Bitcoin’s latest rally has stalled below a crucial resistance level, as spot exchange-traded funds (ETFs) continue to see strong inflows that could provide the necessary momentum for a breakout. On Monday, spot Bitcoin ETFs recorded $260 million in inflows, extending a six-day streak that has brought total capital inflows to more than $2 billion since 8 September.

According to data from Glassnode, US spot Bitcoin ETFs saw net inflows of around 5,900 BTC on 10 September, marking the largest daily inflow since mid-July. This renewed demand from institutional investors signals strengthening confidence in the asset, despite short-term price hesitation.

Resistance remains firm at $118,000

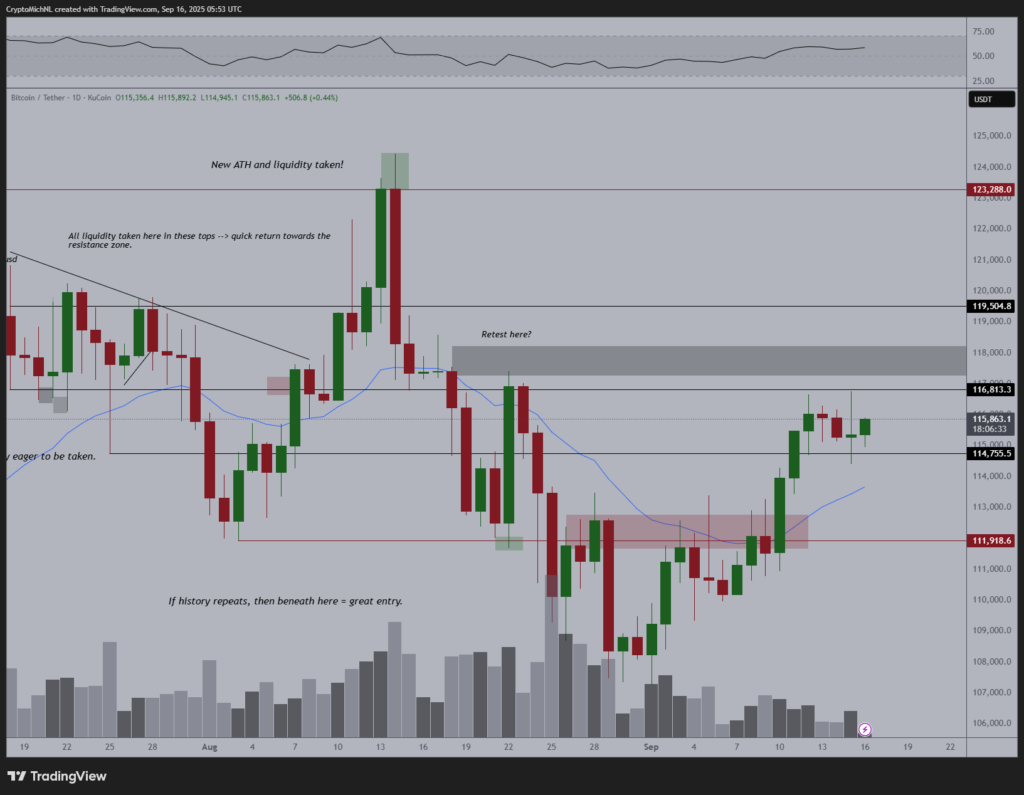

Bitcoin has rallied 9% from its 1 September low of $107,270 but has repeatedly failed to push beyond the $118,000 mark. Traders and analysts suggest this level represents a key battleground between bulls and bears.

Michael van de Poppe, founder of MN Capital, described $117,500 as the “crucial resistance” that must be cleared before Bitcoin can move into “great territory for a potential new all-time high.” Bitcoin was trading at around $115,300 on Tuesday, showing no clear direction as traders awaited the outcome of the US Federal Reserve’s policy meeting.

Market analyst AlphaBTC echoed the cautious tone, noting that Bitcoin could push towards $118,000 in the short term before retreating following the Federal Open Market Committee (FOMC) decision. “I still expect we see a run to 118K sooner rather than later, BUT then we may see a further pullback post the rate decision,” AlphaBTC wrote.

Liquidity cluster adds to resistance pressure

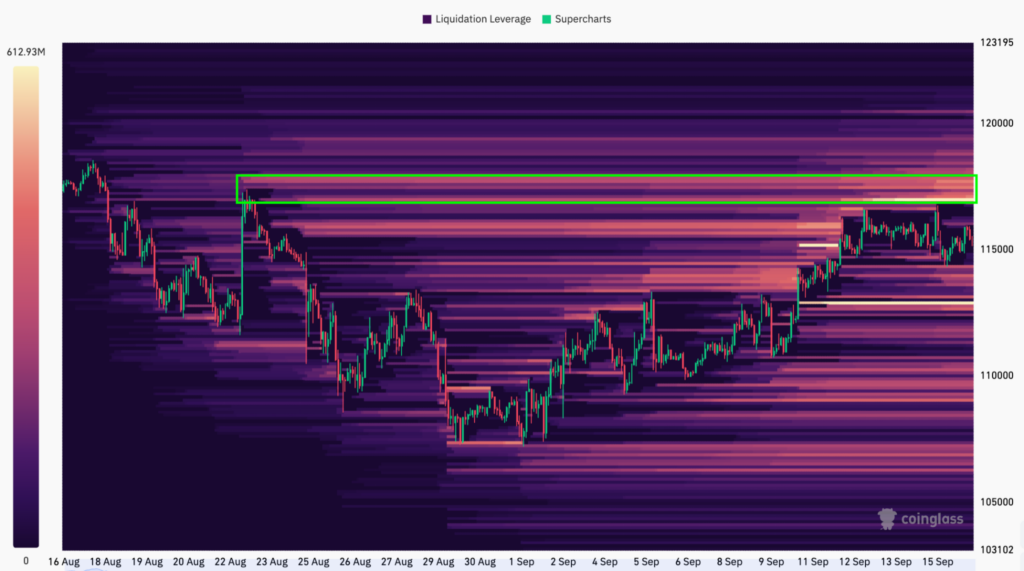

Adding further weight to the resistance zone, liquidation heatmaps show a significant cluster of trader liquidations positioned around $118,000. This concentration acts as both a target and a barrier: Bitcoin’s price may be drawn to this liquidity zone, but once reached, selling pressure could accelerate.

AlphaBTC described the area as “really juicy from a liquidity point of view,” suggesting that Bitcoin may spike up to test the level before experiencing downward pressure. Traders are therefore closely monitoring this zone as a potential flashpoint in the ongoing price battle.

Institutional demand underpins bullish case

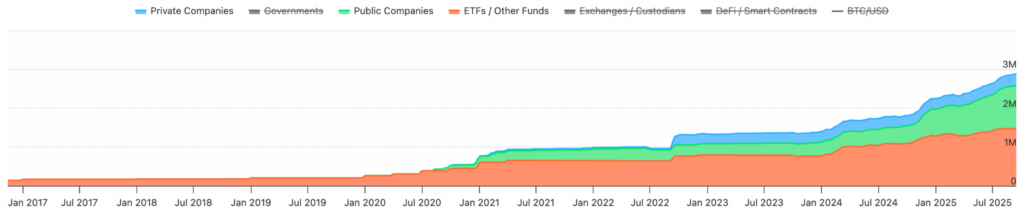

Despite the near-term uncertainty, institutional accumulation continues to build a bullish foundation for Bitcoin’s medium-term outlook. Data from BitcoinTreasuries.NET shows that the combined holdings of strategic reserves and ETFs have risen by 30% so far in 2025, climbing from 2.24 million BTC at the start of the year to 2.88 million BTC by mid-September.

This steady consolidation of Bitcoin into institutional and corporate hands reduces available supply in the open market, increasing the likelihood of sharp price reactions to positive catalysts. CoinShares data further highlights that Bitcoin dominated inflows into exchange-traded products (ETPs) last week, attracting $2.4 billion compared to smaller flows into other digital assets.

Fed decision looms over short-term trend

In the immediate term, Bitcoin’s trajectory hinges on the outcome of the FOMC meeting and comments from Federal Reserve Chair Jerome Powell. Any signs of a dovish shift in US monetary policy could weaken the dollar and provide fresh fuel for Bitcoin’s price. Conversely, hawkish remarks could reinforce resistance levels and trigger profit-taking among traders.

As it stands, Bitcoin remains locked between strong institutional support through ETFs and equally strong resistance around $118,000. A breakout above this level could open the door to a retest of the $124,500 all-time high, but until then, traders appear content to take a wait-and-see approach.

Leave a Reply