Bitcoin has experienced a sharp drop, falling to $91,800, a price not seen since early December. The largest cryptocurrency’s decline comes as a result of a combination of profit-taking after a strong rally and growing concerns about the wider macroeconomic environment. With market sentiment souring, the price of Bitcoin is now over 14% below its December peak of $108,278, marking the end of a strong year for crypto markets.

Profit-Taking Spurs Bitcoin’s Decline

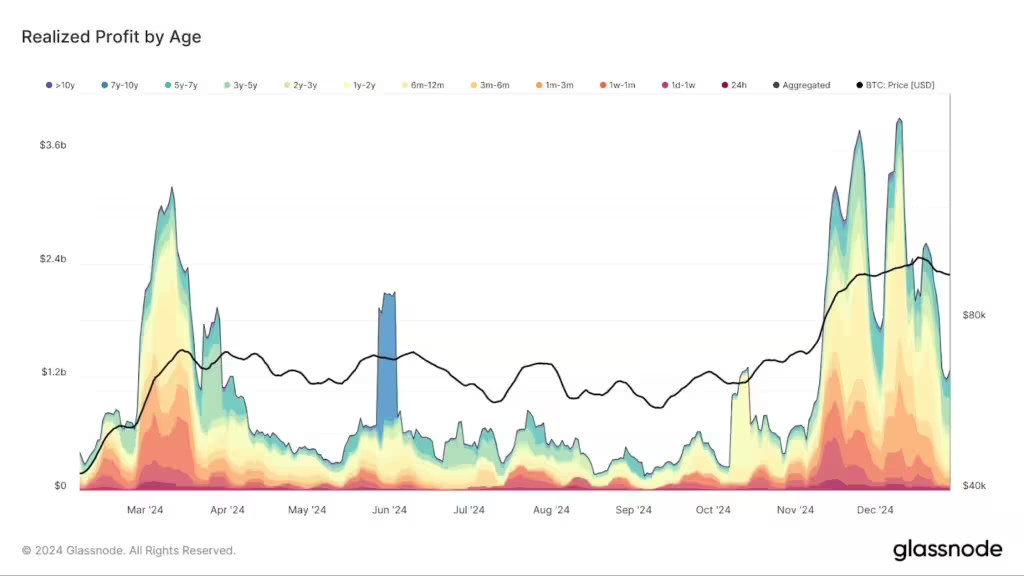

After Bitcoin surged more than 117% in 2024, many long-term holders have decided to cash out. Profit-taking has reached over $1.2 billion on a seven-day moving average, significantly above the usual levels. This ongoing profit-taking is especially noticeable among those who have held Bitcoin for years, who are now securing gains from the recent rally.

While Bitcoin takes a hit, Ethereum (ETH) has shown more resilience, with a smaller 0.7% decline to $3,320. Despite this, it remains 17% lower than its highs from December and has not yet reached the $4,820 all-time high set in 2021. Other altcoins, like Solana (SOL), are performing slightly better than Bitcoin, but the overall trend is negative across the broader crypto market.

Macroeconomic Factors Add Pressure

The cryptocurrency market is also being weighed down by broader macroeconomic concerns. Recent data, including the U.S. Chicago PMI, which measures the performance of both the manufacturing and services sectors in the Chicago region, shows signs of economic slowdown. This has raised concerns about a potential downturn in the global economy.

The uncertainty surrounding the Federal Reserve’s monetary policy for 2025 is also a contributing factor. With the U.S. central bank signaling it will pause any interest rate cuts until at least March, markets are uncertain about future growth prospects. These macroeconomic concerns have spilled over into stock markets, with the S&P 500, Nasdaq, and Dow Jones all down by more than 1%.

Crypto Stocks and Miners Take a Hit

Crypto-related stocks have not been spared from the market downturn. Major companies such as MicroStrategy (MSTR) and Coinbase (COIN) saw declines of 7% and 5.3%, respectively. Bitcoin mining firms like MARA Holdings (MARA) and Riot Platforms (RIOT) also experienced significant losses, down over 7%.

The connection between cryptocurrency prices and mining stocks is clear, as the performance of mining companies is directly tied to Bitcoin’s price. With profit-taking on the rise and Bitcoin’s price falling, the performance of these stocks is likely to remain under pressure in the short term.

Looking Ahead: A Bumpy Road for Bitcoin in 2025

Despite the recent dip, many market observers remain cautiously optimistic about Bitcoin’s future. Joe Carlasare, a partner at Amundsen Davis, noted that while the market may face consolidation, Bitcoin’s adoption continues to grow. He expects the cryptocurrency to move in line with traditional markets in 2025, provided that the U.S. avoids a significant slowdown in growth.

Carlasare also highlighted that while the path forward may diverge from consensus, Bitcoin’s long-term outlook remains positive. However, the volatility seen in 2024 may continue into the new year, with investors navigating both economic challenges and market uncertainty.

Leave a Reply