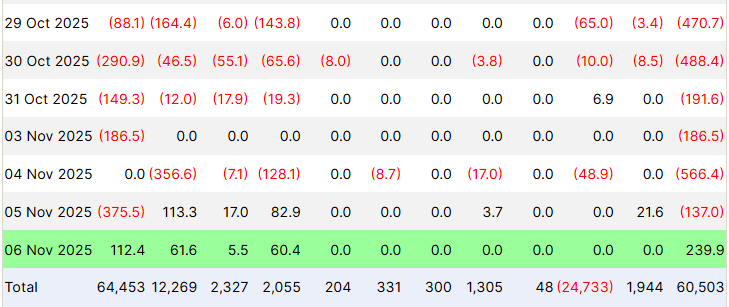

Bitcoin (BTC) is once again under pressure as the world’s largest cryptocurrency struggles to maintain its footing above the crucial $100,000 mark. Recent data indicate that Bitcoin exchange-traded funds (ETFs) have experienced over $2 billion in outflows during the past week, one of the steepest withdrawal periods since their inception.

What was once hailed as a major institutional gateway to Bitcoin is now intensifying the sell-side pressure. The sustained ETF outflows have not only dampened investor sentiment but also raised concerns about whether Bitcoin may be entering a deeper corrective phase.

The withdrawals come at a time when global markets are already showing signs of strain amid rising U.S. Treasury yields, tightening financial conditions and risk aversion across equities and digital assets.

Institutional Retreat Signals Waning Conviction

The magnitude of ETF redemptions reflects a growing hesitancy among institutional investors. In a risk-off environment, many appear to be opting for cash or safer assets rather than maintaining exposure to volatile crypto markets.

Analysts suggest that these moves are less about Bitcoin’s long-term fundamentals and more about macroeconomic uncertainty. With inflationary pressures persisting and bond yields at multi-year highs, the opportunity cost of holding risk assets such as Bitcoin has increased.

If this trend continues, ETFs could remain a significant source of selling pressure. A sustained outflow cycle would mean funds are liquidating Bitcoin holdings to meet redemptions, effectively amplifying downward price momentum.

According to market data, this dynamic mirrors earlier market corrections, where institutional capital outflows preceded phases of panic-driven retail selling, often culminating in a capitulation event.

On-Chain Metrics Hint at Potential Capitulation

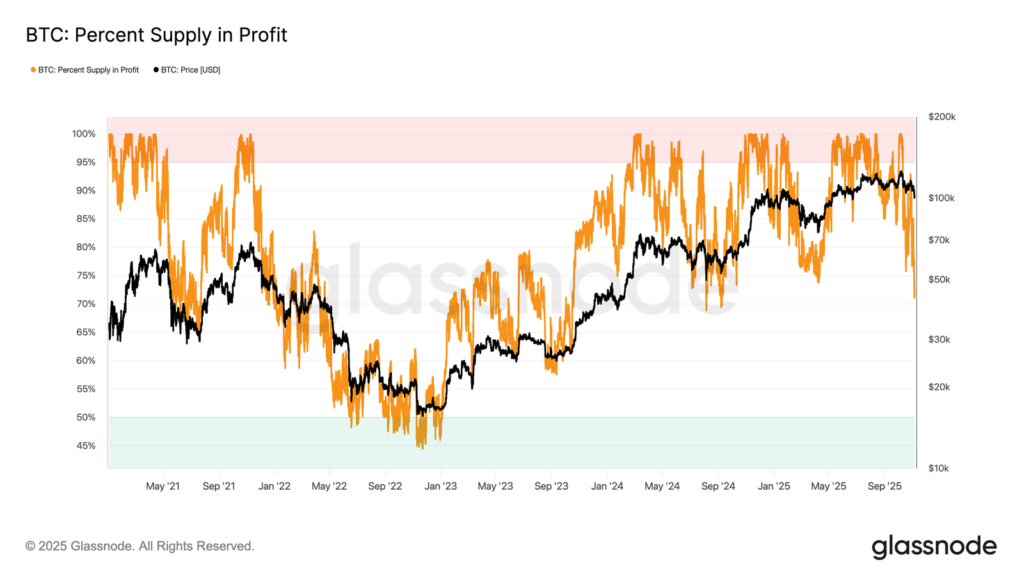

Blockchain analytics offer a mixed picture of Bitcoin’s current health. The percentage of BTC supply in profit has fallen to around 71%, positioning the market near the lower end of the historical 70%–90% mid-cycle equilibrium band.

This level typically signals that Bitcoin is in a consolidation or cooling-off phase. However, if the ratio dips further and more coins move into loss, the probability of capitulation, a sharp and emotionally driven sell-off, increases substantially.

Historically, such conditions have often acted as precursors to deeper drawdowns before recovery. Market participants are closely watching whether new demand, particularly from long-term holders or institutional accumulators, will emerge to stabilise prices.

Should inflows fail to offset the ongoing ETF redemptions, Bitcoin could find itself locked in a feedback loop of selling pressure and falling confidence, a pattern seen during several past bear phases.

Key Price Levels To Watch: $100K Support and $95K Risk Zone

At the time of writing, Bitcoin is trading at $101,274, holding precariously above the $100,000 psychological support. A decisive break below this level could trigger a wave of stop-loss orders and retail panic, pushing prices toward $98,000 and possibly the $95,000 region.

Market analysts caution that $100,000 remains a critical pivot zone. Losing this threshold could reinforce the perception that Bitcoin’s bullish momentum has stalled, inviting further short-term selling.

Conversely, any signs of renewed ETF inflows or strong spot buying activity could fuel a recovery rally. Should Bitcoin manage to reclaim the $105,000–$110,000 zone, it would signal fresh buying interest and potentially invalidate the current bearish outlook.

Outlook: Rebound or Breakdown?

The next few weeks will be pivotal for Bitcoin’s trajectory. Much depends on whether the ETF outflows subside and new institutional demand materialises. If capital continues to exit, Bitcoin risks entering a prolonged consolidation phase or even a deeper correction.

However, history has shown that sharp pullbacks often precede strong rebounds once market participants regain confidence. A stabilisation in ETF flows, coupled with positive macro signals or renewed accumulation from long-term holders, could pave the way for a recovery rally later this quarter.

For now, though, Bitcoin’s struggle to stay above $100,000 underscores the fragility of market sentiment. With ETF outflows crossing the $2 billion mark and investor conviction wavering, the world’s top cryptocurrency faces a critical test of resilience in the weeks ahead.

Leave a Reply