Bitcoin is at risk of a temporary correction towards the $72,000 support level as investor sentiment reaches lows not seen since 2022. Analysts suggest that while a sharp drop below $75,000 is unlikely, market repositioning could push the cryptocurrency further down before a recovery takes shape.

Bitcoin Falls to Three-Month Low

The price of Bitcoin (BTC) hit a three-month low of $78,197 on 28 February, marking a 28% decline from its record high of over $109,000 on 20 January. This downturn has led analysts to predict a possible retracement towards the low $70,000 range.

Iliya Kalchev, a dispatch analyst at digital asset investment platform Nexo, suggests Bitcoin is likely to find support between $72,000 and $80,000, which could act as a foundation for a more sustainable recovery. “While there might be a temporary backtrack as the market fills in the gaps left during the rapid climb, Bitcoin is more likely to establish firm support in this range,” Kalchev told.

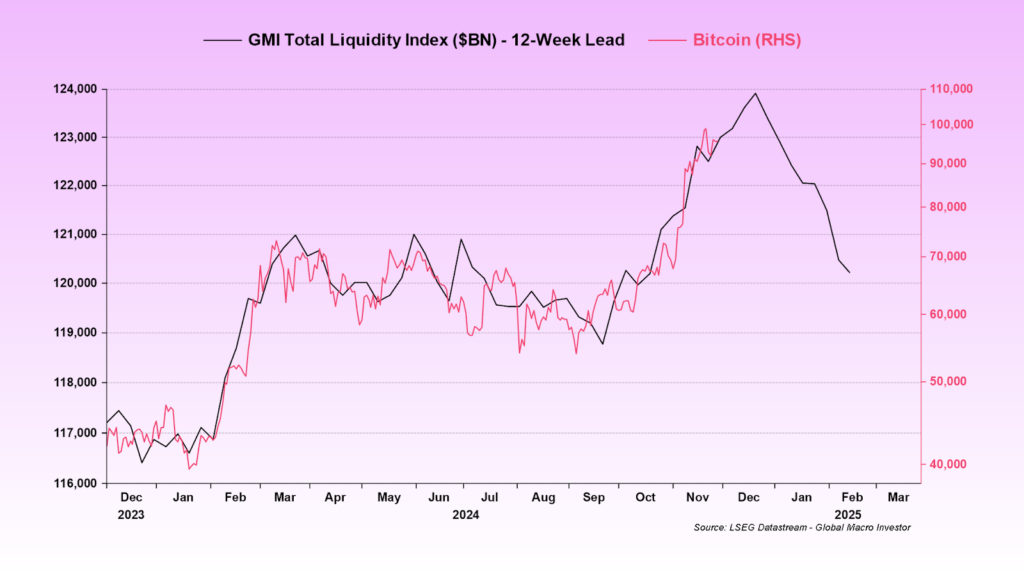

Other analysts have also forecasted a potential Bitcoin bottom near $70,000 in early 2025 before the next major rally. Based on its correlation with the global liquidity index, Bitcoin’s right-hand side (RHS) bid price may fall below $70,000 by the end of February, following its peak near $110,000 in January.

Raoul Pal, founder and CEO of Global Macro Investor, first warned of a correction to $70,000 back in November. He predicted Bitcoin would reach a “local top” above $110,000 in January before experiencing its current decline.

Investor Sentiment at 2022 Lows

Despite expectations of a market recovery, the crypto sector continues to suffer from a lack of investor confidence. The Crypto Fear & Greed Index, which measures overall market sentiment, has dropped to 20, a level last seen in July 2022.

The last time investor sentiment was this low was in June 2022, when Bitcoin fell to $17,500 following a 37% monthly decline. Analysts from crypto exchange Bitfinex attribute the current downturn to multiple factors, including regulatory uncertainty, security breaches, and declining altcoin valuations.

“Overall, the combination of a sharp Bitcoin price drop, regulatory uncertainty, security breaches, and declining altcoin valuations has led to extreme fear in the crypto market,” Bitfinex analysts told Cointelegraph.

They also highlighted an increase in long liquidations, particularly during major price drops such as those seen between 3 and 27 February.

Impact of Bybit Hack on Market Sentiment

The wider crypto market remains affected by the recent $1.4 billion Bybit hack on 21 February—the largest security breach in crypto history. The attack contributed to heightened fears and uncertainty across the industry.

However, in a positive sign, Bybit continued to honour customer withdrawals and fully replaced the stolen $1.4 billion in Ether by 24 February, just three days after the attack. This swift response helped stabilise investor concerns, though market sentiment remains weak.

Bitcoin’s Path Forward

While Bitcoin may face further corrections in the short term, analysts believe the cryptocurrency will eventually find stable support. The $72,000–$80,000 range is expected to serve as a crucial zone for recovery.

With investor sentiment currently at its lowest in nearly three years, Bitcoin’s next major movement will likely depend on broader market conditions, regulatory developments, and overall liquidity trends.

Leave a Reply