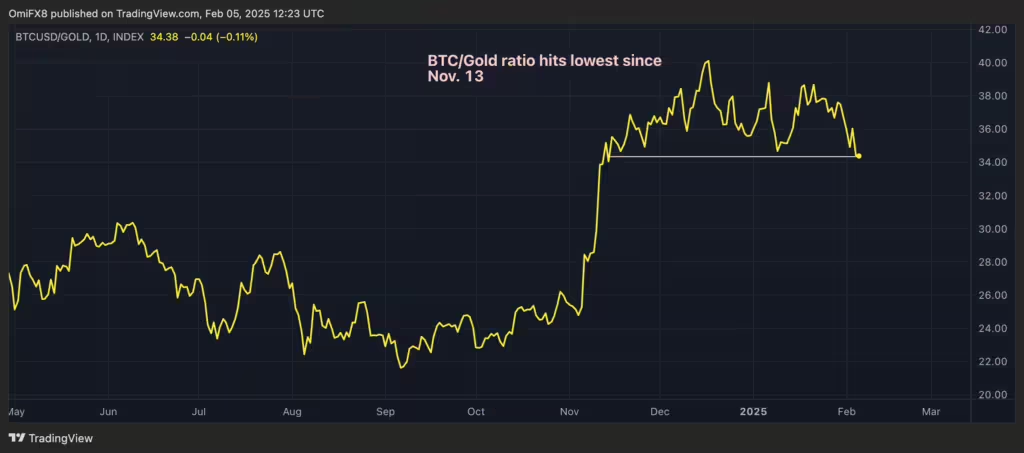

The Bitcoin-Gold ratio has dropped to its lowest point in 12 weeks, reflecting growing investor confidence in gold as a safe-haven asset. The ratio, which measures Bitcoin’s price relative to gold per ounce, has declined to 34, down 15.4% from its mid-December peak of over 40.

This shift comes as physical gold deliveries to the U.S. surge, driven by escalating geopolitical tensions and increased demand from China. In contrast, Bitcoin struggles to maintain upward momentum despite inflows into U.S.-listed spot ETFs.

Gold Prices Surge to Record Highs

Gold prices have surged nearly 10% year-to-date, reaching a record $2,877 per ounce. Safe-haven demand is driving this rally, with fears of a U.S.-China trade war fueling investor interest.

The rising tariffs have also pushed Comex gold futures prices significantly above the spot price. This premium has prompted traders to ship large quantities of gold to the U.S., with JPMorgan alone planning a $4 billion gold delivery to New York this month.

Chinese Demand Boosts Gold Prices

China’s gold demand has surged due to the Spring Festival holidays, further supporting gold’s upward trajectory. Traditionally, Chinese investors flock to gold as a stable store of value during times of economic uncertainty.

This increased buying pressure, combined with global trade tensions, has strengthened gold’s safe-haven appeal, making it more attractive than risk assets like Bitcoin in the short term.

Bitcoin Faces ETF-Driven Market Dynamics

While Bitcoin has seen $4 billion in inflows into U.S.-listed spot ETFs since recent inflation data was released, much of this buying is being offset by arbitrage trading.

According to Markus Thielen, founder of 10x Research, traders engaging in non-directional arbitrage bets are likely counteracting bullish momentum. He notes that simultaneous spot or futures selling is dampening Bitcoin’s price impact despite ETF inflows.

As gold demand surges and geopolitical risks rise, Bitcoin struggles to maintain its bullish momentum. While Bitcoin ETFs continue to attract capital, arbitrage-driven activity is preventing significant price gains. Meanwhile, gold’s role as a safe-haven asset remains unchallenged, driving the Bitcoin-Gold ratio to multi-month lows.

Leave a Reply