Spot Bitcoin ETFs in the United States faced another turbulent day as heavy outflows continued through November. The month is now on track to become the worst since the products launched in January 2024. Meanwhile, a surprise appearance by US Treasury Secretary Scott Bessent at a Bitcoin-themed bar ignited excitement across the crypto community. A new report also shows a significant drop in SEC enforcement actions under the commission’s new leadership.

BlackRock’s IBIT Leads Record ETF Outflows

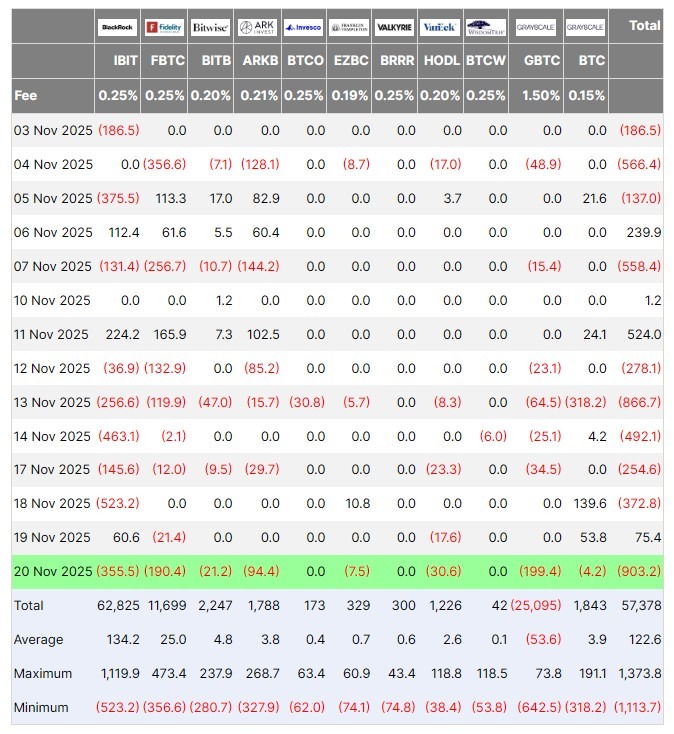

US spot Bitcoin ETFs posted a dramatic reversal on Thursday. The sector saw fresh redemptions worth $903 million, erasing a short-lived recovery earlier in the week. This was the largest single-day pullback of the month, according to data from Farside Investors.

Outflows for November have now reached $3.79 billion, already surpassing the previous record of $3.56 billion from February. Unless the final days of the month bring substantial inflows, November will finish as the worst month on record for US spot Bitcoin ETF withdrawals.

BlackRock’s iShares Bitcoin Trust remains the main driver of this trend. The fund has recorded $2.47 billion in redemptions so far, which represents about sixty three percent of all outflows across US spot Bitcoin ETFs in November. The asset class had recorded a brief pause in redemptions on Wednesday when it attracted $75.4 million in new capital before swiftly returning to negative territory.

Bitcoin Community Celebrates Bessent’s Pubkey Appearance

A different kind of excitement swept through the Bitcoin world after US Treasury Secretary Scott Bessent made an unexpected visit to Pubkey, a newly opened Bitcoin-themed bar in Washington, D.C.

The appearance was met with surprise and enthusiasm. Ben Werkman, chief investment officer at Strive, described the moment as something he could look back on as an obvious inflection point. Steven Lubka, vice president of investor relations at Nakamoto, said the visit felt like “the sign you have been waiting for.”

Other well-known Bitcoin figures, including podcaster Natalie Brunell, analyst Fred Krueger, Gemini chief of staff Jeff Tiller, and Bitcoin Policy Institute co-founder David Zell, echoed the sentiment. Many interpreted Bessent’s presence as a symbolic shift in how policymakers may be viewing Bitcoin.

SEC Enforcement Actions Decline Under New Leadership

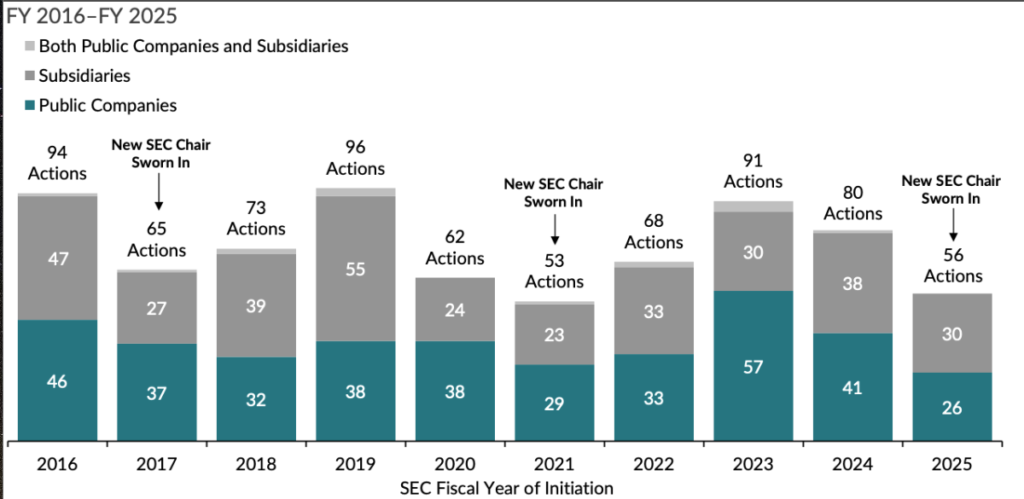

A new report from Cornerstone Research shows that the US Securities and Exchange Commission has taken a noticeably lighter approach to enforcement since Paul Atkins became chair.

The study notes a thirty percent drop in overall enforcement activity in fiscal year 2025. The pattern mirrors previous leadership transitions at the agency, where shifts in regulatory style typically follow new appointments.

Crypto firms have also seen fewer regulatory actions. This trend was expected after several investigations and lawsuits were rolled back following Gary Gensler’s departure. The report highlighted the dismissal of the agency’s case against Coinbase in February as one of the key examples.

Atkins Promises a Coherent Approach to Crypto

The report cites comments from Chair Atkins, who has outlined a renewed approach to digital asset oversight. He has described a “top priority” of establishing a consistent and principled regulatory foundation for the crypto sector.

Market participants remain hopeful that the new direction will bring clarity to long-standing disputes between regulators and the industry. The combination of reduced enforcement, shifting political attitudes and growing mainstream attention continues to shape the evolving regulatory environment for digital assets in the United States.

Leave a Reply