Sharp Bounce Needed to Avoid Downtrend as Market Reacts to Economic Data

Bitcoin (BTC) found itself under pressure on January 11, hovering just below $95,000 after a day of significant market volatility. The cryptocurrency’s performance mirrored the broader decline in US stocks, which saw a similar “bearish overreaction” to new employment data, raising concerns about potential further declines in Bitcoin’s price.

US Employment Data Sends Shockwaves Through Markets

Bitcoin, along with traditional risk assets, initially reacted negatively to the latest US employment data. The report, which indicated stronger-than-expected job growth, sent BTC/USD tumbling toward $92,000. However, the cryptocurrency quickly rebounded, marking a $2,000 move within an hour and pushing prices back into familiar short-term ranges.

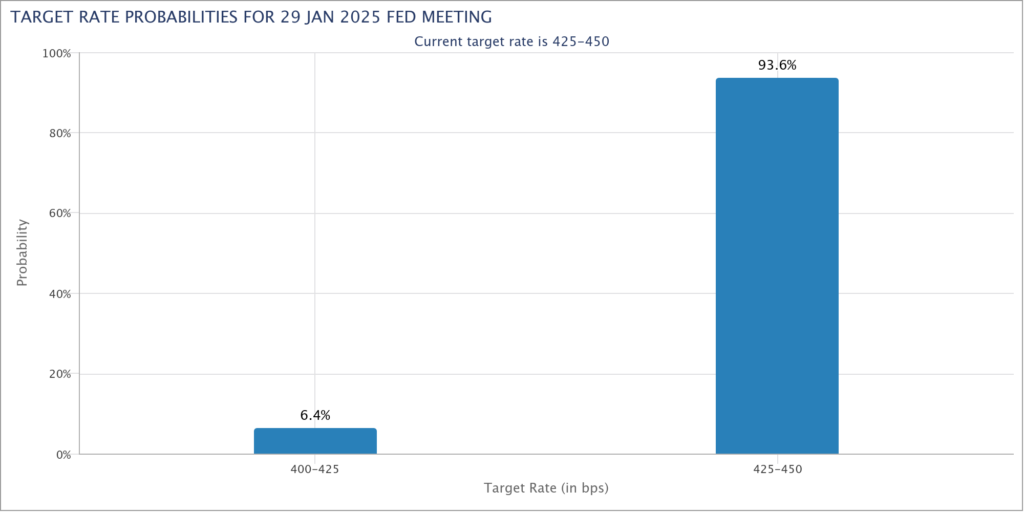

The initial downturn was part of a broader market sell-off. The S&P 500 and Nasdaq Composite Index both ended January 10 down by approximately 1.5%, as investors adjusted expectations for interest rate cuts by the Federal Reserve in 2025. The data led to speculation that more aggressive rate hikes could be on the horizon, prompting nervousness among traders.

Bearish Overreaction or Bullish Potential?

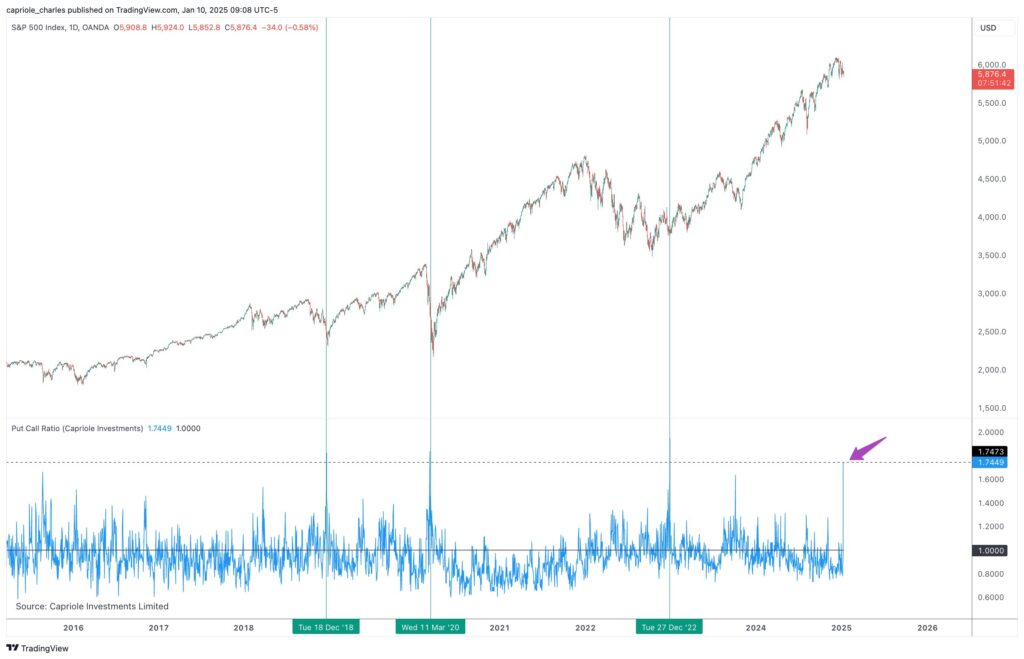

Despite the initial shock, some analysts believe that the market’s reaction may have been an overreaction. Charles Edwards, founder of Capriole Investments, suggested that while the strong employment numbers might suggest a period of high rates, they could also be indicative of a prolonged bull market for Bitcoin and other risk assets.

“Markets are freaking out over a very bullish employment reading,” Edwards wrote on X (formerly Twitter). “Short-term, it’s a bearish overreaction, but strong jobs numbers like today actually mean the bull run can likely go a lot longer than thought.”

Edwards also drew parallels between the current market environment and the chaos following the March 2020 COVID-19 market crash, noting that similar intraday fluctuations were seen during that period. “This was the best reading in 6 months, and it eliminates the potential for a bottoming in unemployment for now,” he added.

Bitcoin Faces Critical Support Levels

As the market calms, attention now turns to Bitcoin’s price action. Popular X analytics account Bitcoindata21 highlighted that Bitcoin’s recent dip below $92,000 brings the cryptocurrency dangerously close to critical support levels. If BTC drops further to around $88,000, the situation could become more dire for the broader crypto market, potentially triggering a 5-10% decline across altcoins.

The account cautioned that Bitcoin would need to show a sharp recovery by the end of the week to avoid a prolonged downtrend. In a market already testing key support levels, the next few days could be pivotal for determining the future direction of Bitcoin’s price.

A Shift in Sentiment?

Despite the market turbulence, some analysts see reasons for optimism. Crypto trader Michaël van de Poppe noted that the initial response to the employment data had already been priced in, suggesting that Bitcoin could begin trending upwards in the next 10-15 days.

“The yields can’t really go way higher, and the initial response is already captured,” van de Poppe explained. “Very likely we’ll see an upwards trending market starting in the next 10-15 days on Bitcoin and the altcoins.”

As Bitcoin and other cryptocurrencies test critical support levels, all eyes will be on the coming days to see whether the market stabilises or whether further volatility lies ahead.

Leave a Reply