Bitcoin markets entered turbulent territory this week as the world’s leading cryptocurrency faced steep selling pressure, triggering widespread liquidations and driving the price to its lowest levels in nearly two weeks. With institutional demand showing signs of divergence and retail traders under strain, Bitcoin’s path forward is increasingly uncertain.

Bitcoin slips below $114K as US selling pressure intensifies

On Tuesday, Bitcoin (BTC) fell beneath the $114,000 mark during the Wall Street open, according to data from TradingView. The decline came in tandem with a wider downturn in US equities, with the Nasdaq Composite Index slipping 1.2% at the same time.

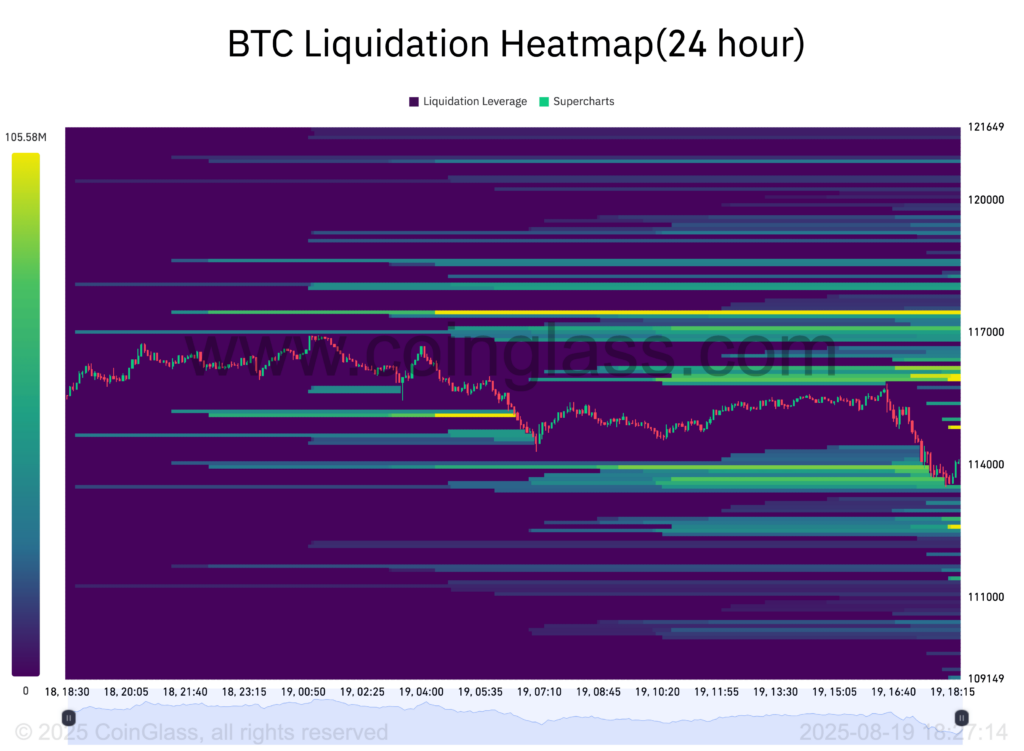

The sell-off fuelled a cascade of liquidations, with long BTC positions suffering an additional $116 million in losses within just one hour, based on CoinGlass data. This extended what has become an ongoing squeeze against leveraged bullish traders who had bet on a price rebound.

Market analysts cautioned that the move was not a sign of resilience. Keith Alan, cofounder of Material Indicators, observed:

“The $107k – $110k range is coming into focus. This is not a sign of strength for $BTC. The downward pressure is palpable, but bulls are trying to find their footing.”

Alan pointed to the 100-day simple moving average (SMA) at $110,950 as a potential short-term support, while stressing the importance of reclaiming the 50-day SMA at $115,875 to restore bullish momentum.

Bid liquidity at $105K branded ‘plunge protection’

Exchange order book data suggests that significant liquidity is building just below the current market. Material Indicators identified a $25 million liquidity band stacked at the $105,000 level, describing it as a form of “plunge protection” designed to prevent a deeper market collapse.

However, the firm noted scepticism over whether these bids were genuine. Analysts suggested the liquidity may have been strategically placed to manipulate market behaviour by encouraging upward momentum rather than signalling an intention to execute actual trades.

“If it fails to accomplish that and price reverts, I expect it to get rugged or moved before it gets filled,” Material Indicators warned, referring to the possibility of orders being withdrawn before execution.

Such tactics highlight the fragility of current order book dynamics, where large players, often referred to as whales, can shift sentiment by simply placing visible bids or asks without following through.

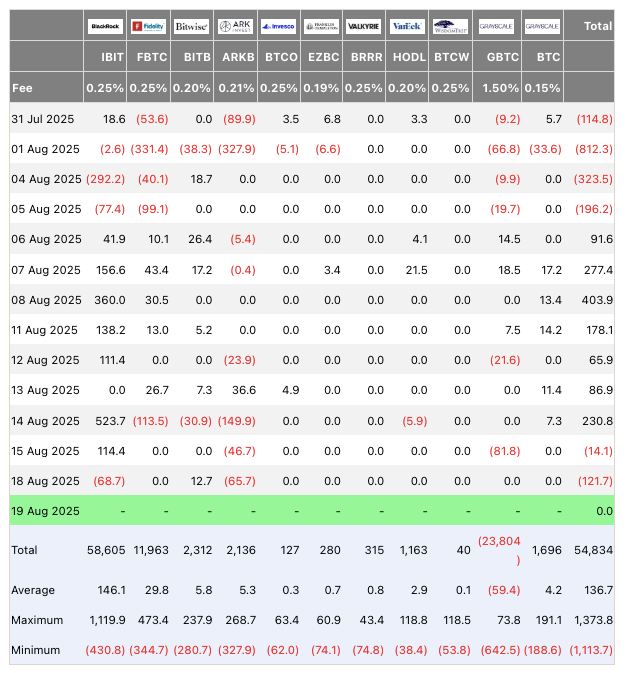

ETF flows diverge from weakening on-chain signals

In parallel to the sell pressure, Bitcoin exchange-traded funds (ETFs) in the United States have presented a mixed picture. On-chain analytics platform Glassnode highlighted a growing divergence between institutional investment flows and Bitcoin’s price action.

While ETF products had previously attracted steady inflows, this week saw a reversal. Data from UK-based Farside Investors revealed a net outflow of $121 million across US spot Bitcoin ETFs on Monday. Notably, BlackRock’s flagship iShares Bitcoin Trust (IBIT) recorded its first outflows since 5 August, signalling a potential shift in sentiment among institutional players.

Glassnode’s Market Pulse report further highlighted weakening on-chain indicators, such as declining trading volumes and a rise in profit-taking activity. Analysts suggested that the interplay between ETF demand and on-chain behaviour will be pivotal in determining whether the current contraction evolves into a stabilisation phase or extends into deeper market consolidation.

“With profit-taking on the rise, the sustainability of institutional flows and renewed buyer conviction in both spot and futures will determine whether this contraction stabilises into fresh upward momentum or extends into deeper consolidation,” the report stated.

Bulls under pressure as consolidation risks deepen

Despite the presence of bid support at $105,000, traders remain cautious. The combination of ongoing liquidations, weakening on-chain health, and declining ETF inflows paints a fragile picture for Bitcoin’s near-term trajectory.

If bulls manage to defend the $110,000–$112,000 zone and reclaim the 50-day SMA, a path towards recovery may open. However, failure to hold these levels could leave Bitcoin vulnerable to a sharper correction, potentially testing the $105,000 “plunge protection” zone.

For now, the market is caught between strong downward pressure and tactical efforts by bulls to stabilise sentiment. The coming days will likely determine whether Bitcoin consolidates before another upward push or faces a deeper retracement that could unsettle broader crypto markets.

Leave a Reply