Bitcoin recently surged to an all-time high of $98,367, driven by speculation that President-elect Donald Trump’s administration may create a dedicated cryptocurrency policy role. The rally has sparked optimism for Bitcoin to breach the $100,000 milestone by late 2024, with crypto betting platforms showing 92% confidence in this price target.

This bullish momentum has also pushed the cryptocurrency market capitalization to $3.17 trillion, marking a 3.65% rise. Analysts predict institutional demand and potential regulatory clarity under Trump’s pro-crypto stance could fuel further gains.

Ambitious Predictions for 2025

Looking ahead, Bernstein Research forecasts Bitcoin reaching $200,000 by 2025, citing factors such as:

- Rising adoption of Bitcoin exchange-traded funds (ETFs).

- Proposed U.S. Bitcoin reserve acquisition of up to 5% of total supply.

- Aggressive buying strategies by firms like MicroStrategy, planning $42 billion in Bitcoin investments.

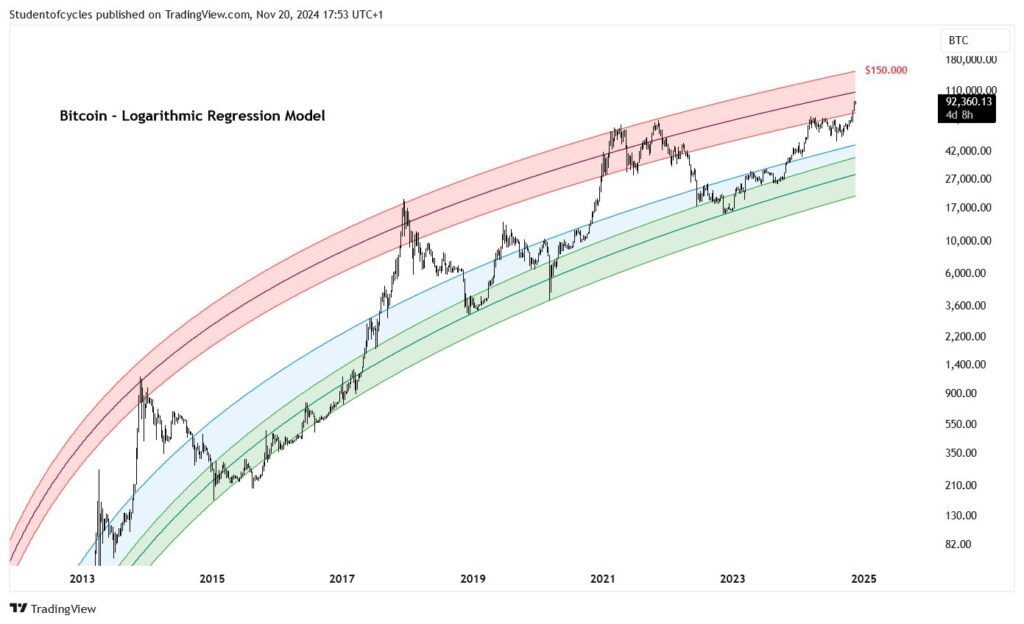

Bitcoin’s post-halving history also supports a bullish outlook. Following the 2024 halving, analysts project a 300–400% rally, aligning with a $150,000 top.

Fractal Indicator Signals Potential 40% Correction

Despite optimism, historical patterns suggest caution. Bitcoin’s price action resembles its 2021 peak of $69,000, which was followed by a 77% crash. The current rally shows signs of a bearish divergence, with rising prices but declining momentum on the Relative Strength Index (RSI).

If this fractal repeats, Bitcoin could face a correction after breaching $100,000, potentially retracing to its 50-week exponential moving average (EMA) at $60,000—a 40% drop.

Path to Recovery Post-Correction

A dip to $60,000 could act as a springboard for the next rally, as it aligns with a long-term ascending trendline that has historically drawn strong buyer interest. Analysts suggest this correction may flush out weak hands, setting the stage for a rebound toward the $100,000 mark by late 2025.

Leave a Reply