Bitcoin and the wider cryptocurrency market turned red on 12 February as new US inflation data came in higher than anticipated, raising concerns over macroeconomic pressures on digital assets.

Bitcoin Reacts to Inflation Data

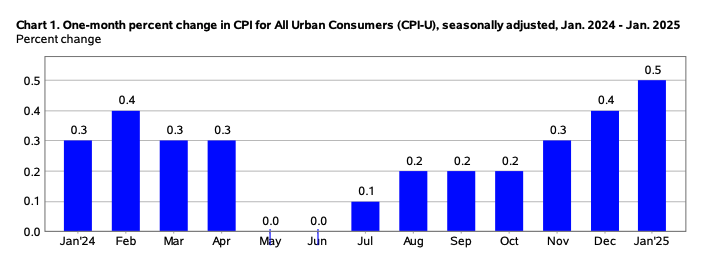

Bitcoin (BTC) briefly dropped below $95,000 after the release of the US Consumer Price Index (CPI) report, which showed annual inflation at 3% in January 2025—0.1% higher than expected. The US Bureau of Labor Statistics reported a monthly CPI increase of 0.5%, surpassing the Dow Jones forecast by 0.2%. This marked the largest monthly rise in inflation in a year.

Trump Calls for Interest Rate Cuts

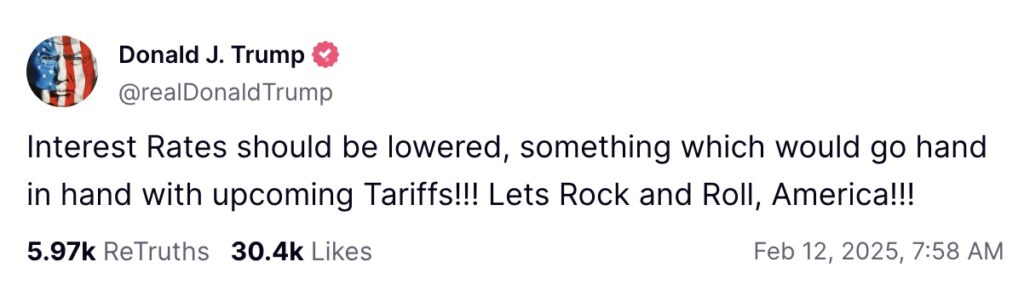

The latest inflation figures come amid renewed pressure from US President Donald Trump to lower interest rates. Posting on his social media platform, Truth Social, Trump reiterated his stance:

“Interest rates should be lowered, something which would go hand in hand with upcoming tariffs! Let’s Rock and Roll, America!”

His comments followed remarks from Federal Reserve Chairman Jerome Powell, who stated that the central bank does not need to rush into rate cuts.

“With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” Powell said.

Trump has been vocal in criticising Powell and the Federal Reserve, blaming them for failing to control inflation and accusing them of poor bank regulation.

Inflation and the Impact of Tariffs

Some analysts believe the inflation rise was expected due to seasonal factors. Coin Bureau founder Nic Puckrin argued that it would be a mistake to directly link the data to Trump’s tariff policies.

“January often sees seasonal price increases,” Puckrin said. “It would be an error to attribute this to President Trump’s tariffs.”

He added that the president’s policies could, in fact, have an “unexpected disinflationary effect” and suggested that the latest CPI data is unlikely to influence the Fed’s interest rate decision in March.

Fed to Focus on Employment and PCE Data

Rather than reacting to the January CPI figures, the Federal Reserve is expected to focus on upcoming economic indicators. Key data releases include the US unemployment report on 7 March and the Personal Consumption Expenditures (PCE) index on 28 February.

“I wouldn’t be surprised if the latter comes in lower than expected, easing concerns over the impact of Trump’s tariffs,” Puckrin said.

Crypto Market Faces Macroeconomic Pressure

The latest CPI report has reinforced concerns that rising US inflation could trigger further selloffs in Bitcoin and other cryptocurrencies. Analysts at Steno Research have warned that an inflationary environment creates an unfavourable macroeconomic backdrop for risk assets, including digital currencies.

Historically, interest rate cuts have led to increased investments in crypto, with lower borrowing costs encouraging inflows into digital assets. However, with the Federal Reserve signalling a cautious approach, Bitcoin’s price remains vulnerable to economic uncertainty.

Leave a Reply