Bitcoin moved closer to a potential breakout near the $92,000 to $93,000 zone on Tuesday as US inflation data came in slightly cooler than expected, fueling a rally across global risk assets. The positive macro backdrop pushed US equities to new record highs, while crypto traders assessed whether Bitcoin has enough momentum to break through a major resistance band.

Bitcoin reacts to softer US CPI data

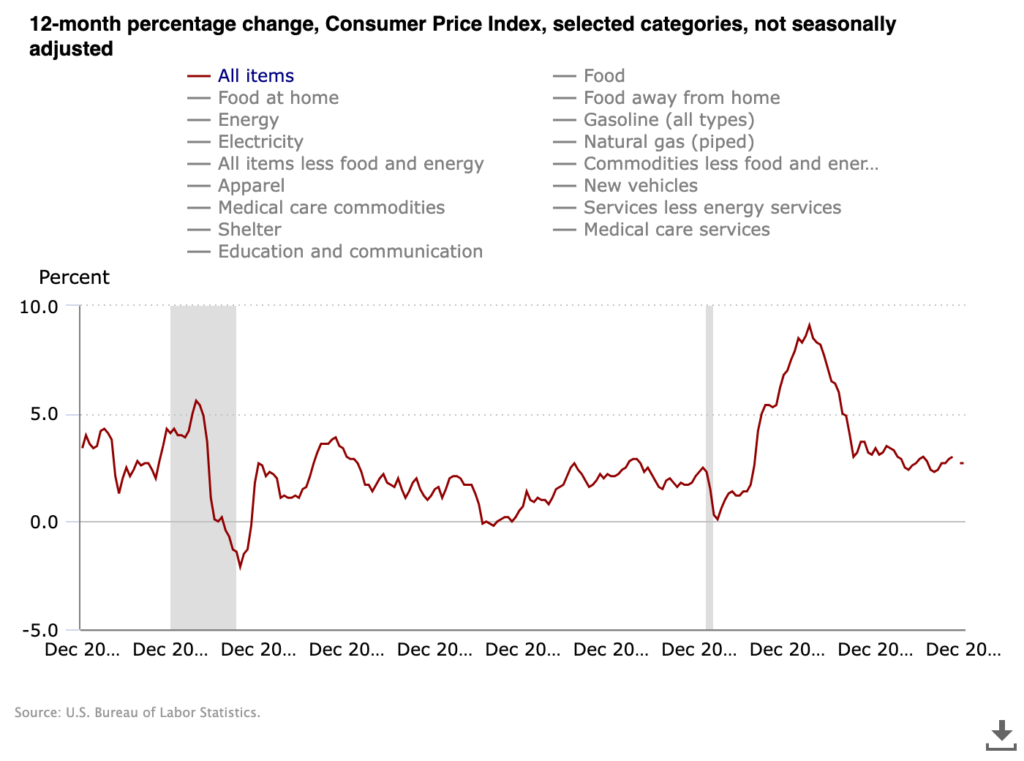

Bitcoin rose around 1.5 percent during the Wall Street opening hours after the latest US Consumer Price Index data signaled easing inflation pressures. According to figures released by the Bureau of Labor Statistics, headline CPI increased 2.7 percent year over year in December 2025, in line with market expectations. Core CPI, which excludes food and energy prices, came in at 2.6 percent, marginally below forecasts.

The BLS noted that overall inflation growth remained unchanged from November, reinforcing the view that price pressures are stabilizing. Markets responded swiftly. Bitcoin climbed toward one week highs, hovering just below the $93,000 mark as traders positioned for a possible upside move.

Market commentators highlighted that both headline and core inflation showed no acceleration during the month, which strengthened confidence that tighter monetary conditions may no longer be necessary.

US stocks hit record highs alongside crypto gains

The inflation data triggered a broad rally in traditional markets, with US equities surging almost immediately after the release. The S&P 500 pushed to new all time highs, extending a strong run that has been supported by optimism around easing inflation and resilient corporate earnings.

The rally came despite continued friction between the White House and the Federal Reserve. President Donald Trump has repeatedly urged the central bank to cut interest rates further, arguing that lower borrowing costs would support economic growth. The Federal Reserve, however, is widely expected to keep rates unchanged at its upcoming January 28 policy meeting.

This tension has been underscored by a recent legal investigation involving Federal Reserve Chair Jerome Powell, which Powell suggested stemmed from disagreements over monetary policy. The dispute has added political pressure to an already sensitive policy environment, even as markets appear focused on the improving inflation outlook.

Trump renews call for rate cuts

Following the CPI release, President Trump reiterated his demand for lower interest rates, framing the inflation slowdown as evidence that current policy is too restrictive. He also pointed to US trade tariffs as a factor contributing to easing price pressures, a claim that remains controversial.

The tariffs themselves are under renewed scrutiny, with the Supreme Court expected to rule on their legality later this week. While the outcome remains uncertain, traders view any move toward lower rates as supportive for liquidity and risk assets, including cryptocurrencies.

Historically, expectations of easier monetary policy have boosted Bitcoin and other digital assets by increasing capital flows into alternative investments. Tuesday’s price action reflected that dynamic, even as traders remained cautious near key technical levels.

Bitcoin faces heavy resistance near $93,000

Despite the bullish macro signals, traders warned that Bitcoin is approaching a significant resistance zone that could slow or stall further gains. Analysts identified the $92,600 to $94,000 range as a critical area, supported by volume weighted average price trendlines that suggest concentrated selling pressure.

One market commentator described this zone as a huge resistance wall, noting that recent sideways trading has built substantial liquidity on both sides of the current range. Below the market, key support levels were identified between $89,800 and $88,700, making the next directional move especially important.

VWAP levels are closely watched by traders as they reflect the average price paid over a given period, adjusted for trading volume. When price approaches these levels, reactions can be sharp as both buyers and sellers defend their positions.

Traders expect the current range to break soon

Bitcoin has spent the past several days consolidating between roughly $90,000 and $92,000, a pattern that many traders believe is nearing its end. According to market participants, the longer price remains in a tight range, the stronger the eventual breakout or breakdown tends to be.

Liquidity data from CoinGlass showed nearly $170 million in crypto liquidations over the past 24 hours, underscoring the intensity of positioning as traders prepare for volatility. Short term traders suggested that the current low timeframe range is unlikely to persist much longer, with a decisive move expected once liquidity is taken on either side.

As Bitcoin continues to track macro developments, attention now turns to whether buyers can absorb sell pressure above $92,600. A clean break could open the door to fresh highs, while failure may send price back toward lower support levels.

For now, Bitcoin remains tightly linked to broader market sentiment, with inflation data and interest rate expectations continuing to shape the near term outlook.

Leave a Reply