Bitcoin’s ongoing bull market may face significant risks, with on-chain data suggesting the possibility of an imminent cycle top. Despite ambitious price targets for 2025, recent analysis warns of a potential distribution phase for investors.

On-Chain Indicators Flash Warnings

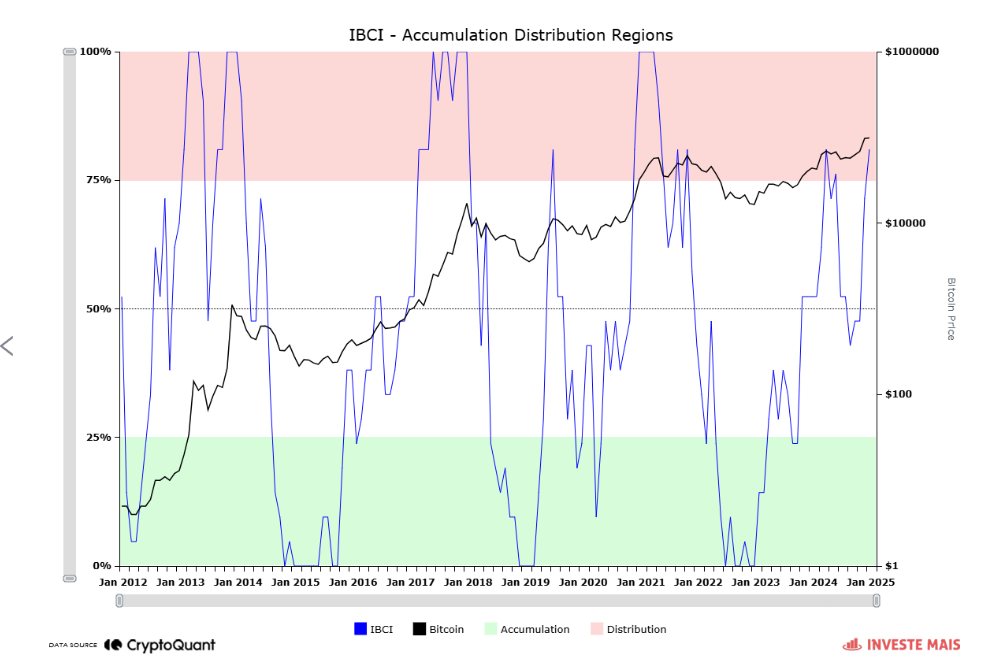

Bitcoin, currently priced at $105,738, is showing signs of approaching a potential macro top, according to the Index of Bitcoin Cycle Indicators (IBCI). Research from on-chain analytics platform CryptoQuant highlights that the IBCI has entered the “distribution region” for the first time in eight months.

The IBCI is a composite of seven popular on-chain indicators, including the Puell Multiple, Spent Output Profit Ratio (SOPR), and Net Unrealized Profit/Loss (NUPL). Together, these metrics offer insights into Bitcoin price trends, helping to identify macro tops and bottoms in the market cycle.

CryptoQuant contributor Gaah noted in a market update that Bitcoin “may be approaching a possible cycle top” but stopped short of providing absolute confirmation.

“For IBCI to reach 100%, all the indicators in the formula must hit their historical distribution range, the top regions. This hasn’t happened yet, suggesting there may still be room for growth before a definitive market top,” Gaah explained.

Current Indicators Show Mixed Signals

While the IBCI’s position is concerning, not all constituent indicators signal immediate danger for Bitcoin bulls. For instance, the Puell Multiple, which evaluates daily BTC issuance relative to its 365-day moving average, remains below the critical level of six typically associated with market tops.

However, the broader index suggests caution, with past instances of IBCI reaching its macro top zone correlating with subsequent market corrections. Notably, the IBCI briefly entered this risk zone in early 2024, but the event was not followed by a sustained downtrend.

Price Volatility and Predictions

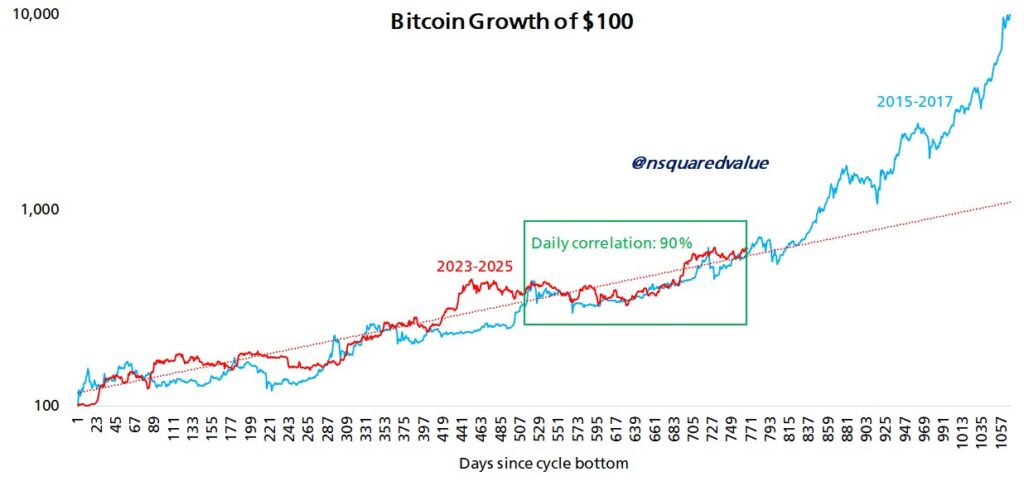

As analysts monitor the IBCI, other predictions suggest Bitcoin may still have room for price surges before any significant downturn. Network economist Timothy Peterson forecasts Bitcoin could reach $137,000 before experiencing a sharp dip below six figures.

Peterson highlighted a striking 90% correlation between the current bull run and the 2015-2017 cycle over the past 250 days. This echoes broader optimism about Bitcoin’s long-term trajectory, with Peterson projecting a price of $1.5 million per BTC by 2035.

Despite these lofty predictions, the risk of a correction remains. Analysts emphasise the importance of monitoring key indicators, as distribution phases often precede bear markets.

Outlook for Bitcoin Bulls

Although the IBCI signals caution, Bitcoin’s trajectory remains uncertain. Historical patterns suggest the market may have further upside potential before a definitive top is reached. Investors, however, should prepare for heightened volatility and closely track on-chain metrics to navigate this complex market phase.

With Bitcoin’s price still surging and ambitious targets for the future, the coming months will be crucial in determining whether the bull market continues or gives way to a multi-year downtrend.

Leave a Reply