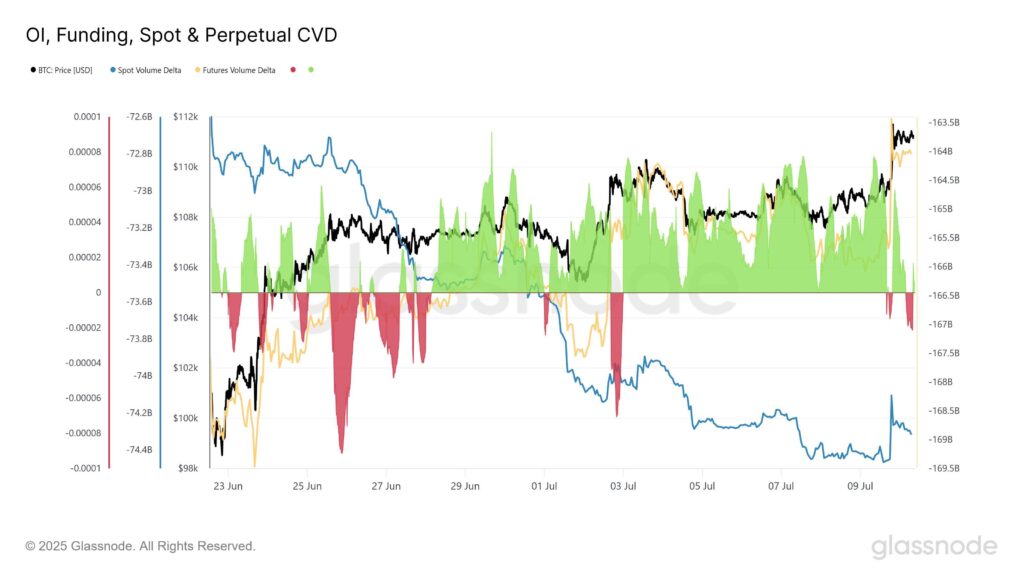

Bitcoin futures led the charge, accounting for $590 million of the total liquidations. Ether futures followed with $241 million. This comes amid a sharp $2 billion increase in open interest on BTC-tracked futures in just four hours, an indicator of rapidly growing market activity.

The long-short ratio has shifted in favour of the bulls, currently standing at around 52%. This shows that more traders are placing their bets on Bitcoin continuing its upward trend, adding further momentum to the ongoing rally.

Short liquidations often have a cascading effect. When traders betting on a price fall are forced to exit, it pushes prices even higher, triggering more forced exits. This reflexive cycle played out in dramatic fashion as Bitcoin soared to fresh all-time highs.

Bybit, HTX, and Binance Take the Biggest Hits

Crypto exchanges saw massive activity as short positions were liquidated across the board. Bybit was hit the hardest, recording $461 million in total liquidations with a staggering 93% of that coming from short trades. HTX followed with $193 million, and Binance reported $204 million in liquidated positions.

These figures reflect how widely the bearish sentiment had spread and how quickly it was undone by the sudden spike in prices. The concentration of short positions across these platforms contributed to the scale of the wipeout.

What Sparked the Rally?

The rally was fuelled by a combination of renewed optimism in crypto markets and broader positive signals from traditional finance. Recent policy hints from the U.S., alongside continued strength in equity markets, have restored confidence among investors.

Bitcoin wasn’t alone in its rise. Other major cryptocurrencies such as Ethereum (ETH), XRP, Dogecoin (DOGE), and Solana (SOL) also posted gains of up to 5%, each driven by their own bullish narratives.

This sudden reversal caught many short traders off guard, highlighting the high-risk nature of leveraged trading and the unpredictability of market sentiment.

The past 24 hours have served as a stark reminder of how quickly fortunes can change in the crypto world. Bitcoin’s rally past $118,000 did more than just set a new record, it reshaped market positions, flushed out bearish bets, and reaffirmed the reflexive nature of crypto price action.

Leave a Reply