BTC retraces December lows as leverage liquidations dominate the market, while easing inflation offers a silver lining.

Bitcoin Retests $92K Amid Leverage Liquidations

Bitcoin (BTC) experienced significant volatility on December 20, dropping to $92,000 on Bitstamp before recovering to $96,000. Despite the recovery, the cryptocurrency was still down 1.5% on the day, marking a 15% pullback from recent highs.

Popular analyst Rekt Capital highlighted similarities with historical bull market corrections, suggesting this dip could last several weeks. “This is the first Price Discovery Correction in this cycle, providing an optimal re-accumulation opportunity,” the analyst noted.

Data from CoinGlass revealed $1.4 billion in cross-crypto liquidations over the past 24 hours, with long positions bearing the brunt of the losses.

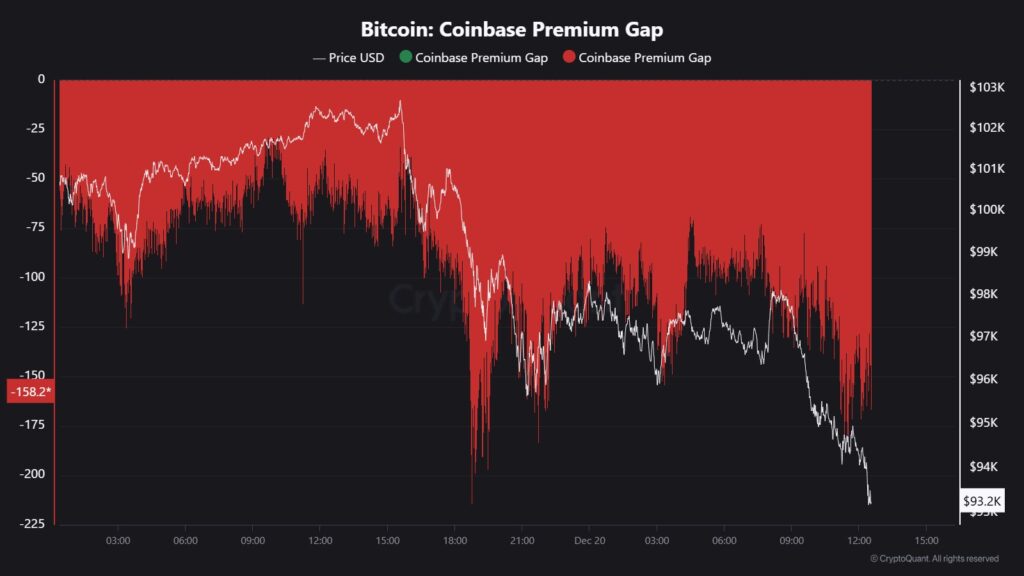

Coinbase Premium Signals Weak US Market Conditions

On-chain data pointed to the United States as a significant driver of recent price weakness. CryptoQuant contributor J.A. Maartun identified strong sell-side pressure on Coinbase, evidenced by a negative Coinbase premium—the price difference between Bitcoin on Coinbase and Binance.

“When Coinbase Premium is negative, stay on the sidelines,” advised BQYoutube, another CryptoQuant analyst. A shift to a positive premium could signal a market recovery.

Inflation Data Offers Mixed Signals

Amid Bitcoin’s turbulence, macroeconomic conditions provided some relief. The US Personal Consumption Expenditures (PCE) index—a key inflation measure—rose by 2.4%, slightly below the expected 2.5%.

“The lower-than-expected inflation print offers some market relief,” noted The Kobeissi Letter, adding that inflation remains a concern.

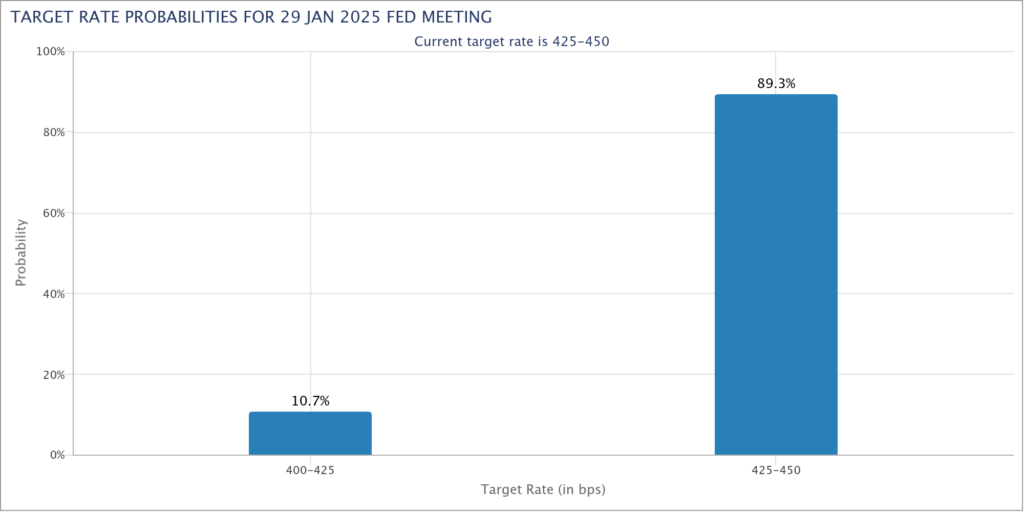

Market expectations for a Federal Reserve interest rate cut in January rose slightly to 10.7%, up from 8.6% the day prior, according to CME Group’s FedWatch Tool.

As traders navigate this challenging landscape, analysts suggest this correction phase may present an opportunity for long-term Bitcoin investors to re-enter the market.

Leave a Reply