Bitcoin dropped sharply on Friday, reaching a three-week low of $114,322 on Bitstamp. This move perfectly “filled” a CME Group Bitcoin futures gap from July, a common price phenomenon in crypto markets. Gaps like these often occur over weekends when CME markets are closed but crypto trades 24/7. Historically, Bitcoin tends to revisit these unfilled zones within a short period.

This price action comes amid growing caution from traders and investors. Though some saw the gap fill as a healthy technical event that may now support a bounce, others warned the worst might not be over.

Crypto investor Ted Pillows commented on social media platform X (formerly Twitter), predicting: “We should see a nice upwards movement now.” But not everyone shared his optimism.

$116K Is Key: Traders Split on Next Move

Bitcoin’s dip and bounce left the market in a critical spot. Popular trader Cipher X said reclaiming $116,000 is essential, or BTC could fall further, even as low as $104,000.

Another trader, Crypto Candy, warned the market needs to close above the $115,000–$116,700 range by the end of the day to avoid a deeper correction. Failing that, he sees $111,800 as the next key level before any potential rebound toward all-time highs.

This highlights a clear split in trader sentiment, some expect a recovery, while others brace for more downside.

Bitcoin Drops Harder Than Stocks on Trade War News

The price drop in Bitcoin came as fresh US-China trade tariffs dampened investor mood. The Trump administration announced a new round of tariffs, renewing fears of a trade war. Surprisingly, traditional markets like the S&P 500 held up relatively well, dipping just 0.4% before the Wall Street open.

This difference in market reaction is notable. In the past, such trade-related shocks would have caused 3%+ drops in stock indices. But according to The Kobeissi Letter, the market has now “acclimatised” to trade war headlines. In contrast, Bitcoin showed more sensitivity, falling faster and harder than equities.

This suggests that, at least for now, Bitcoin is acting more like a high-risk asset than a safe haven.

Inflation Worries and Fed Outlook Add Pressure

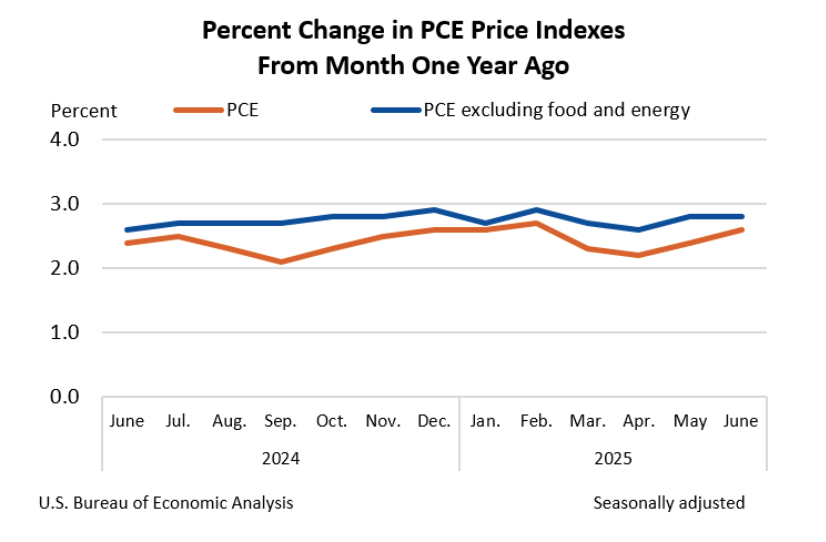

Adding to the pressure on Bitcoin, recent data showed the Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred measure of inflation came in higher than expected. That’s bad news for investors hoping for rate cuts anytime soon.

Earlier in the week, Fed Chair Jerome Powell maintained a hawkish stance, leaving interest rates unchanged and signalling that no cuts are likely this year. This pushed many traders to scale back expectations for monetary easing in 2025.

Higher interest rates generally make risk assets like Bitcoin less attractive compared to bonds or cash, which offer better returns without volatility.

What’s Next for Bitcoin?

Bitcoin’s recent dip to fill the CME gap has been a closely watched technical event, but its ability to hold key levels like $116K could determine its next major move. A strong recovery might encourage bullish momentum toward a new all-time high (ATH), while a failure could send prices down to $104K or even lower.

Meanwhile, macroeconomic factors from US tariffs to inflation data and Federal Reserve policy will likely continue to influence investor sentiment.

As traders watch closely, the Bitcoin market remains on edge. Whether this gap fill marks the start of a new rally or a warning of deeper correction is a question only time, and price action will answer.

Leave a Reply