As the highly anticipated Bitcoin 2025 Conference kicks off in Las Vegas, traders are voicing concerns that history may repeat itself with a sharp BTC price correction. The event has already sparked heightened volatility, and some analysts warn that a 30% crash — similar to the one that followed last year’s conference — could be looming.

Bitcoin Recovers, but Jitters Linger

Bitcoin rebounded slightly to hover around $110,000 as Wall Street reopened on 27 May following the Memorial Day holiday. The price had recently tested support near $107,000, prompting large-volume traders to exploit short-term volatility.

Despite the recovery, market participants remain cautious. A mix of macroeconomic uncertainty — including US trade tariffs — and memories of last year’s steep drop after the Bitcoin 2024 Conference have raised red flags.

Flashback to 2024: 30% Crash After Nashville Event

In July 2024, Bitcoin plunged by 30% following the Nashville edition of the Bitcoin Conference. After reaching highs near $70,000, the cryptocurrency plummeted to $49,000 in early August, just days after the event concluded. A keynote speech by former President Donald Trump was credited with sparking an extreme surge in volatility, with 1-day implied volatility exceeding 90, followed by a swift reversal.

Analysts are now drawing parallels between the 2024 crash and this year’s event, noting the potential for “market memory” to trigger similar outcomes.

Volatility Builds Ahead of High-Profile Line-Up

According to trading firm QCP Capital, the market is already reacting to the 2025 conference’s star-studded line-up. Key speakers include JD Vance, Michael Saylor, Donald Trump Jr., and Eric Trump. The firm highlighted in a Telegram update that the continued elevation in near-term volatility points to trader positioning around headline risk tied to the event.

“The sustained elevation in near-term vols suggests that traders are positioning around headline risk ahead of the Bitcoin Conference in Las Vegas,” QCP noted.

The conference, running from 27 to 29 May, has become one of the biggest gatherings in the crypto space and often serves as a catalyst for major price swings.

Analysts Warn: Corrections Are Inevitable

Crypto analyst and entrepreneur Michaël van de Poppe reminded investors that drawdowns are a normal part of market cycles. Speaking on X (formerly Twitter), he stated that a drop of 10-20% should not come as a surprise during bullish phases.

“Corrections do happen and they’ll continue to happen,” he said on 26 May, referencing the earlier move from $110,000 to the mid-$70,000 range. He added that such retracements are not necessarily signs of weakness but rather natural pauses in broader trends.

Meanwhile, other voices in the market are warning that the current bull cycle may be entering its final stage. Some predict a prolonged trend reversal following the current rally.

$106K Identified as Liquidity Magnet

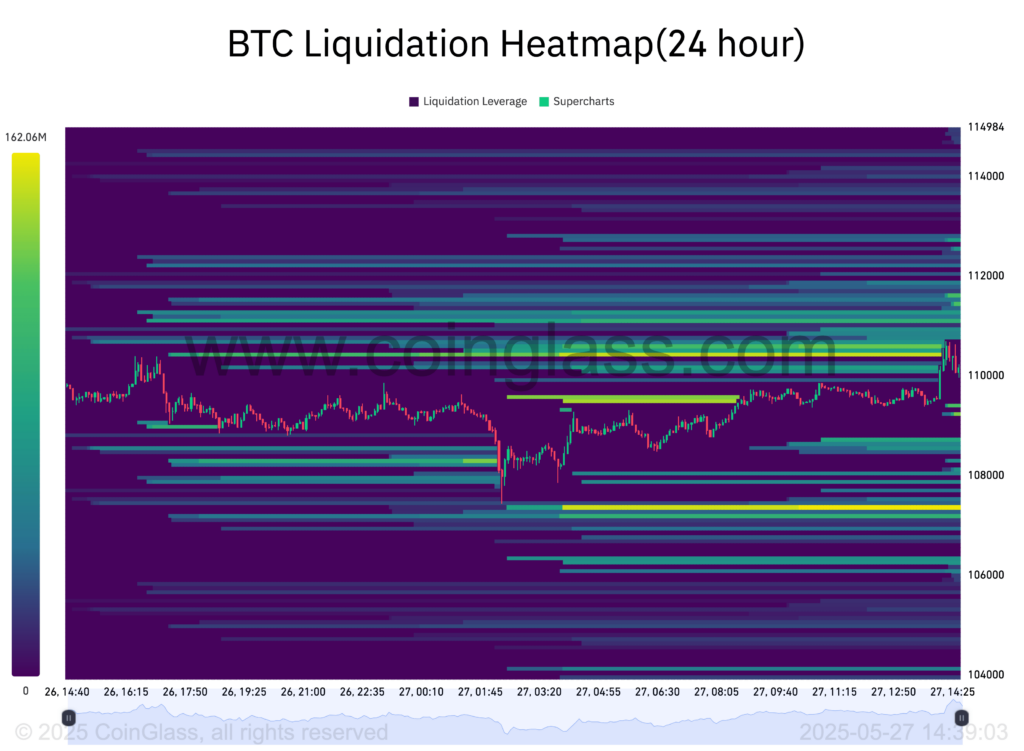

Short-term traders are also eyeing liquidity levels to gauge where Bitcoin might be heading next. Prominent trader Daan Crypto Trades pointed to exchange order book data showing significant liquidity concentrations around $106,000 on the downside and from $111,000 upward.

“The longer price hovers around this price region, the thicker the liquidity clusters above and below will become,” he explained. Such liquidity “magnets” tend to attract price movements when trading hovers nearby, and many are watching for a decisive move toward one of these levels.

Data from CoinGlass confirmed that a chunk of sell-side liquidity was already being consumed as the US trading session got underway, reinforcing the view that markets remain highly reactive in the short term.

What a 30% Correction Would Mean Now

If Bitcoin were to mirror last year’s 30% decline, it could fall to around $77,000 — a price level that acted as a local bottom in April 2025. While such a drop would be significant, it would not break the longer-term uptrend that has defined Bitcoin’s performance over the past year.

With Bitcoin currently trading just below all-time highs, some investors may view potential dips as buying opportunities. However, the memory of last year’s post-conference crash is keeping many on edge.

As the Bitcoin 2025 Conference unfolds, all eyes are on price action and volatility, with market sentiment delicately balanced between optimism and caution.

Leave a Reply