Spot Bitcoin ETFs Reverse December Slump

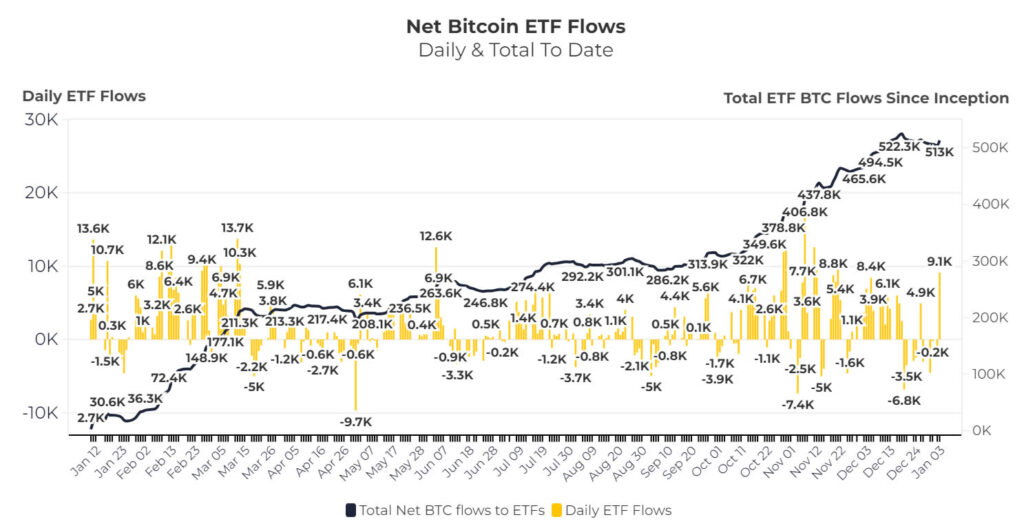

United States-based spot Bitcoin exchange-traded funds (ETFs) recorded a significant recovery, raking in nearly $1.9 billion in total net inflows on January 3 and January 6. This marked a sharp turnaround from the low demand observed in the latter half of December.

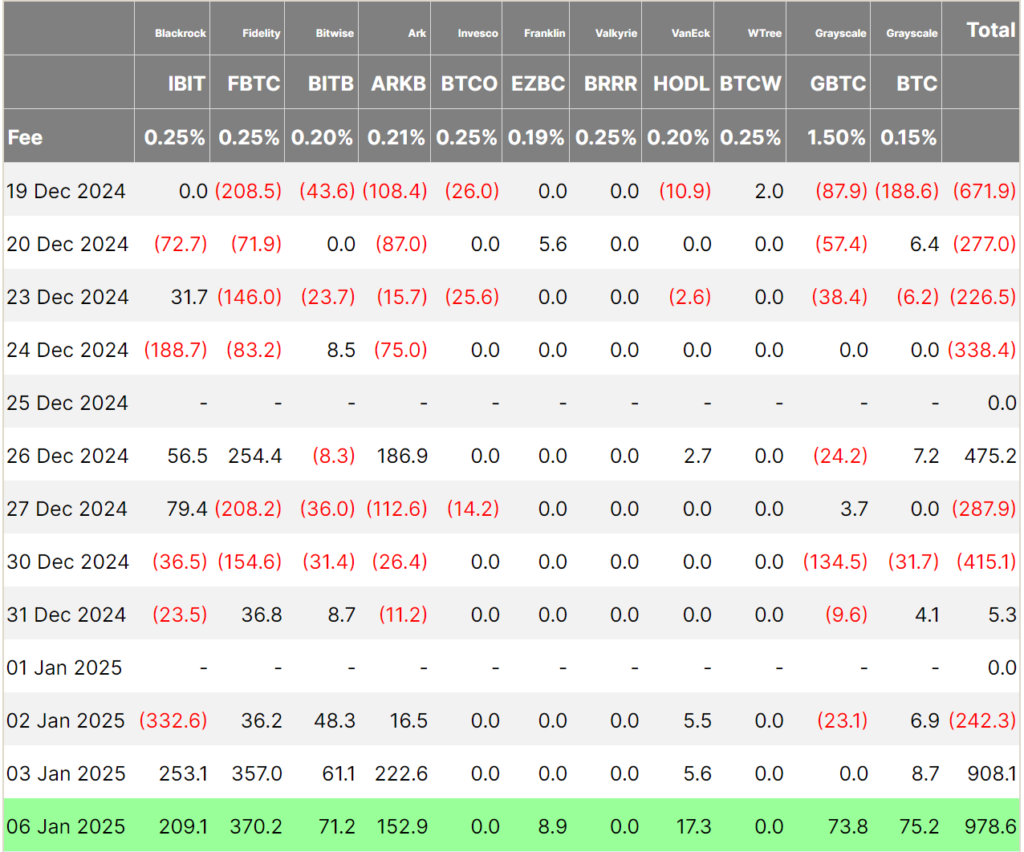

On January 6 alone, Bitcoin ETFs attracted $978.6 million in inflows, led by the Fidelity Wise Origin Bitcoin Fund, which accounted for $370.2 million. BlackRock’s iShares Bitcoin ETF and ARK 21Shares Bitcoin ETF followed with $209 million and $153 million, respectively, according to data from Farside Investors.

Other ETFs, such as the Bitwise Bitcoin ETF and Grayscale’s spot Bitcoin ETFs—tickered GBTC and BTC—garnered over $70 million on the same day. Meanwhile, VanEck Bitcoin ETF and Franklin Bitcoin ETF secured $17.3 million and $8.9 million, respectively.

However, not all ETFs benefitted from the surge. Invesco, Valkyrie, and WisdomTree’s spot Bitcoin ETFs recorded no inflows on January 6, according to the same data.

The strong performance on January 3 and January 6 nearly offset the $1.9 billion in net outflows seen between December 19 and January 2. Since their launch nearly a year ago, spot Bitcoin ETFs have now accumulated $36.9 billion in net inflows.

BlackRock Leads the Pack

BlackRock’s iShares Bitcoin ETF continues to dominate, boasting $37.4 billion in net inflows since its inception. Fidelity’s Wise Origin Bitcoin Fund trails with $12.4 billion in inflows. In contrast, Grayscale’s converted GBTC has struggled, bleeding $21.4 billion in outflows.

An October 25 report by cryptocurrency exchange Binance revealed that nearly 80% of demand for spot Bitcoin ETFs has come from retail investors, with institutional interest expected to pick up in 2025.

Matt Hougan, Chief Investment Officer of Bitwise, predicts increased institutional involvement as more clearinghouses for spot Bitcoin ETF trading come online. Bitwise has issued a bullish forecast for Bitcoin, estimating a price of $200,000 by 2025. Similarly, VanEck expects Bitcoin to top $180,000 in the same timeframe.

Bitcoin Mining Companies Report December Production

Major Bitcoin mining firms have also reported their production figures for December. MARA Holdings, the largest Bitcoin mining company by market capitalisation, led the pack with an impressive 9,457 BTC mined in the month.

Riot Blockchain recorded a 4% increase in production over the previous month, mining 516 BTC. Cleanspark followed with 668 BTC produced in December.

Other mining companies also contributed significantly to the market. Core Scientific mined 291 BTC from its owned fleet, Bitfarms produced 211 BTC, Terawulf mined 158 BTC, and cloud mining provider BitFuFu reported producing 111 BTC in the same period.

The Road Ahead

While retail investors have driven much of the demand for spot Bitcoin ETFs, industry analysts are optimistic about increased institutional involvement in the near future. The recent surge in ETF inflows and robust production figures from leading Bitcoin miners signal renewed optimism in the cryptocurrency market as 2025 approaches.

Leave a Reply