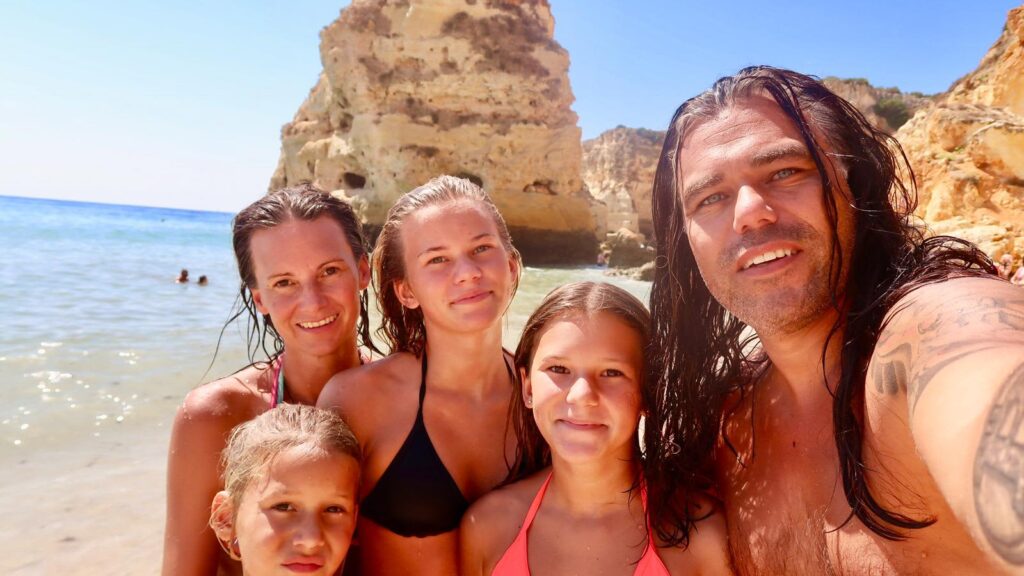

As kidnappings targeting crypto holders become more frequent and brutal, the Taihuttus known globally as the “Bitcoin Family” are taking unprecedented steps to protect their digital wealth and personal safety. Led by patriarch Didi Taihuttu, the family, who famously sold everything in 2017 to go all-in on Bitcoin, has now moved beyond hardware wallets to adopt a complex, decentralised system for storing their assets. The transformation highlights a growing fear within the crypto community and a shift in how high-profile investors manage risk.

From Full Transparency to Full Secrecy

Didi Taihuttu once proudly shared his family’s crypto journey online from vlogs to interviews. However, recent threats and global incidents involving kidnappings of crypto executives have forced the family into near-total silence.

“Even if someone held me at gunpoint, I can’t give them more than what’s on my phone wallet. And that’s not a lot,” Taihuttu told CNBC from Phuket, Thailand. After receiving chilling emails identifying their exact home location, the family immediately moved and stopped posting their whereabouts. Content creation, once a passion, has now become a liability.

The Taihuttus, known for travelling full-time with their three daughters and staying unbanked, now face an uncomfortable reality: fame in the crypto world brings exposure to real-world threats.

A Hybrid Storage System Spanning Continents

In response to rising attacks, the Bitcoin family has eliminated hardware wallets from their storage system. Concerns over third-party devices, especially after controversial firmware updates like Ledger’s 2023 release pushed them towards a hybrid setup.

They now use a system that is part analog, part digital. Their Bitcoin seed phrase is split into four parts, six words each from a 24-word key and distributed across four continents. Some are stored via blockchain based encryption services, while others are etched into steel plates and physically hidden.

To further thwart potential attackers, Taihuttu has introduced a layer of personal encryption by swapping out select seed words, a simple, yet effective method that requires only his memory to decode.

Even if someone finds 18 of the 24 seed words, they can’t access the funds without knowing the substituted words.

Multi-Layered Digital Defence

While a portion of their crypto is kept in “hot” wallets for daily use and trading, the majority is in cold storage. Accessing these funds would require an international trip, a built-in security buffer the Bitcoin family accepts in exchange for long-term safety. These reserves, Taihuttu says, are locked away until Bitcoin hits $1 million, a milestone he targets for 2033.

The Taihuttus now rely on multi-signature and multi-party computation (MPC) wallets for added protection. Unlike traditional wallets, where one key grants full access, multi-sig setups require approval from multiple parties for any transaction. MPC goes further by cryptographically splitting the key so that no one person, not even the owner, holds a complete version. This structure significantly reduces the risk of theft or forced access.

A Chilling Global Trend

The family’s actions come amid a surge in high-profile, often violent kidnappings of crypto holders:

- In France, the co-founder of wallet firm Ledger and his wife were abducted in a crypto ransom scheme.

- Another victim, the father of a crypto millionaire had a finger severed while being held captive in a brutal extortion attempt.

- In New York, an Italian tourist was kidnapped and tortured for 17 days in a Bitcoin ransom plot.

These cases underscore the irreversible nature of crypto transactions and how valuable and vulnerable private keys can be.

Unsurprisingly, insurance firms are beginning to offer bespoke kidnap and ransom (K&R) policies for wealthy crypto holders, but for Taihuttu, decentralisation remains the safest bet.

The Future: Decentralised, Yet Cautious

Despite the threats, the Taihuttus remain firm in their belief in decentralised finance. About 80% of their trading now happens via decentralised exchanges like Apex, keeping with crypto’s core principle: self-custody.

However, the cost of this lifestyle is rising. With their daughters now aware of kidnapping risks, the family has started making decisions not just based on market trends, but on safety, even avoiding entire countries like France.

As the market matures and digital assets become increasingly valuable, the world is beginning to see the darker side of crypto wealth. For those like the Bitcoin Family, staying safe now means staying silent, decentralised, and always one step ahead.

Leave a Reply