The crypto market took a sharp hit on Friday, with Bitcoin falling below $116,000 and triggering widespread liquidations across the board. In just 24 hours, more than $585 million in long positions were wiped out, affecting over 213,000 traders globally. While the downturn came unexpectedly for many, some analysts say it was a classic case of over-leveraged trading catching up to the market.

Sudden Crash Wipes Out Over $600M in Longs

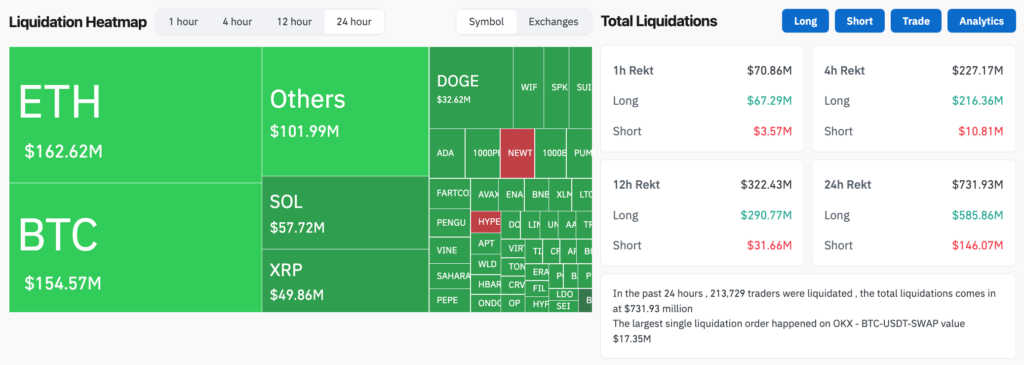

According to data from CoinGlass, the total value of long positions liquidated across the crypto market reached $585.86 million within a single day. Of this, Bitcoin alone accounted for $140.06 million as its price dropped by 2.63% to $115,356.

Ethereum followed with $104.76 million in long liquidations, falling 1.33% to $3,598. Dogecoin suffered the worst percentage drop among the top 10 cryptocurrencies, losing 7% in 24 hours and leading to $26 million in long liquidations, as per Nansen data.

The total number of traders liquidated during this period stood at 213,729, revealing just how widespread the impact was. Including both long and short positions, the total liquidation figure reached $731.93 million.

Leverage Blamed for the Dump

Crypto trader Ash Crypto commented on X (formerly Twitter), describing the crash as a “pure leverage flush.” He explained that many traders rushed to long altcoins after seeing Ethereum’s recent strong performance. This gave market makers an opportunity to trigger liquidations by intentionally pushing prices downward, effectively punishing late long positions.

This kind of manipulation isn’t new to seasoned traders, but it often catches retail investors off guard, especially during periods of high optimism. Leverage trading allows users to amplify their bets using borrowed funds, but it also exposes them to much higher risks during volatile moves.

Sentiment Still Bullish Despite Drop

Interestingly, despite the dramatic fall, overall sentiment in the crypto market remains strong. The Crypto Fear & Greed Index remains in the “Greed” zone with a score of 70, suggesting that investors are still largely optimistic.

Just days earlier, on July 14, Bitcoin had reached an all-time high of $123,100, fuelling expectations of a continued rally. Some analysts believe the current drop is a temporary correction rather than a sign of a deeper crash.

Michael Novogratz, CEO of Galaxy Digital, stated on Thursday that he expects Ethereum to reach at least $4,000, a nearly 10% increase from its current price. Meanwhile, analysts at Bitfinex have predicted that if Bitcoin regains upward momentum, its next target could be $136,000.

Short Positions Now in the Danger Zone

While long traders were the primary victims of Friday’s crash, those shorting the market may also soon be at risk. Analysts note that if Bitcoin bounces back to its Thursday price of $119,500, it could trigger over $3 billion in short liquidations.

This precarious position highlights the unpredictable nature of the current market. Many traders are now choosing to hedge their bets or reduce leverage in anticipation of further volatility.

The latest crypto market downturn serves as a stark reminder of the risks involved in leverage trading. With over half a billion dollars in longs liquidated and thousands of traders caught off guard, it’s clear that even in bullish times, the crypto market can turn sharply without warning. While sentiment remains positive, caution is advised as both long and short positions hang in the balance.

Leave a Reply