The crypto market took a sharp turn on Friday, with Bitcoin (BTC) plunging below $84,000, wiping out nearly all of the week’s gains. A $115 billion rout hit the broader market, fuelled by macroeconomic worries and poor U.S. data, with Ethereum (ETH) also suffering a historic drop in strength against BTC.

Market-Wide Sell-Off Erases Weekly Gains

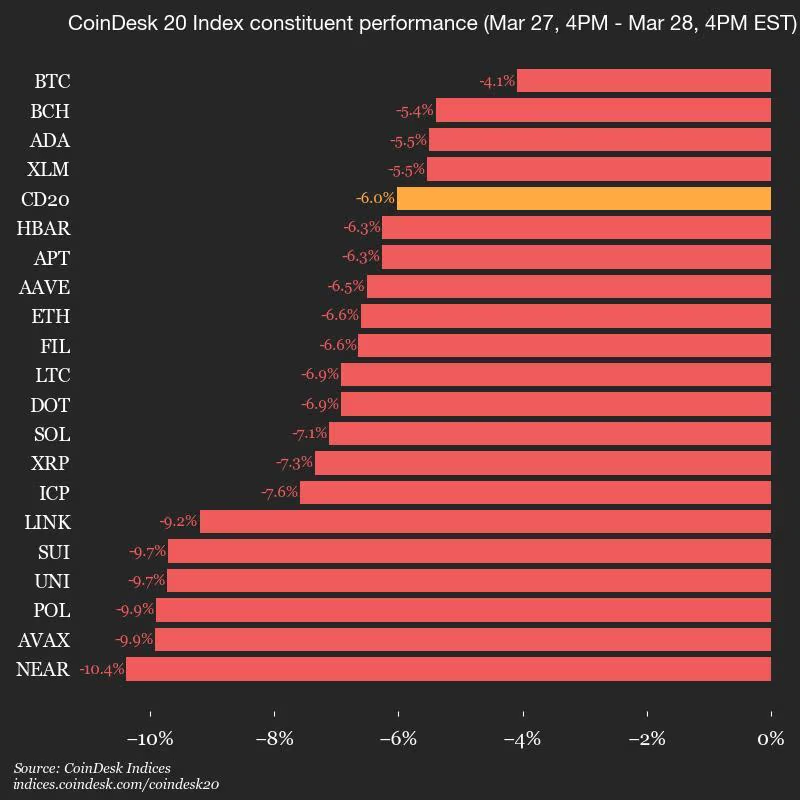

Just a day ago, Bitcoin hovered near $88,000. By Friday, it had slipped to $83,800, marking a 3.8% daily loss. The CoinDesk 20 Index fell 5.7%, with altcoins like Avalanche (AVAX), Polygon (POL), Near (NEAR), and Uniswap (UNI) each losing around 10%.

The crash wiped $115 billion off the crypto market cap, according to TradingView data, as investor sentiment flipped amid global economic uncertainty.

Ethereum Weakens Against Bitcoin

Ethereum (ETH) fell over 6%, continuing its downward spiral against BTC. ETH hit its weakest BTC pairing since May 2020, reflecting waning investor interest.

Spot ETH ETFs have failed to attract net inflows since early March, while Bitcoin ETFs saw over $1 billion in inflows over the past two weeks, according to Farside Investors.

Macro Woes Fuel Risk-Off Mood

The crypto slump mirrored a broader risk-off trend in traditional markets. The S&P 500 dropped 2%, and the Nasdaq fell 2.8% following a disappointing February PCE inflation report, which showed a 2.5% year-over-year rise. Core inflation at 2.8% exceeded expectations, while weak consumer spending raised fears of slowing economic growth.

The Atlanta Fed’s GDPNow model now projects a 2.8% contraction in Q1 (0.5% when adjusted), hinting at stagflation risks. Upcoming U.S. tariffs set to begin on April 2 — dubbed “Liberation Day” by the Trump administration — have further shaken investor confidence.

CME Gap or Deeper Correction Ahead?

Some analysts suggest Friday’s drop may simply be Bitcoin filling the CME futures gap between $84,000–$85,000. Historically, BTC often revisits such price gaps.

Still, LMAX Group’s Joel Kruger noted uncertainty over whether the 2025 bottom is in. While acknowledging the current correction, he pointed to positive longer-term trends, including crypto-friendly U.S. policies and increasing institutional adoption.

He believes any further dips could find strong support between $70,000 and $75,000, hinting that the crypto bull cycle may not be over just yet.

Leave a Reply